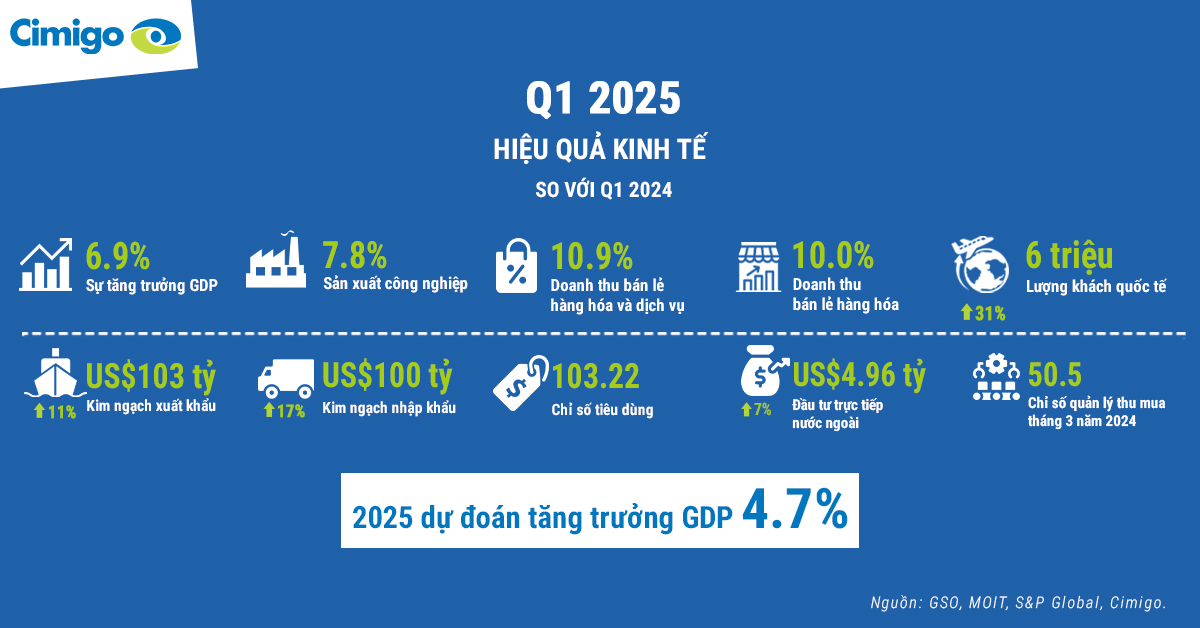

Kinh tế Việt Nam năm 2025: Tăng trưởng mạnh trong quý 1 giữa bối cảnh bất ổn thương mại toàn cầu

Th4 14, 2025

Kinh tế Việt Nam khởi đầu năm 2025 đầy ấn tượng với kết quả tăng

Indonesia economic outlook 2023

Indonesia Economic Outlook 2023 explores the five reasons that Indonesia will prosper in the next decade.

Indonesia’s economy is on the right track. The Q2 2023 GDP data shows that it grew by 5% from the same quarter last year. Indonesia has not only bounced back to the pre-pandemic levels, but also surpassed them. As businesses grow, so does the size of workforce they can employ. This enables Indonesia’s substantial labor force to further contribute to this growth. The continuously increasing young and urban population also plays a significant role in this process.

5-minute read

Cimigo believes Indonesia’s economy will keep growing over the next ten years. There are five catalysts that we have identified that will propel this growth.

