Marketing tactics

7 steps to winning innovations

7 steps to winning innovations

Concept writing guide

Concept writing guide Concept development

Concept development Rapid concept screening

Rapid concept screening Concept testing

Concept testing Predicted volume, value and source of business

Predicted volume, value and source of business

Product tests

Product tests Synaesthesia

Synaesthesia

Pack development

Pack development Pack tests

Pack tests Pack tests with eye tracking

Pack tests with eye tracking

Right price for consumers’ brand equity

Right price for consumers’ brand equity Simple price sensitivity test

Simple price sensitivity test Complex price optimiser

Complex price optimiser

Advertising development

Advertising development Advertising tests

Advertising tests Advertising tests with emotional engagement

Advertising tests with emotional engagement

Trade insights

Trade insights Retail census

Retail census Sales force effectiveness

Sales force effectiveness Mystery shopping

Mystery shopping

Marketing tactics

Innovation: new product development

Cimigo will help you make better choices when developing new products and services which will win in the market. Cimigo will help you make better choices throughout the process from conceptualisation to market delivery.

Cimigo are fortunate to be in fast growing and innovation led markets, where innovation often leapfrogs years of evolution that businesses and consumers will have experienced in developed markets. Most people in Vietnam and Indonesia have never used a fixed line telephone but all spend far too long every day on a smart phone. Many have skipped over credit cards and use mobile wallets.

This has provided Cimigo’s team ample opportunities to guide their client across all categories in the development of new products and services. A minority are truly innovative, the majority are evolutions and adaptions to local cultures, rituals and tastes.

Cimigo have built innovation programmes to ensure the correct processes maintain innovation pipelines. Cimigo’s preferred approach has been built by Cimigo’s founder Richard Burrage encompassing 30 years of experience and over 100 successful innovation launches where products and services are still generating revenue for Cimigo’s clients.

7 steps to winning innovations

Concept development and testing

Concept writing guide

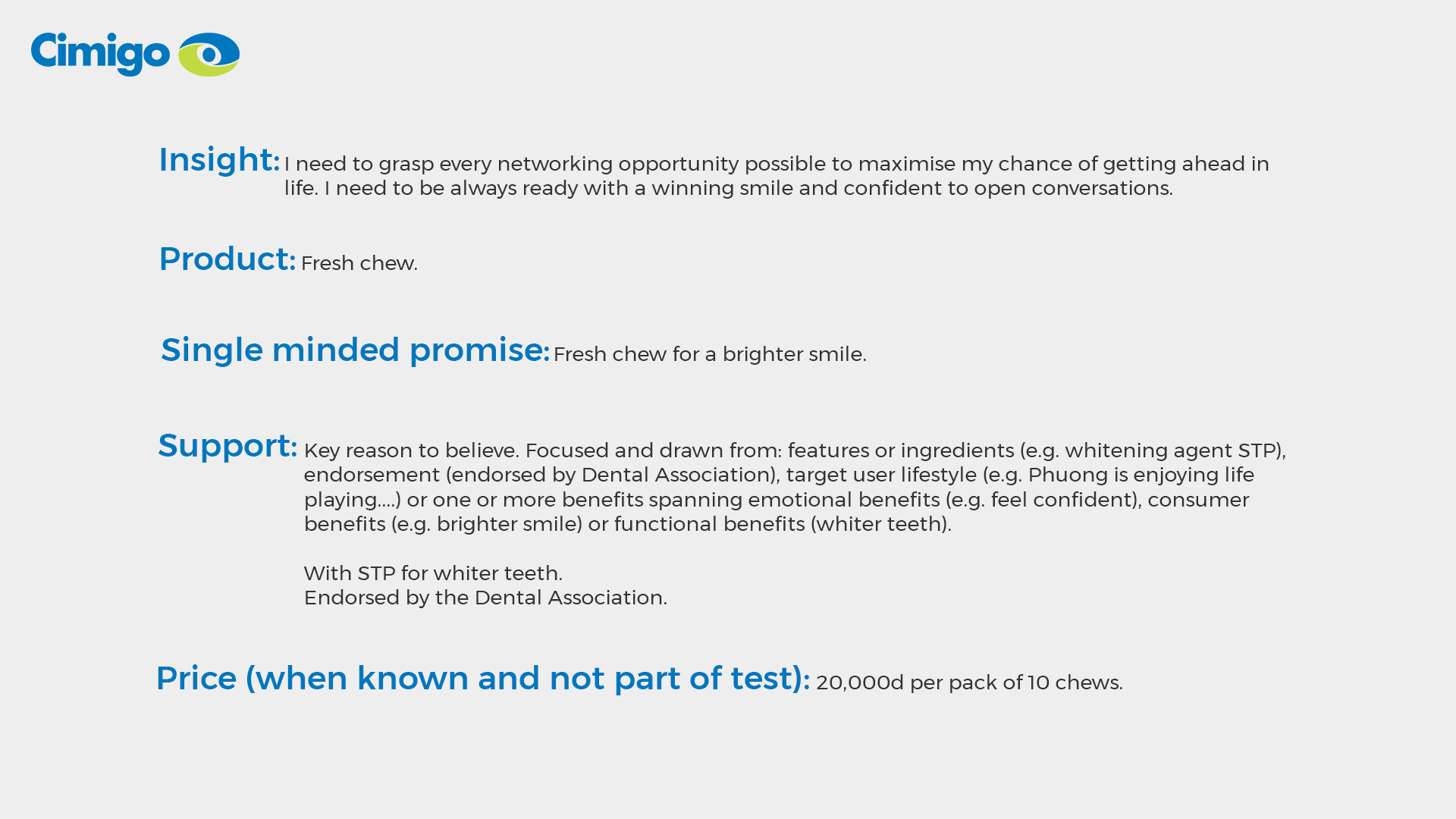

Concept writing, development and iteration is an integral part of new product development and advertising development. Distilling concepts to make them simple is the hardest part of concept writing. The closer to real communication and the more grounded in reality the better. A clear and single-minded concept prevents exposing verbose boring stimulus which only serves to frustrate participants (your target consumers).

It is not possible to realistically communicate your brand architecture through in market communications. A thorough verbose concept may test well (becomes hard to argue with the rationale your concept promotes) but fails to reflect your in-market reality to communicate.

