ESOMAR Connect: Shaping tomorrow’s insights in Vietnam – hosted by Cimigo

Jun 05, 2025

Join us for ESOMAR Connect: Shaping tomorrow’s insights in Vietnam on Thursday, June 26th at

Vietnam consumer trends 2022

Vietnam Consumer Trends 2022 explores the 10 consumer trends accelerating dynamism in Vietnam. The speed of change will accelerate through 2030. Opportunities to leapfrog abound. Sector-wide tech adoption will continue to leapfrog the development paths followed by mature markets.

12 minute read

The key Vietnam consumer trends in 2022:

If you prefer to listen, then please feel free to view the presentation here.

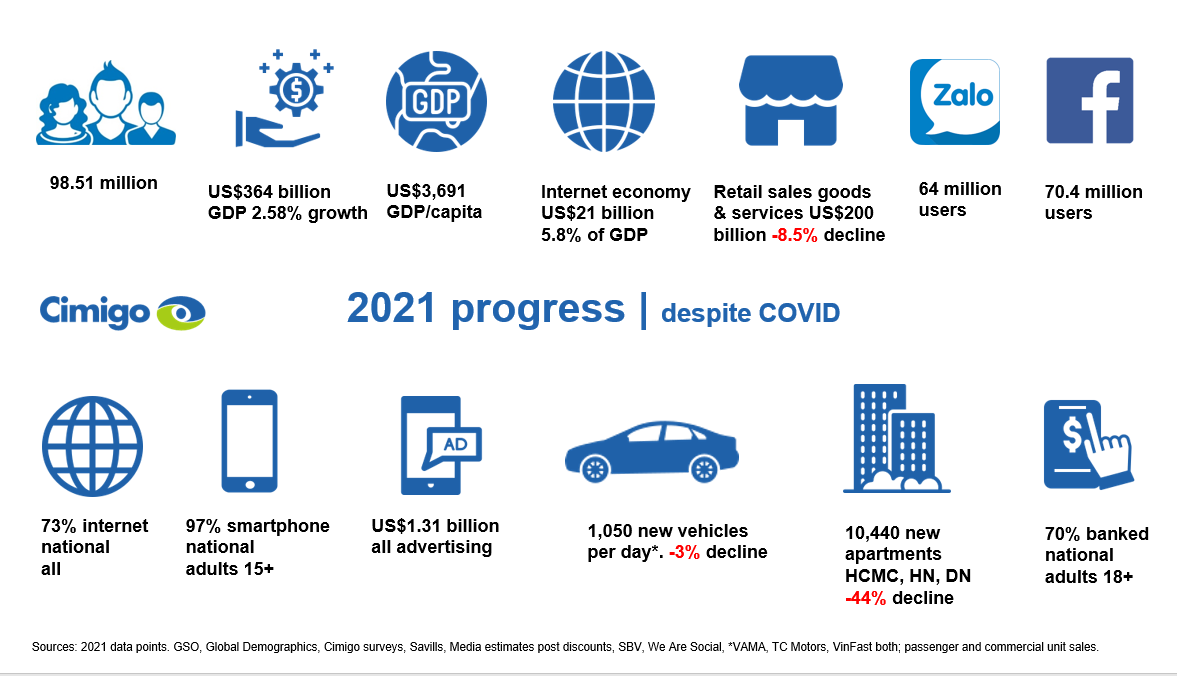

Vietnam is the 4th largest economy in SE Asia, with an economy that grew 2.5% last year reaching $365 billion. With a population of 98 billion people, Vietnam has a per capita income of US$3,691.

The internet economy is now valued at US$21 billion, nearly 6% of the overall economy. Smartphone penetration is now ubiquitous at 97%. 7 in 10 adults are banked today. US$1.31 billion was spent on advertising. 1,050 new cars were sold a day, a slight decline compared with 2020.

A huge decline in new apartment sales occurred in 2021, the result of limited available supply as well as financial pressure from Covid on the economy.

Download the free presentation on consumer trends

Exports were up 19% in 2021, but imports were up 27%, leaving a very small trade surplus. The purchasing manager index in December 2021 was 52.5% signaling growth. Inflation was low and despite Covid travel restrictions, dispersed foreign direct investment was down just 2% over 2020.

Covid in 2021 had a much harder impact on consumers than in 2020. Cimigo estimated over 4 million job losses in 2021 and household incomes dropped 38% in 2021. Consumers were hit hard and curtained their household expenditure.

Categories that shrank in 2020, and 2021 include; outbound travel, entertainment, eating out, and many retail services. Big price ticket items also suffered as consumers held on to the little money which was available to them. Some categories accelerated their growth during 2020-2021, Cimigo believes the categories above the arrow in the chart below will endure. The ones below the arrow, Cimigo believes were temporary reactions to Covid.

Consumer confidence is now 30% above the all-time low noted in September 2021. However, confidence remains 30% lower than pre-Covid consumer confidence in 2019. Confidence is rebounding because people are vaccinated, workplace protection measures are in place, kids are back at school and people can travel domestically again. However, after the bashing experienced by most consumers in 2021, income insecurity remains. Many workers went through terrible experiences in 2021 with an inability to earn any money, an inability to travel home to the relative safety and food security of their provincial homes and increased medical costs.

Download the free presentation on consumer trends

Consumers feel raising petrol prices fast and this hits consumer confidence. In October 2021 a litre was just VND22,000 and reached VND30,000 in March 2022. Raising transport costs will trickle down to the majority of the basket included in the consumer price index. Cimigo expects inflation to reach 4.5% in 2022.