The Indonesia economic outlook 2023 report explores the five reasons that Indonesia will prosper in the next decade:

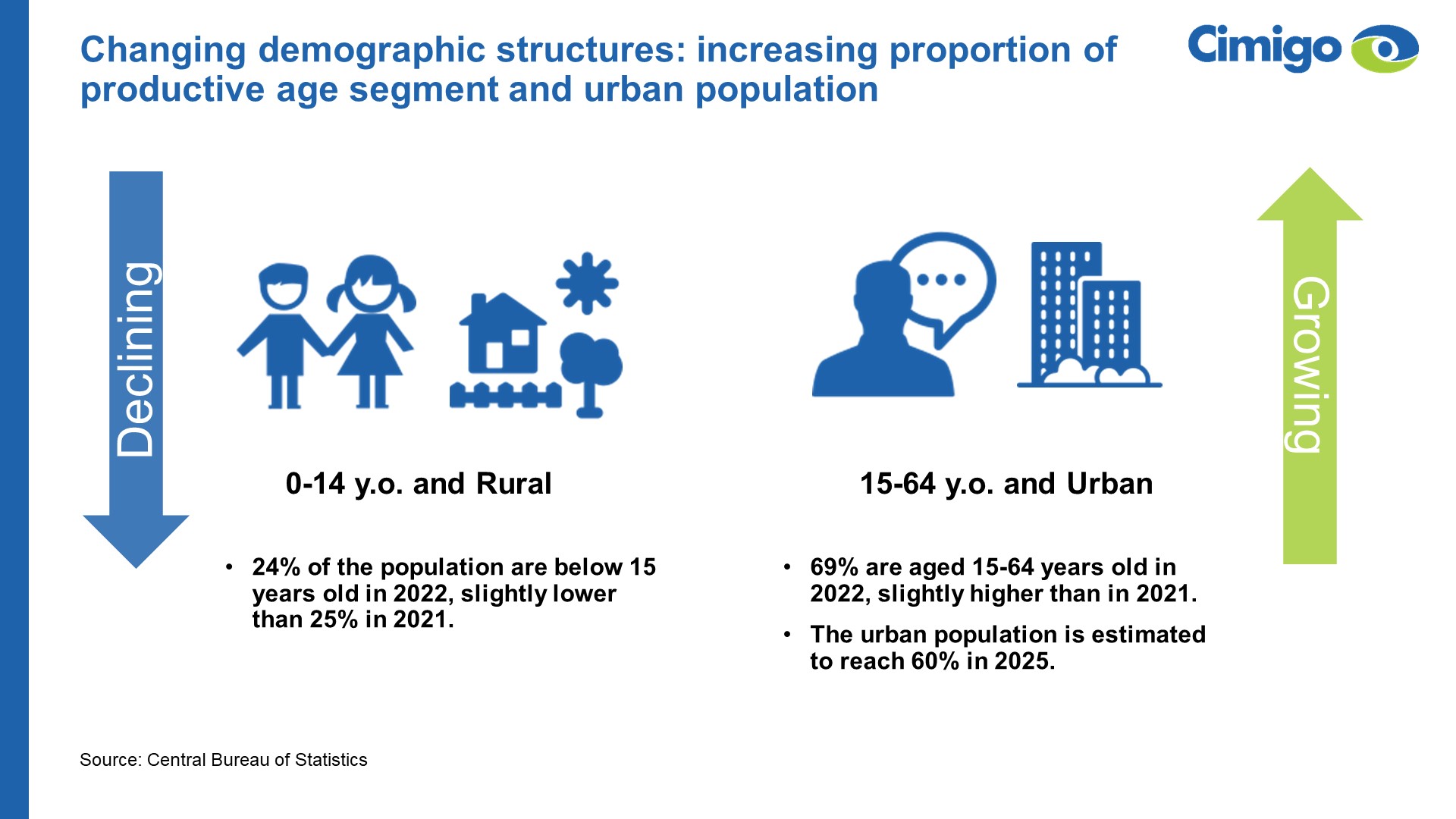

Indonesia is a vast country, home to nearly 300 million people, with a positive growth rate of 1.13%. Approximately half of them are working-age population. A low dependency ratio of 0.6 per employed person indicates a substantial workforce supply, with the majority being relatively young (44% are aged 20 – 39 years old).

Furthermore, there is a continuous urbanization of individuals in their productive age years. Therefore, the next challenge is to prepare them with the necessary qualifications and skills.