The best concepts are simple and consist of:

Concept development

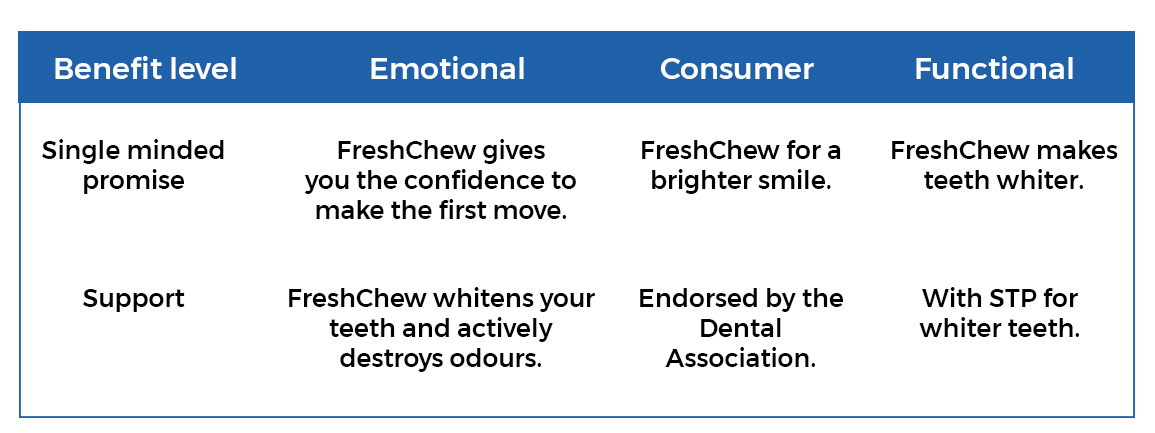

Concept development is iterative to optimise product ideas for your target groups. It typically involves exposing several concepts amongst focus groups with the target group participants. These may be different product ideas or the same product with a different benefit focus; emotional, consumer of functional benefits. Exposing concepts which are directionally different in their proposition and the key supporting benefits helps learn at what level it is necessary to communicate.

For example

This helps to unveil which resonate with the consumer and which do not. It helps the moderator to facilitate the participants to optimise the concept, to that which will be the most compelling. Note that the learning from what does not work well, is often the most insightful.

After each focus group discussion, the Cimigo and your team will reconvene to summarise learning’s from the group to allow for refinement and optimisation of the concepts with the objective of having the final proposition messaging at the end of all the group discussions.

The discussion is moderated to provide the target group’s perspective on;

Understand the decision and shopping journey;

- Consideration of products.

- Motivations and barrier towards brands.

- Drivers of brand choice.

- Touch points and the influencers.

Iterative concept development to explore;

- Spontaneous reactions.

- Concept insight (truth, relevance and attraction) ability to impact behaviour.

- Concept benefits and reason to believe.

- Brand name reactions and associations.

- Comprehension and message taken out.

- Relevance.

- Differentiation.

- Credibility.

- Appeal and interest.

- Price and source of business.

Cimigo will help you make better decisions on how to optimise the concept for your target group and help you to determine which to drop and which may have potential to be re-cycled either at a later date or for another target group.

Rapid concept screening

Often there are too many ideas seeking resources and development in Cimigo’s client’s innovation funnels. The ideas may have been developed from the bottom up, following the innovation process. Alternatively, they may be ideas that the client has launched successfully in one country and wish to explore the potential in another.

To help screen and focus on concepts with the best potential, Cimigo will quantitatively screen concepts rapidly, to help make better choices and enable resources to be focused on the best opportunity.

Rapid concept screening offers these advantages:

- Quick and easy to administer.

- Screening of many ideas.

- Learn concept potential immediately.

- Rank prediction of best volume opportunity.

- Any stimulus – concept, print ad, videomatic may be used.

- Filter to ideas to proceed with quickly.

This service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

The results rank concept’s by:

- Best volume opportunity.

- Most appealing concept.

- Interest score, buy score and success score.

Concept testing

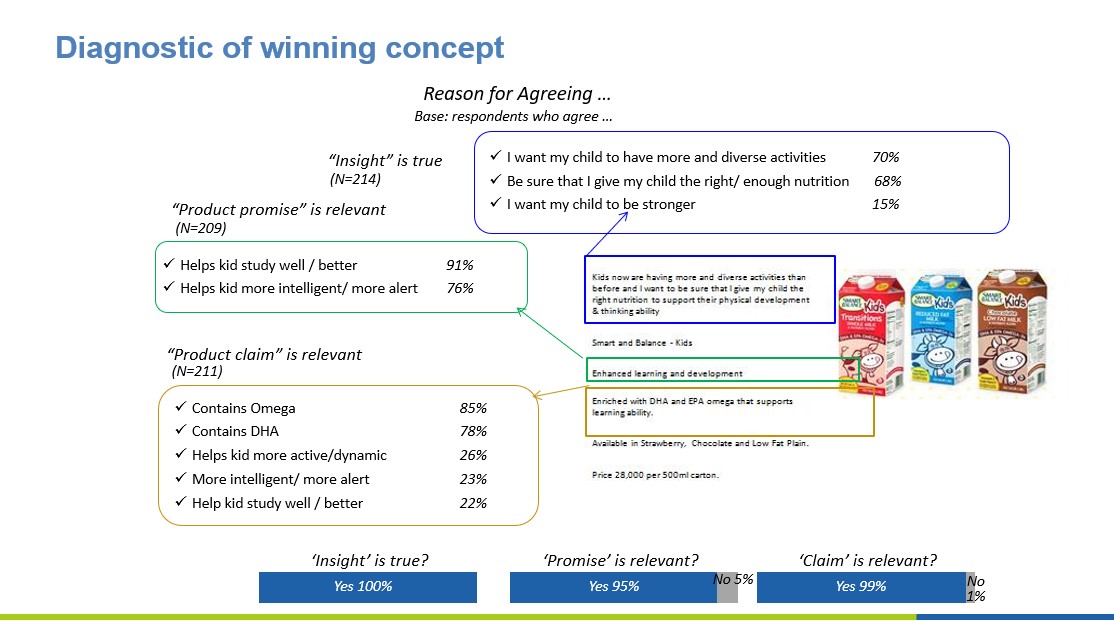

Validating concepts quantitatively is an integral part of Cimigo’s new product development service. Testing an optimised concept involves validating;

-

Appeal. -

Optimal price. -

Name. -

Pack design. -

Relevance. -

Source of business. -

Pricing. -

Uniqueness.

