Behind household appliances: understanding consumers’ preference and purchase

Aug 05, 2025

Electronic household appliances have continued to evolve over time in line with technological

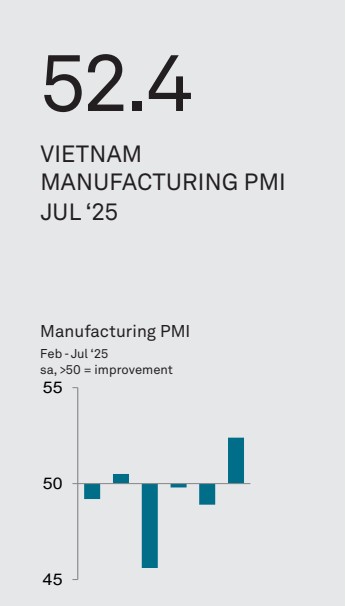

Vietnam PMI July 2025 – manufacturing purchasing managers index

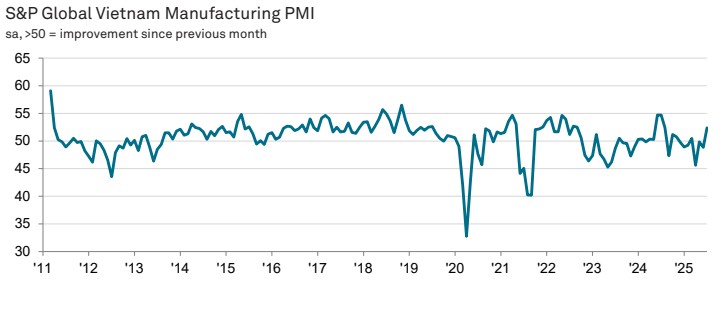

Cimigo Vietnam market research has collected the Vietnam PMI – manufacturing purchasing managers index since 2013. S&P Global compiles the Vietnam PMI S&P Global from responses to monthly questionnaires sent to purchasing managers in a panel of around 400 manufacturers.

The Vietnamese manufacturing sector returned to growth in July as a renewed expansion in new orders supported a faster rise in production. This was despite further export weakness as a result of tariffs. Purchasing activity also increased, while employment neared stabilisation. There were a number of reports of difficulties sourcing raw materials, resulting in supplier delivery delays, lower input stocks and higher costs for purchases.

The S&P Global Vietnam Manufacturing Purchasing Managers’ Index™ (PMI®) posted 52.4 in July, up from 48.9 in June and back above the 50.0 no-change mark for the first time in four months. As such, the index pointed to a strengthening in the overall health of the manufacturing sector. In fact, the solid improvement in business conditions was the most marked for almost a year.

The improvement in operating conditions coincided with a return to growth of new orders in July. New business expanded for the first time in four months, and at the fastest pace since November last year amid reports of customer demand strengthening.

That said, some respondents highlighted the negative impact of US tariffs on new order growth. In fact, new business from abroad continued to fall as a result of tariffs, extending the current sequence of contraction to nine months. The renewed increase in new orders helped to support production growth in July. Output rose for the third month running. Moreover, the pace of expansion was marked and the fastest in 11 months.

Higher output requirements led to a return to growth of purchasing activity. Here too, the pace of expansion was the sharpest since August last year. Meanwhile, employment neared stabilisation. Although staffing levels continued to fall amid ongoing spare capacity following the recent period of declining new orders, the latest reduction was the slowest in nine months as output requirements increased.

Backlogs of work continued to fall, albeit to the smallest extent in the current seven-month sequence of depletion. Despite renewed growth of input buying, stocks of purchases declined again as panellists reported challenges securing raw materials. That said, the pace of depletion was the weakest since December 2023. Stocks of finished goods also decreased in July.

Material shortages resulted in a further lengthening of suppliers’ delivery times. The latest deterioration in vendor performance was solid and only slightly less pronounced than that seen in June. Difficulties sourcing materials, particularly those from abroad, led to an increase in input costs at the start of the second half of the year. Input prices increased for the second successive month, and at a solid pace that was the fastest in 2025 so far.

The pace of output price inflation also quickened in July as firms passed on higher input costs to customers. Here to, the rise was the sharpest in seven months. That said, the increase in charges was only modest.

Although manufacturers remained optimistic that output will increase over the coming year, sentiment dipped to a three month low in July and was well below the series average. Confidence was linked by panellists to hopes for more stable economic conditions, new product launches and new orders. On the other hand, concerns around the impact of US tariffs weighed on the outlook.

Approach

The S&P Global Vietnam Manufacturing PMI® is compiled by S&P Global from responses to monthly questionnaires sent to purchasing managers in a panel of around 400 manufacturers. The panel is stratified by detailed sector and company workforce size, based on contributions to GDP.

Survey responses are collected by Cimigo Vietnam in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses.

The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

Behind household appliances: understanding consumers’ preference and purchase

Aug 05, 2025

Electronic household appliances have continued to evolve over time in line with technological

TikTok vs. Shopee: Gen Z and Millennial e-commerce showdown

Aug 08, 2025

TikTok vs. Shopee: Gen Z and Millennial e-commerce showdown plays out in Vietnam’s US$8.5

Indonesia consumer trends 2025

May 11, 2025

Indonesia consumer trends 2025 highlights eight key reasons why Indonesia is poised for a rebound.

Linda Yeoh - CMI Manager

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.