In Q2 of 2023, Indonesia enjoys a GDP growth of 5.2% compared to the same quarter in 2022. Industrial production grows by 4.9% and manufacturing Purchasing Managers Index (PMI) increases by 5% (Jun ’23 vs Jun ’22). Investment from outside of Indonesia is increasing, with a 47% increase in foreign direct investment disbursements. However, the trade surplus has suffered due to decrease in total value of exports and imports by 18% and 6% respectively.

Despite this setback, it is estimated that Indonesia will continue the positive trend overall and experience an approximate 5% increase in GDP in 2024.

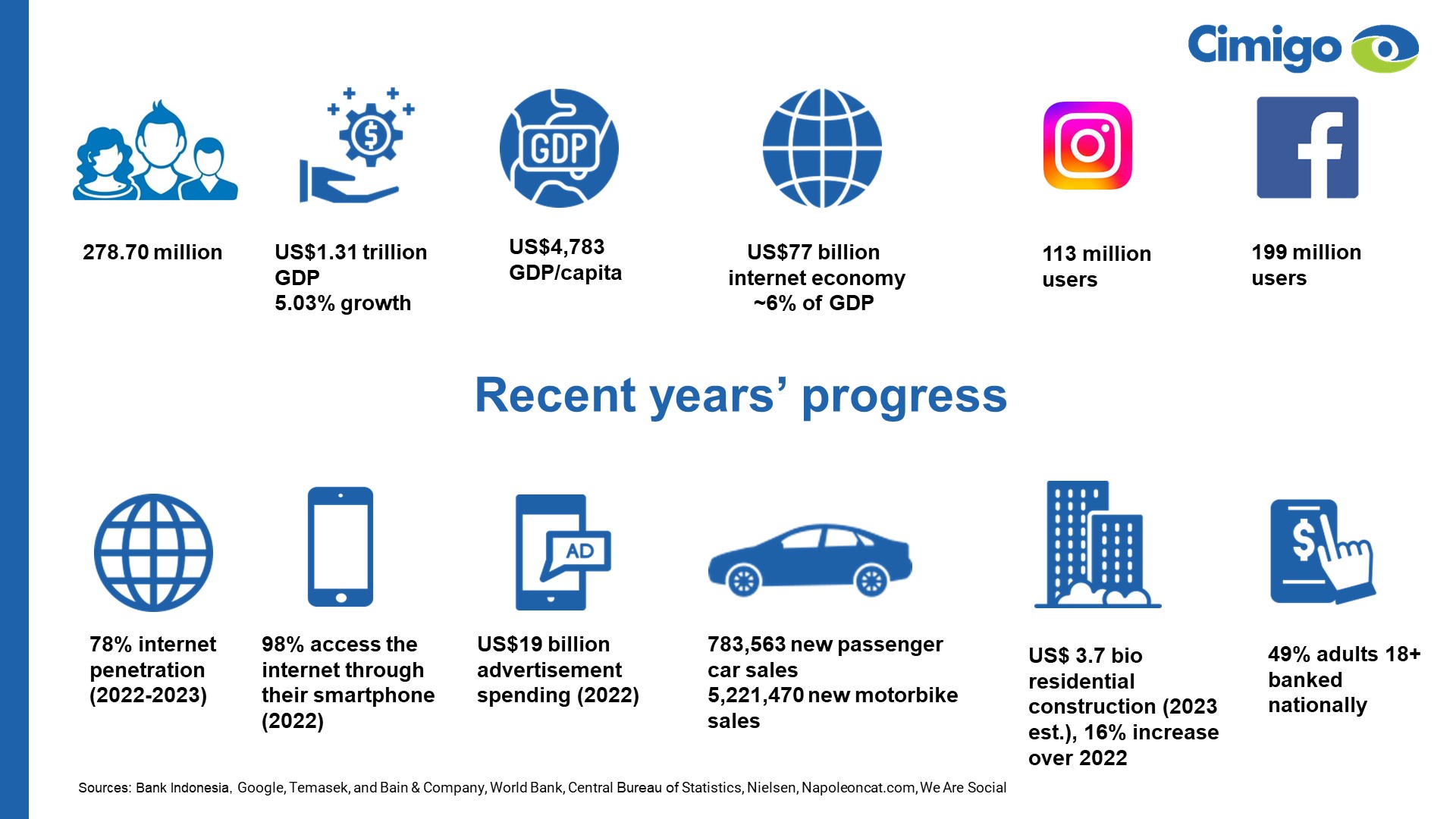

As of the full year 2022, Indonesia, with a GDP of US$1.31 trillion, is ranked as the #16 largest economy in the world. However, Indonesia is still a developing nation. The GDP per capita is merely US$4,783, which is significantly lower than some other Southeast Asian countries such as Singapore, Malaysia, and Thailand. Only 49% of adults aged 18 years old or older have bank accounts, despite a 78% internet penetration rate. Nevertheless, Indonesia’s consumer market remains attractive to advertisers, who spend US$19 billion to reach them in 2022.