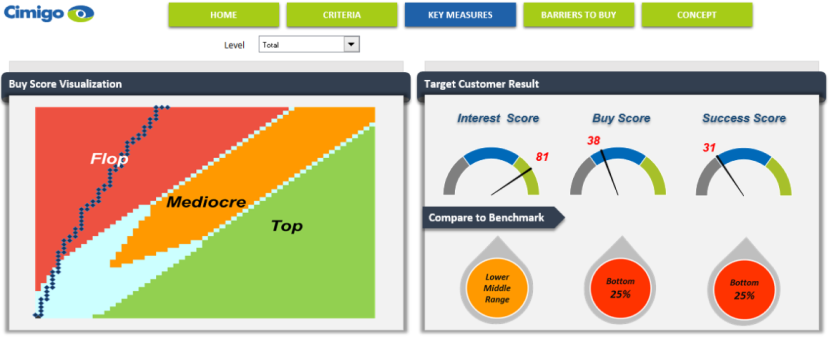

Providing meaningful volume and value forecasts to asses commercial viability requires that Cimigo crack the code of individual buying decisions. Whilst most market modelling merely aggerate the crowd (i.e. all participants to the survey) using overall metrics, Cimigo analyse each individual’s purchase decision. Cimigo then set a validated but tough minimum benchmark for each participant in this concept test survey.

Cimigo’s approach requires that the survey participant response to the concept must be positive on all aspects evaluated. For example, if the pack is not appealing, yet all other factors are, Cimigo recognise that this will not result in a buy decision for this individual. Therefore, even though the overall appeal may be positive, Cimigo do not account for this individual in the volume and value forecasts. It is a tough standard by which to be judged, but produces sales forecasts that have been proven time and time again.

Cimigo’s approach recognises that not all individuals are open to change and also takes into account the individual’s historic engagement with the brand and variant in question. The key metrics that enable Cimigo to make accurate forecasts of commercial success are;

Interest score

It is accepted that not all consumers will be interested to try. This measure assesses the interest to try based on the concept exposed.

Buy score

In order to buy consumers must not reject any key aspect of the concept. If they reject just one it is unlikely that they will buy. The buy score includes all consumers who are positive to all aspects. The key aspects are: overall appealing, promise relevance, claim relevance, uniqueness, design appeal, name appeal and price for pack shown.

Success score

Determines a buying percentage when launching product. Cimigo can predict success and more importantly where concepts will flop.

Cimigo can diagnose the barriers to buy and guide improvements and diagnose the impact of successfully overcoming barriers.

Diagnostics help Cimigo advise you better choices within your concept, what to highlight and what to change.

Predicted volume, value and source of business

Cimigo will use the concept test results to predict volume, value and source of business (including cannibalisation). To do so Cimigo use three further data points (or multiple scenarios thereof in a simulator) which link back to commercial and marketing planning. Specifically:

- Target weighted distribution.

- Target awareness.

- Current volume shares.

Combined this analysis enables to determine key commercial forecasts in accordance with launch planning time frames and the aforementioned targets.

- Penetration.

- Annual volumes (before and after own portfolio cannibalisation).

- Annual values of retail sales (before and after own portfolio cannibalisation).

- Retail share of sales.

This provides the business case support required to justify commercialisation, enabling the launch and management of known barriers to success.

Product testing

Product tests

Cimigo test products every week, some new, some evolutions and some just to ensure Cimigo’s clients are out performing their competitors. There is a plethora of approaches to test products depending on the decisions you need to make. Cimigo will help you make better choices depending on the decisions in hand.

Most commonly products are tested against the current product or competitive products or several alternative options for new products. This enables a benchmarking comparison. This is typically managed by matching panels of participants or testing on a rotated basis, one after the other (sequential monadic design).

In home use test

Whether it be for a washing detergent, a beauty regime, a children’s milk or a rice cooker, Cimigo will recruit the target consumers in the identified segment to use the product at home. These participants will put aside their ‘usual’ product and use and evaluate your product, providing feedback with video, images and answers to questions on Cimigo’s mobile application after (and often during) their use.

In home use tests are critical in many categories where experience can change with continued use, through saturation, boredom or different occasions of use.

Central location tests

Typically employed for sensory testing, be that; apples, rice, sauces, beverages, candies, motorbikes or cars. Cimigo will recruit the target consumers in the identified segment to visit Cimigo’s in-house testing facilities where in a controlled environment (de-branding and consistent; testing protocols, temperatures, serving equipment, stimulus exposure, processes, etc.) they can test the product and Cimigo can collate feedback from interviews and in-depth interviews.

Synaesthesia

The senses are critical to branding, by focusing on synaesthesia, the multi-sensory experience, you can heighten the brand’s appeal and differentiation. Synaesthesia brings together the science of sensory perception. So many products permeate eight senses

-

Sight -

Hearing -

Touch -

Taste -

Smell -

Kinaesthesia (derived from consumer posture and movement) -

Temperature -

Pain

They interact with one another – some more than others. I look at my laundry, smell it, feel it with my fingers and brush it across my face! I do so when I open the package, when I wring out my clothes, when I hang them to dry and when I iron and fold them.

Consumers struggle to articulate and describe their sensory experience. Consumer language is especially naïve, subjective, limited and variable in describing the senses. Specialist synaesthesia techniques can provide rich consumer diagnostics to fuel development process and helps consumers articulate the sensory experience, the gaps and desires.

Cimigo help elicit the unconscious as consumers are often unaware of their sensory experiences. Synaesthesia projective and elicitation techniques are numerous, some examples:

- Sensory audit.

- Video sequencing.

- Magnifying.

- Cross sensory probing.

- Cross sensory stimuli.

- Metaphors.

Pack development and testing

Pack development

Packaging is the embodiment of your brand’s proposition. Without packing there would be no differentiation. Most packs continuously evolve to stay contemporary whilst preserving readily identifiable brand assets. Qualitative packaging development often will be integral to concept development or if treated separately and follow a similar approach.

Pack tests

Simple quantitative pack tests often compare new designs with current designs to determine preference. They are typically tested on a rotated basis, one after the other (sequential monadic design) before being compared side by side.

- Pack associations.

- Pack messaging.

- Pack aesthetics and utility.

- Pack preference between options and versus competitors.

- Brand recognition.

- Areas for improvement.

Cimigo’s pack testing service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

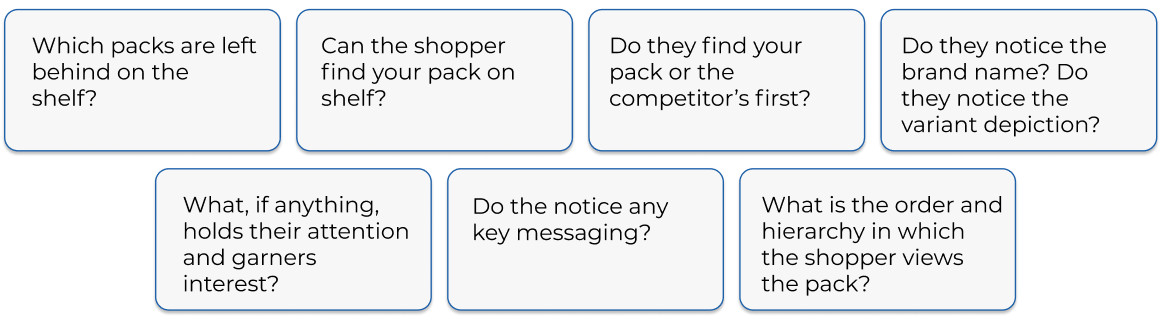

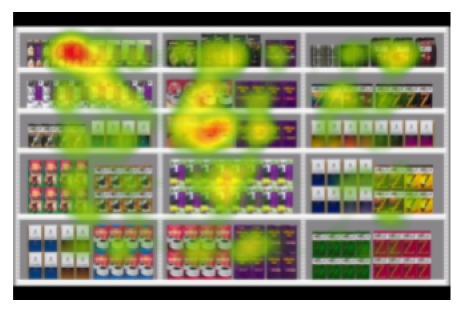

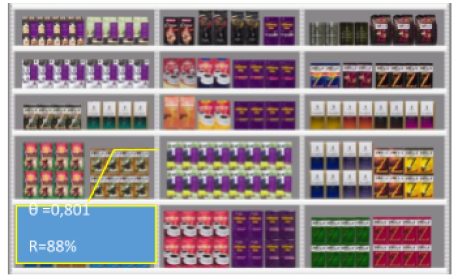

Pack tests with eye tracking

Eye tracking is often deployed in addition to survey questions. This helps Cimigo to determine the impact the pack has on shoppers in store and on the shelf. Occasionally this uses a mock store environment, but this setup is prohibitively expensive for many clients. Eye tracking technology is often a virtual solution that can be conducted with the target group online. Typically, packs including competitors

Cimigo’s pack testing service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

Typically, packs including competitors are shown on virtual shelf so that Cimigo can learn how shoppers scan their shopping environment and just what grabs attention. The ability to gauge exactly what is looked at, for how long and in what order enables Cimigo to help you make better decisions on which pack option to pursue and how best to optimise it.

Eye tracking enables Cimigo to determine;

Heatmaps show you which products are looked at most – those which are “hot” are superior to those that are not.

Quantitative metrics allow Cimigo to identify which packaging is attracting first gaze and length of gaze to determine which attract attention and hold attention.

With eye tracking Cimigo can identify what in the range is actually looked at and in what concentration. Using “fixations” (i.e. when a consumer focuses) Cimigo have clear metrics on the speed at which a product is found; the extent to which it is focused on; and whether respondents come back to look at the product again. All of these metrics mean Cimigo can identify the effectiveness of a product standing out and therefore its ability to capture the attention of consumers.

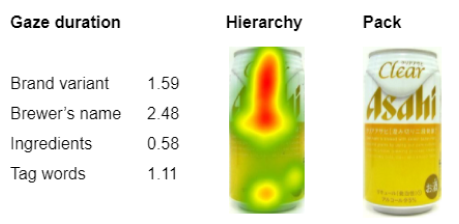

In this Clear Asahi beer example, the gaze movement from mid-to-upper; indicates viewing of the brand logo and beer bubbles logo motif in the centre which includes a brand message. Fixations demonstrate that most time is spent on the brewer’s name ahead of the brand variant.

At the individual pack-level, Cimigo can also determine key messaging, hierarchy and fixations. Hence Cimigo can determine in what order and for how long respondents spend on key elements of the packaging. This enables Cimigo to determine whether respondents are spending time (and seeing) key communication elements or whether they are confused or spending time on elements that are not helpful in increasing understanding of the brand and its features. Comparing across pack designs enables Cimigo to help you make better choices and to ensure your pack does not get left behind on the shelf.

Price

Cimigo can best help you make better pricing decisions. Price choices and the necessary solutions differ in their complexity.

Pricing decisions are critical to determine;

Right price for consumers’ brand equity

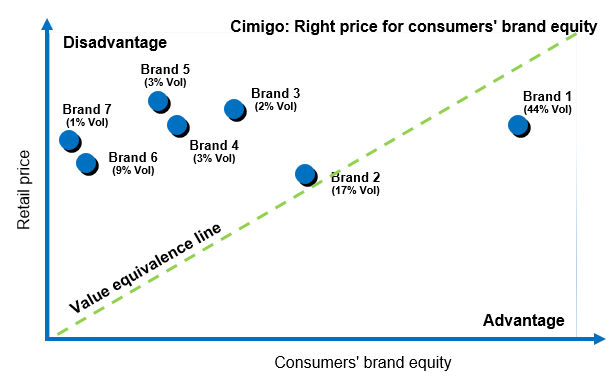

How do you know if you are at the right price point? The chart that both the CEO and CFO most love is below. It helps determine whether the brand’s equity is under or overpriced.