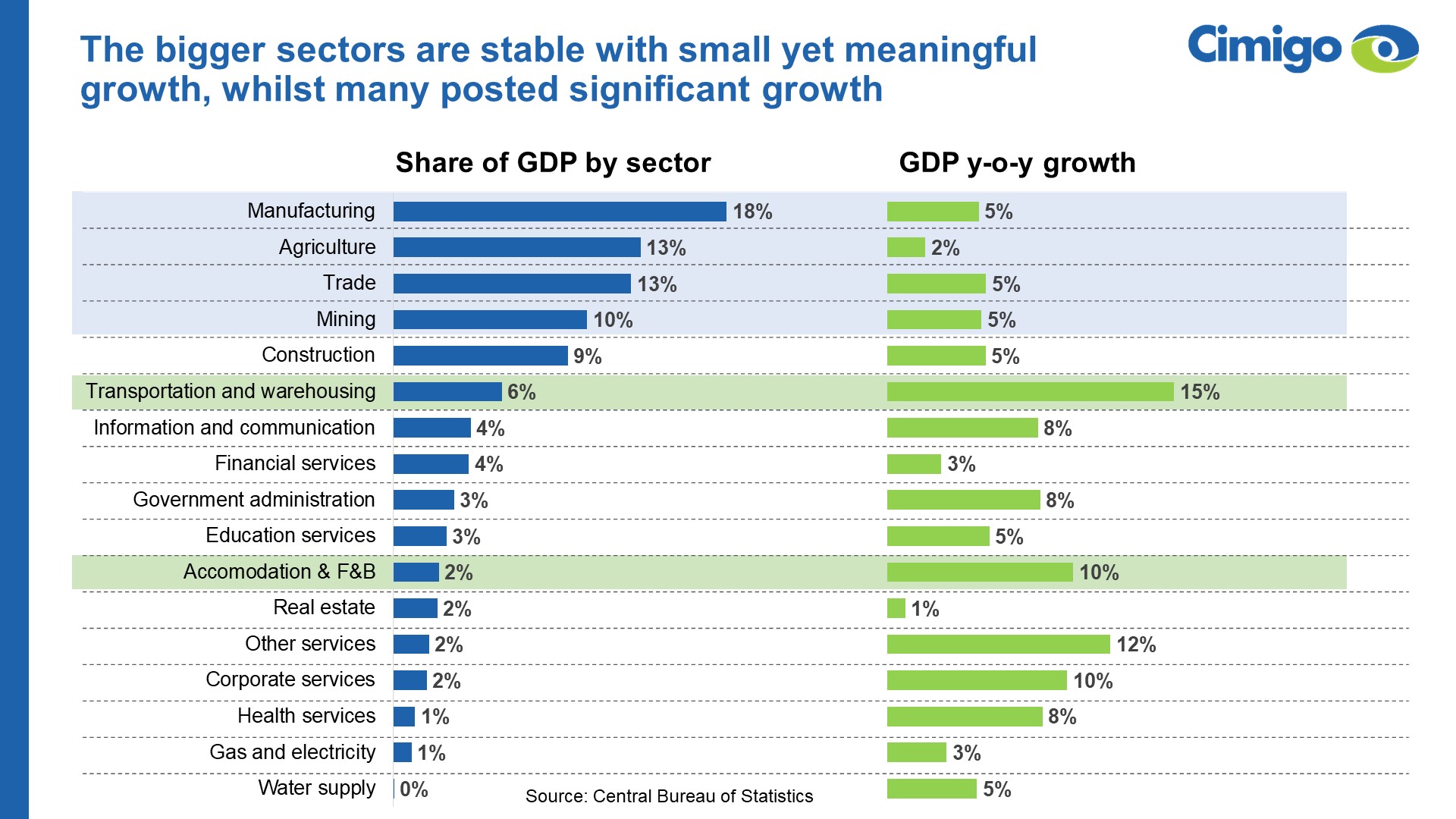

In terms of contribution, the top contributors are manufacturing, agriculture, mining, and the trade sector. Export values of the first three sectors have been flourishing over the past two years. Notably, palm oil and coffee are among Indonesia’s top exported goods. Despite the decline compared to the same period in 2022, Indonesia is actively striving to achieve its target trade surplus for 2023, which is set at US$38.5 billion. A striking example of this effort is the 71% increase in total mining exports, driven by coal, copper ores, and lignite.

In addition, there are notable gainers: transportation & warehousing and accommodation & F&B sectors. The number of vehicles operating in Indonesia is steadily increasing, and national motor vehicle production has also grown by 8.3%. Regarding the latter sector, there has been an increase in the number of visits by both international and domestic tourists to Indonesia over the past year. International tourist arrivals have surged by 250%, while domestic tourist visits have increased by 13%. The occupancy rate of starred hotels is at 47% with 3.75% growth, primarily driven by 4-stars and 5-stars hotels. People are choosing Indonesia as their holiday destination, and it is not limited to Bali alone. Interestingly, Riau and Jambi have also experienced over 5% growth in holiday trips.

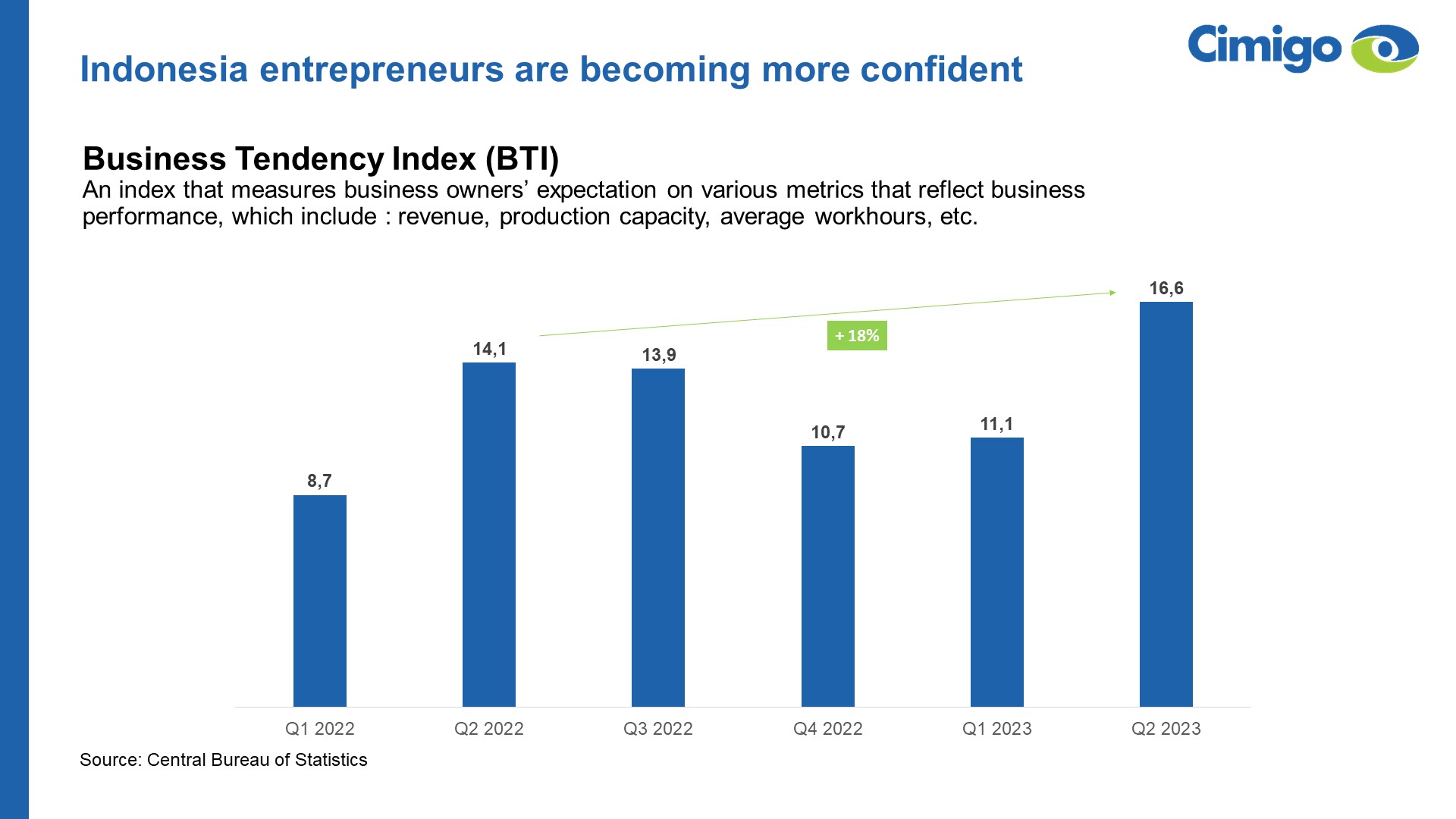

Indonesia entrepreneurs are displaying growing business confidence as indicated by an 18% increase of Business Tendency Index (BTI) during Q2 2023 compared to the same period last year. Sources of investment are relatively balanced between domestic and international origins. In addition to West Java, Central Sulawesi is also one of the provinces with a significant amount of investment.