Few brands are overpriced, but too many brands are simply under-priced. Relative to the advantages they bring over competitors the brand could be commanding a greater price. Too many brand owners simply are unaware of the achieved value they have built within their brand’s equity. Too many brand owners leave sales revenue on the shelf as they are under-priced.

Cimigo’s right price for consumers’ brand equity service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

Cimigo can help you make better choices by understanding whether your brand is over or under priced. Cimigo’s brand value model compares the equity across brands in the category, relative to what is driving purchase behaviour and maps these relative to current retail prices.

Some brands (such as brand 2 on the map) have a fair price given the equity that the brand delivers to consumers, hence it sits close to the value equivalence line.

Brand 1 falls in the advantage zone to the right on the brand value equivalence line. This brand delivers far more equity than the price at which consumers pay for it. The brand it being rewarded with significant volume share. This brand owner would be asked to pursue further price research (to understand the impact of higher prices on volume and value shares, as well as margin delivery) to determine the optimal price point. In this example, following further research, the price of brand 1 was increased, delivering slightly less volume share but more margin for the manufacturer.

Brands 3,4,5,6 and 7 all fall in the disadvantage zone to the left on the brand value equivalence line. All of these brands under deliver equity relative to their price position. They need to understand consumer drivers in the category and build their equity and whilst building they will need to re-consider their pricing tactics. Many in this example were already depending on promotions to move stock.

Simple price sensitivity test

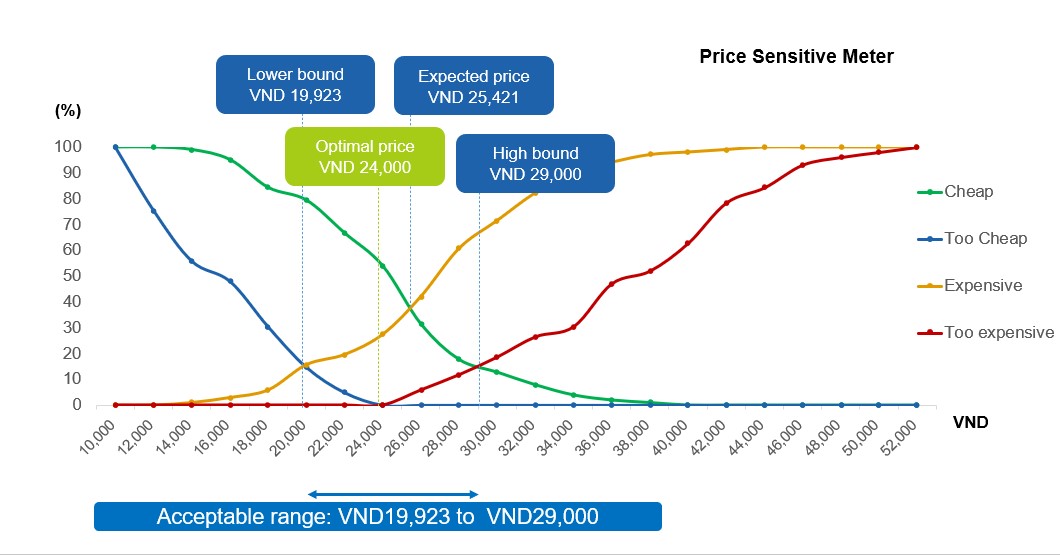

Cimigo applies a simple price sensitivity meter model to determine acceptable price range and the optimal price therein. Consumers are asked at which price the brand being tested is;

- Too expensive: at what price do you perceive the product as too expensive to the point where you would not consider this product?

- Too cheap: at what price do you perceive the product as too cheap to the point where you would feel that the quality cannot be very good?

- Expensive: at what price do you perceive the product is getting expensive, but you would still consider buying it?

- Bargain: at what price do you perceive the product to be a bargain – a great buy for the money?

In this example, the optimal price is VND 24,000. The acceptable range is from VND19,923 to VND29,000. Beyond this range too much demand is lost.

Cimigo’s price testing service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

Complex price optimiser

A more advanced pricing solution is the Cimigo price optimiser, this test deploys discrete choice modelling. Discrete choice modelling assesses how different combinations of the chosen product attributes (brand, pack and price) are likely to affect sales volumes and values.

This approach is best used in situations where significant, high risk decisions are being made. It is the most robust method for estimating market share that Cimigo know of, short of undertaking a test market. It is intended to simulate the actual purchase decisions as closely as possible by simulating all the consumer choices where consumers make holistic choices.

Discrete choice modelling is perfectly matched for portfolio management issues because numerous brands can be included in the experimental design. It captures interaction effects so that it is possible to evaluate the price sensitivities by brand. It will provide the volume and thus value share in different price scenarios.

The main benefits of Cimigo price optimiser over other approaches are:

- Realistic stimulus – real pack pictures with prices.

- Realistic consumer tasks which simulate the actual purchase decisions as closely as possible by simulating choices where consumers make holistic choices.

- Disguised task owing to the use of randomisation and a statistically robust experimental design, respondents cannot establish the purpose of the research as they see no relationship between prices and brands.

- Explicit estimates of market share, which unlike other approaches that involve rating scales or purchase intent scores, the discrete choice model output is choice.

- Interaction effects are captured – so that it is possible to evaluate the price sensitivities by brand.

Using the brand, variant and price range as inputs, ‘choice tasks’ are generated through a systematic factorial design. Each such choice task will contain brand variant photos with the price levels indicated.

These variables will fit into a regime where different scenarios will be presented to your target consumers. As one consumer cannot see all scenarios, groups of consumers will see different scenarios. All consumers will see the scenario with the current range at current prices. Consumers will be asked to ‘purchase’ for requirements for their household for the next 7 days (or appropriate time frame).

Cimigo provide an easy-to-use Excel based simulator, showing the results of the model in any pricing scenario, within the scope of the design. The simulator will include profitability analysis, where margin and cost have been provided to Cimigo. This enables profitability to be calculated under different pricing strategies.

Advertising development and testing

Cimigo will help you make better choices from unveiling insights from the first creative ideas through to the evolution and validation of a communication campaign.

Learn more about what just makes advertising work here.

Advertising development

Communications development and iteration can take many forms depending on the creative process. It may begin with alternative big creative ideas, several or just one-story board for video development or key visuals and copy for digital or print publication.