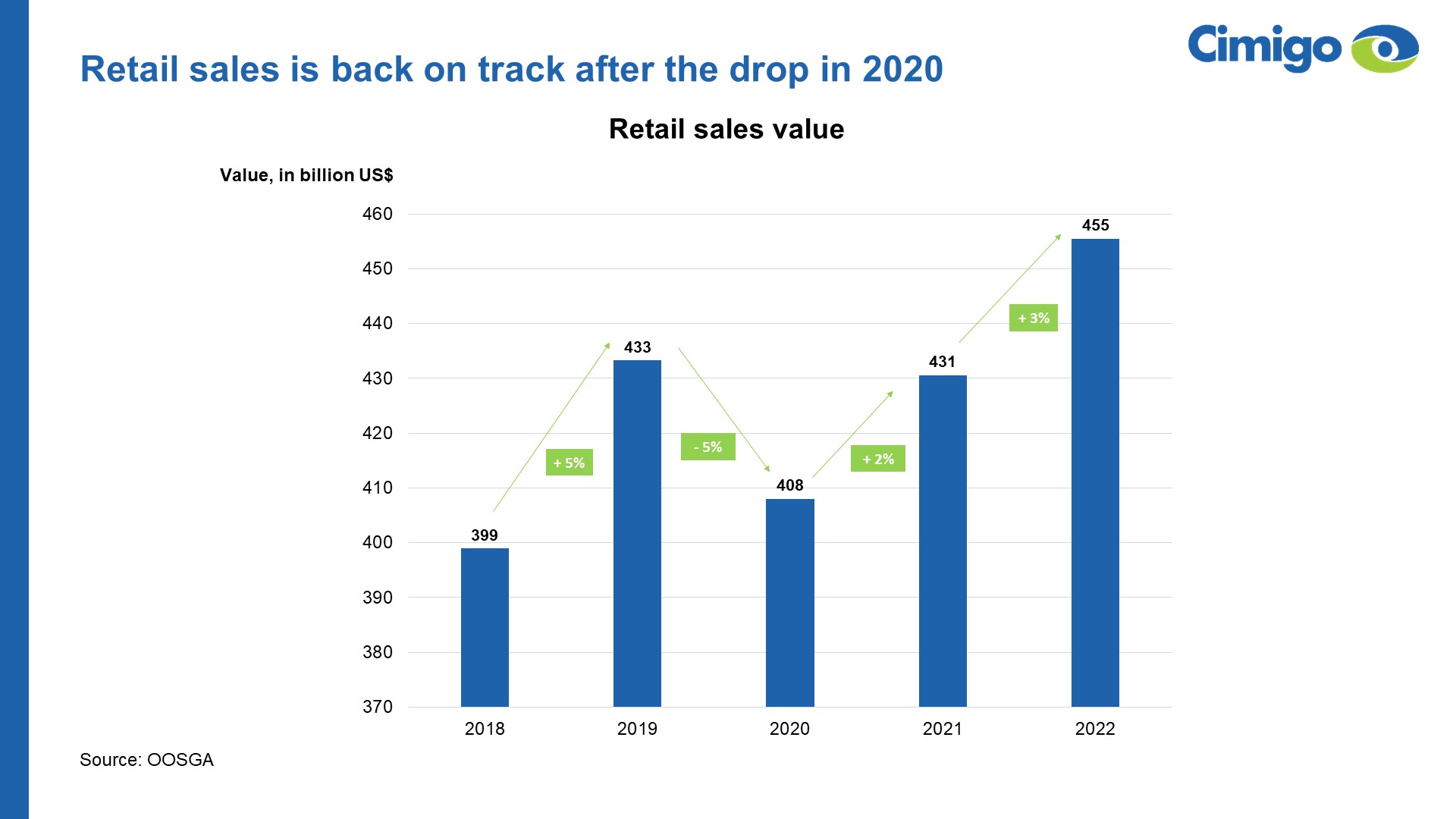

The retail sector continues to recover, now at US$455 billion in sales value. This figure is now higher than the pre-COVID condition. However, the growth rate remains modest with only 3% from 2021 to 2022, which is slightly below the 5.51% inflation rate for the same period.

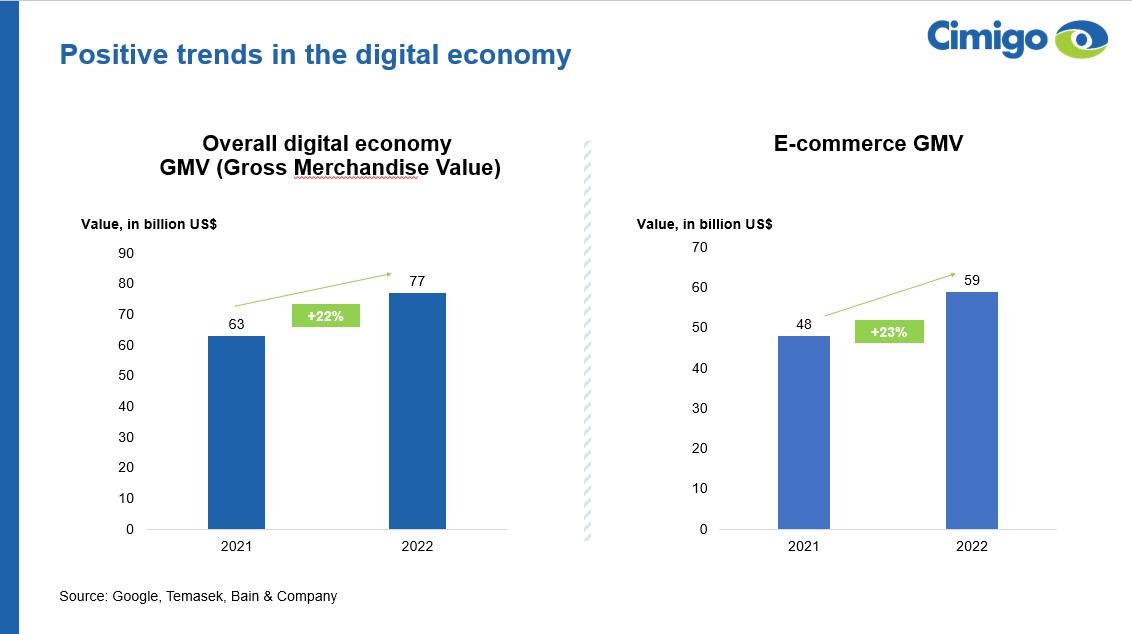

Businesses are going digital and those who have done so, are continuing to do it. From 2021 to 2022, there was a 22% increase of Gross Merchandise Value (GMV) in the overall digital economy, a clear indication that having digital presence yields both short-term and long-term benefits for businesses. 63% of Indonesians are making online purchases at least once a week, ranking Indonesia 6th in the world in this regard. Preferred e-commerce platforms are currently Shopee and Tokopedia, but we anticipate the rise of TikTok shop in the near future.

End.

Kinh tế Việt Nam năm 2025: Tăng trưởng mạnh trong quý 1 giữa bối cảnh bất ổn thương mại toàn cầu

Th4 14, 2025

Kinh tế Việt Nam khởi đầu năm 2025 đầy ấn tượng với kết quả tăng

PMI Việt Nam tháng 6/2025 – Chỉ số nhà quản trị mua hàng

Th7 07, 2025

Số lượng đơn đặt hàng xuất khẩu mới giảm mạnh nhất trong hơn hai năm

Xu hướng tiêu dùng Việt Nam 2025

Th3 20, 2025

Báo cáo xu hướng tiêu dùng Việt Nam 2025 phân tích các yếu tố tác động đến

Kevin McQuillan - Chief Marketing Officer

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Lisa Nguyen - VN Marketing Lead

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Matt Thwaites - Commercial Director