Communications development typically involves exposing the creative ideas amongst focus groups with the target group participants. Communications development is iterative to optimise stories, ensure that the brand cuts through and that the message is delivered effectively. Communications development work can save a great deal of expense or missed opportunity later in both the production process and media expenditure. There is nothing more frustrating for a brand team than learning once invested in media expenditure that the brand cut through is weak (or worse mis-attributed to a key competitor) or that the key message is not being received by the target audience.

Most typically the results support the creative team to;

- Correct scenes that lead to miscomprehension or cultural rejection.

- Ensure that the brand’s role is strongly defined.

- Enhance both message focus and clarity. Bringing messaging back to the core proposition.

- Brand assets (e.g. pack shapes, icons, logos, jingles) which enhance recall are maximised.

This helps to unveil which resonate with the consumer and which do not. It helps the moderator to facilitate the participants to optimise the concept to that which will be the most compelling. Note that the learning from what does not work well, is often the most insightful.

After each focus group discussion, the Cimigo and your team will reconvene to summarise learning’s from the group to allow for refinement and optimisation of the communications stimulus with the objective of enabling the creative team to identify final direction at the end of all the group discussions.

The discussion is moderated to provide the target group’s perspective on;

Understand the decision and shopping journey;

Motivations and barrier towards brands.

Drivers of brand choice.

Touch points and the influencers.

Consideration of products.

Iterative storyboard development to explore;

- Spontaneous reactions.

- Appeal.

- Relevance.

- Surprise.

- Brand role.

- Brand impact.

- Comprehension and message taken out.

- Most memorable scene.

Cimigo will help you make better decisions on how to optimise the creative ideas for you target group.