Joyce - Pricing Manager

Dr. Jean-Marcel Guillon - Chief Executive Officer

Anya Nipper - Project Coordination Director

Janine Katzberg - Projects Director

Rick Reid - Creative Director

Private English Language Schools - Chief Executive Officer

Chad Ovel - Partner

Thanyachat Auttanukune - Board of Management

Thuy Le - Consumer Insight Manager

Kelly Vo - Founder & Host

Hamish Glendinning - Business Lead

Ha Dinh - Project Lead

Richard Willis - Director

Aashish Kapoor - Head of Marketing

Thu Phung - CTI Manager

Tania Desela - Senior Product Manager

Dennis Kurnia - Head of Consumer Insights

Aimee Shear - Senior Research Executive

Louise Knox - Consumer Technical Insights

Geert Heestermans - Marketing Director

Linda Yeoh - CMI Manager

Đội ngũ Cimigo tại Việt Nam sẵn sàng giúp bạn đưa ra những sự lựa chọn tốt hơn.

Cimigo cung cấp các giải pháp nghiên cứu thị trường tại Việt Nam sẽ giúp bạn có những lựa chọn tốt hơn.

Cimigo cung cấp các xu hướng tiếp thị của người tiêu dùng Việt Nam và nghiên cứu thị trường về phân khúc người tiêu dùng Việt Nam.

Cimigo cung cấp các báo cáo nghiên cứu thị trường về các lĩnh vực thị trường và phân khúc người tiêu dùng tại Việt Nam.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.