Advertising tests

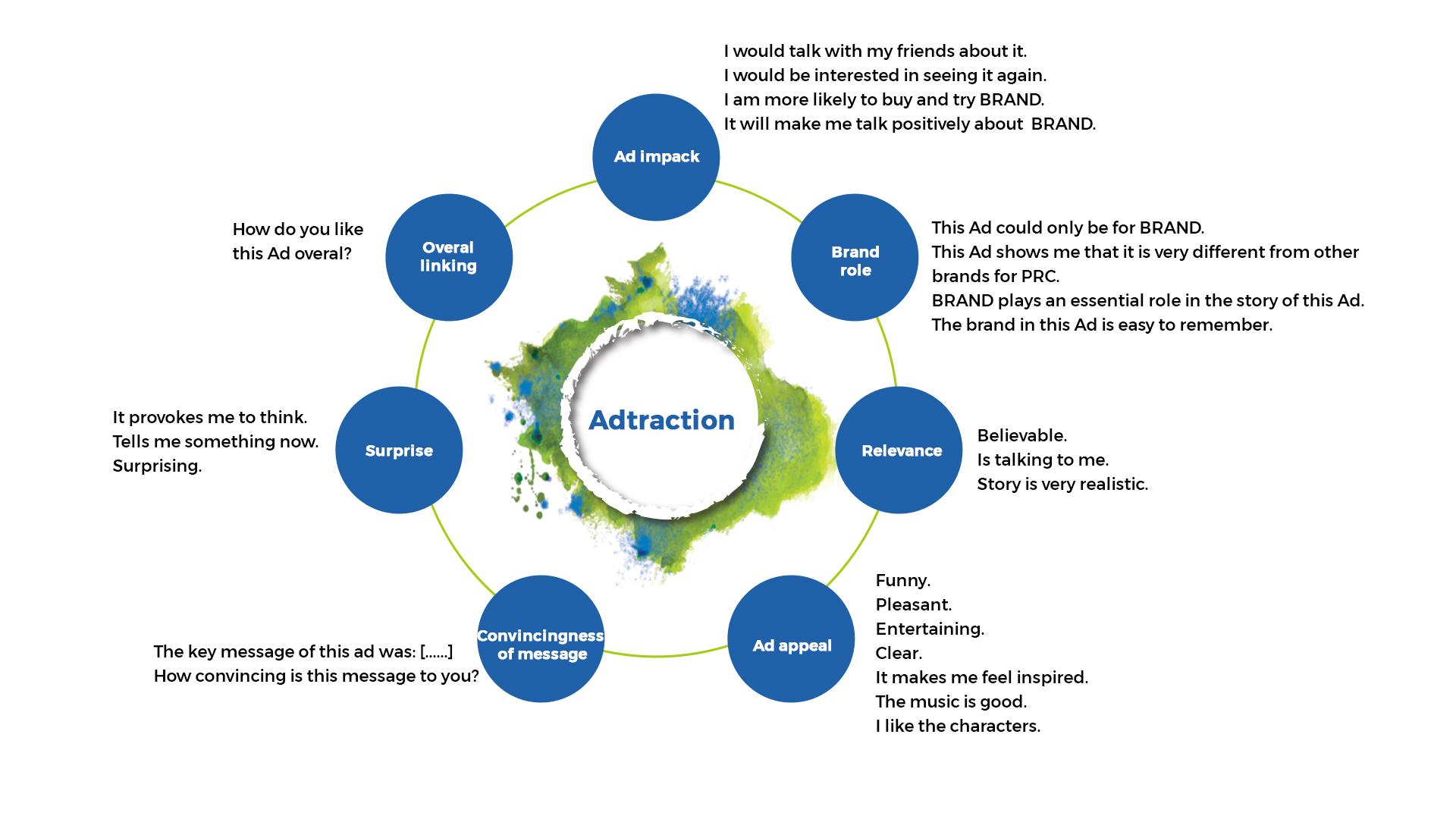

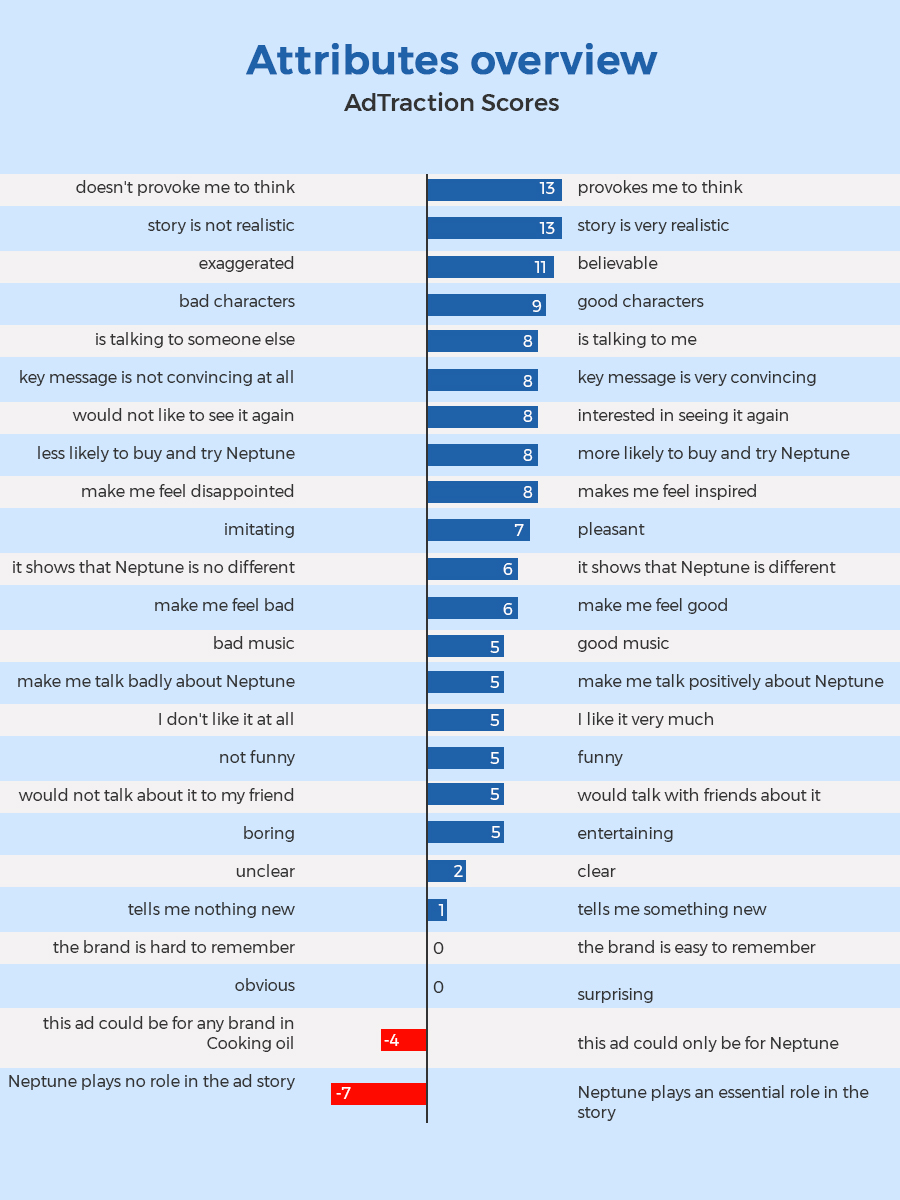

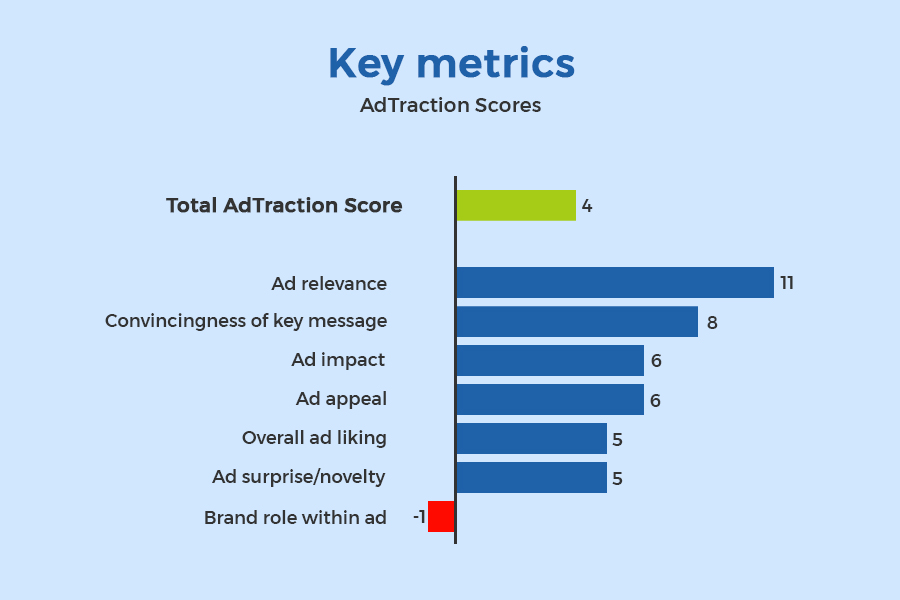

Cimigo has the empirical knowledge to best advise you on what advertising works and what does not for your target group and category. The Cimigo AdTraction advertising test shows how your advertising performs on a set of standard metrics. Your advertising is compared to a benchmark of over 500 advertisements, to find out specific strengths and weaknesses.

Cimigo’s AdTraction advertising test service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

Advertisements are typically tested in an online survey on a rotated basis, one after the other (sequential monadic design). AdTraction metrics include 24 standard attributes, as well as ad recall, brand recognition and three open-ended questions.

Cimigo’s AdTraction tests the performance of advertising and provides rapid feedback on your advertising performance so you may adjust your communications plan.

- Quickly pre-test.

- Improve emotional engagement.

- Re-visit execution (post editing) and media investments.

- Learn from each advertising to benefit future advertising development.

- Learn from your competitor’s advertising – success or failure.

Learn more about what just makes advertising work here.

Results of the Cimigo AdTraction advertising test will be provided in AdTraction scorecard format.

Scorecard

Overall brand performance

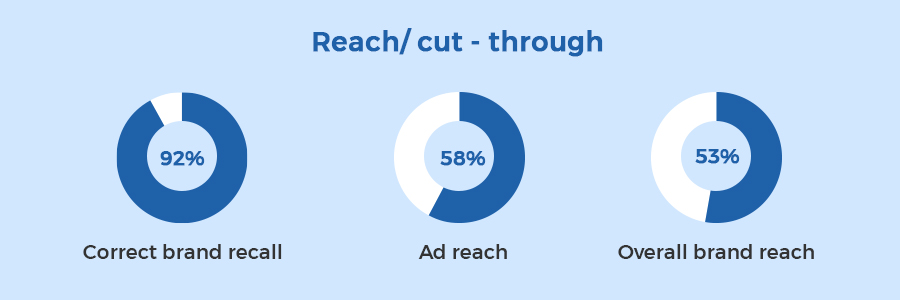

Brand reach and cut through

Advertising tests with emotional engagement

AdTraction advertising tests will also tell you what level of emotional engagement and which emotions are being evoked second by second. Cimigo use facial imaging to scientifically measure and analyse emotional response to advertising using the webcam or smartphone camera.

Cimigo’s AdTraction advertising test service is available as a self-service RapidSurvey solution or Cimigo can support you with a customised service.

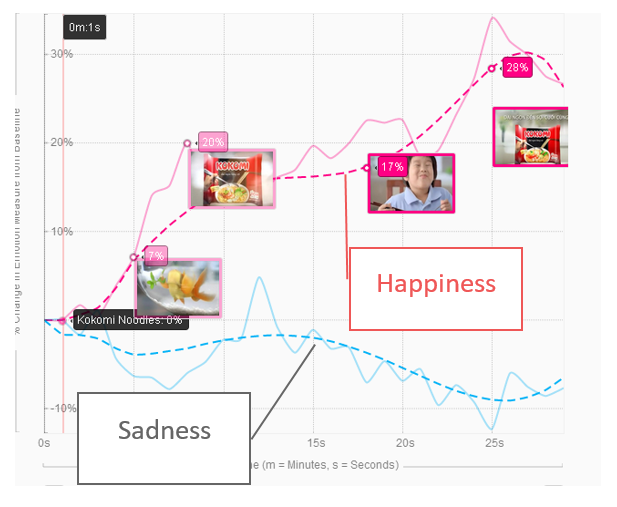

The result is second by second emotional engagement, translated from the 188 facial muscle movements into emotion. Emotive response determines whether the audience watches an advertisement and determines how well the advertisement can become anchored into the long-term memory of the audience. Seven key emptions can be shown, the example below highlight just two emotions; happiness and sadness.

Emotions can be compared and highlighted on a second-by-second basis which supports post editing of any video formats. Emotions are also compared to benchmarks to provide a relative understanding.

The most common impact of emotion response for the creative team is in determining frames within a story line that detract from the story. Specific images may create confusion and generate, fear, anger or disgust (in most cases never the intention of the story teller).

Variation in emotional valence in a story line is perfect (like a good movie which makes up both cry and laugh out loud) but you want to leave the audience feeling good and ensure a negative emotion is followed by positive emotions.

Learn more about what just makes advertising work here.

Further emotional response by second becomes irreplaceable when clients seek to shorten longer spots to shorter posts to increase the audience opportunities to see (viewing frequency).

Route to market

Cimigo will help you make better route to market and trade marketing choices.

Trade insights

Cimigo deploy in depth interviews with distributors, wholesalers, retailers and store managers. This unveils the trade’s motivations, trade terms and service gaps with existing brands and helps you make better choices when optimising trade marketing concepts.

Retail census

Cimigo are experienced across numerous consumer packaged goods on locating, auditing, GIS mapping every single outlet (on and off trade) to build a retail classification, segmentation and route to market strategy for the brand nationally.

A recent example includes a study to gather the GPS location, a photograph, sales volume and key brand share data in over 500,000 outlets selling a consumer-packaged goods category across on and off premise outlets across 63 provinces in Vietnam. The results were used to segment retail stores, prioritise segments by brand, target specific areas and streamline a more effective sales and distribution strategy.

In another example Cimigo completed a study to gather the GPS location, a photograph, sales volume, signage, contract details and key brand share data across 63 provinces in Vietnam. The results are visualised in a dynamic mapping system built by Cimigo; which was used to build and prioritise distribution plans and routes.

Sales force effectiveness

Cimigo can audit on or off trade performance. Whether you are seeking improvements to in store execution, in store promotion and sampling programmes, display or compliance to trading terms with retailers.

Cimigo will design and deploy the most efficient approach to provide rapid results – so your teams can focus on driving improvement. Cimigo will support you with independent and objective measures, including photographs of displays. Cimigo’s store auditors use the Cimigo OnMobile application to report findings instantly and easily. Using OnMobile Cimigo provide updates in real time so that actions can be taken quickly to ensure standards are being met.

Cimigo auditors follow a structured audit assessment on Cimigo’s OnMobile application. This same device is used to take photos when prompted by the audit survey. The OnMobile application enables auditors to capture data digitally so that Cimigo can feedback all the more quickly. Photos are linked to the store and audit question. Quality control is enhanced as Cimigo capture the start and end time plus the GPS location of each completion.

Typically, studies investigate:

-

Independent observation of performance based standard metrics for improvement. -

In-store tracking for brand standards adherence. -

Comparison across store type and area. -

Trade promotional compliance. -

Stock and facility standards. -

Range, facing, servicing, pricing and display compliance. -

Environment standards. -

Identify problem areas. -

Identify and showcase best performers. -

Actions to improve.

Mystery shopping

Cimigo can help you make better choices for your retail execution. Staff on the frontline can make a huge difference to sales and brand perceptions; both positive and negative. Cimigo’s mystery shopping team can be deployed to assess that performance and to identify areas to improve. Cimigo’s mystery shoppers use the Cimigo OnMobile application to report findings instantly and easily.

Cimigo do not only assess whether staff met standards in terms of uniform or other functional aspects. Cimigo’s team assesses the frontline capability to positively engage customers and their knowledge of brand and service. Cimigo’s results feed into programmes that drive performance, survey training, protocols to follow and innovations to simplify the customer journey.

Typically, studies investigate;

-

Independent observation of performance based standard metrics for improvement. -

Comparison across store type and area. -

Front line staff performance. -

Stock and facility standards. -

Range, facing, servicing, pricing and display compliance. -

Environment standards. -

Task based assessments. -

Identify and showcase best performers. -

Identify problem areas. -

Qualitative feedback from mystery shoppers. -

Actions to improve.