Adding to inflationary pressures are increased global prices for grain, fertilizer and fuel resulting from the invasion of Ukraine. Beyond the human tragedy of the invasion, the impact on Vietnam will be limited. Russian and Ukrainian trade with Vietnam represents 1.1% of Vietnam’s total international trade. Direct investments from Russia and Ukraine are negligible at 0.3% of total foreign investment.

Cimgio expects to see a limited bounce back for inbound tourism from Russia as international travel eases. 646,524 inbound Russian tourists visited Vietnam in 2019. The 6th largest source after China, S Korea, Japan, Taiwan and the US. The more alarming impact on inbound tourism recovery is China’s travel restrictions. 5,806,425 inbound tourists from China visited Vietnam in 2019 and they are highly unlikely to be permitted to travel in 2022.

Consumer dynamism and economic growth will rebound unabated by mid-2022. There will be GDP growth of approximately 6.5% in 2022.

GDP growth in 2021 was just 2.58%. This is the lowest level since 1986 which recorded 2.3%. Less than 2020 which recorded 2.9% and in sharp contrast to the 7.0% achieved in 2019.

Download the free presentation on consumer trends

Cimigo expects the economy to return to strong growth in 2022 at 6.5%. The manufacturers purchasing manager index indicates growth expectations. Manufacturers are facing headwinds from shipping issues with both container availability and costs disrupting plans. Container costs have a far more damaging impact on low-value manufacturers. The average composite index of the WCI, assessed by Drewry for year-to-date, is US$9,180 per 40ft container compared to March 2020 when it was below US$2,000.

Labour force disruptions continue as not all migrant workers living in the provinces have returned to work because of Covid fears, this is lessening with time, but continues to hamper operations for some.

Vietnam remains the most interconnected trading nation on Earth. Calculated from the value of imports and exports as a % of GDP, Vietnam equates to 184% (up from 154% in 2020). Vietnam continues to attract new manufacturers largely for export, thanks to geopolitical stability, a diligent workforce and low minimum wages. Minimum wages in Siagon, where they are the highest nationally, are just US$191 per month, compared with US$308 dollar in China’s Pearl River Delta.

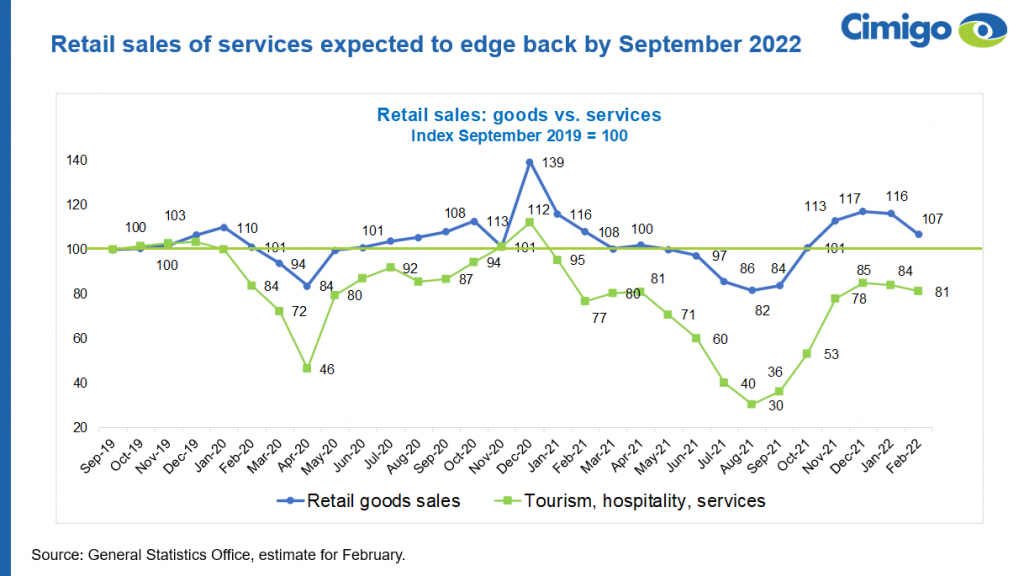

This chart below shows retail sales of goods and services in Vietnam, it is an index of monthly levels based on September 2019, way before the Covid, at 100. This does mask some seasonal impact. As of February 2022 data, Vietnam is already back to the monthly levels achieved in September 2019.

Retail sales of goods have bounced back but services ((tourism and hospitality, etc) have a long way to recover. 2021 retail service sales remained 32% below the 2019 level. Cimigo expects sales of these services to edge back by September 2022 and then return to their pre-Covid growth trajectory.

Changes in wealth were most marked amongst the super-rich since 2017. In 2021 there were 69,000 millionaires in Vietnam, increasing 218% over 2017. Ultra-high network individuals ((>30 US$ million) reached 1,228 in 2021 and there were six 6 billionaires.

The rise of the middle-class acceleration has been restrained by the economic impact of Covid in 2020 and 2021. In 2021 there were 1,530,577 households earning over US$1,000 a month (up 24% over 2017) and 9,603,248 households that earn between US$500-and US$1,000 (up 21% over 2017). The value of inbound remittances, mostly from the overseas diaspora of Vietnamese in the US and Australia, increased from US$15 billion in 2017 to US$18 billion in 2021 (up 20%).

Download the presentation on consumer trends

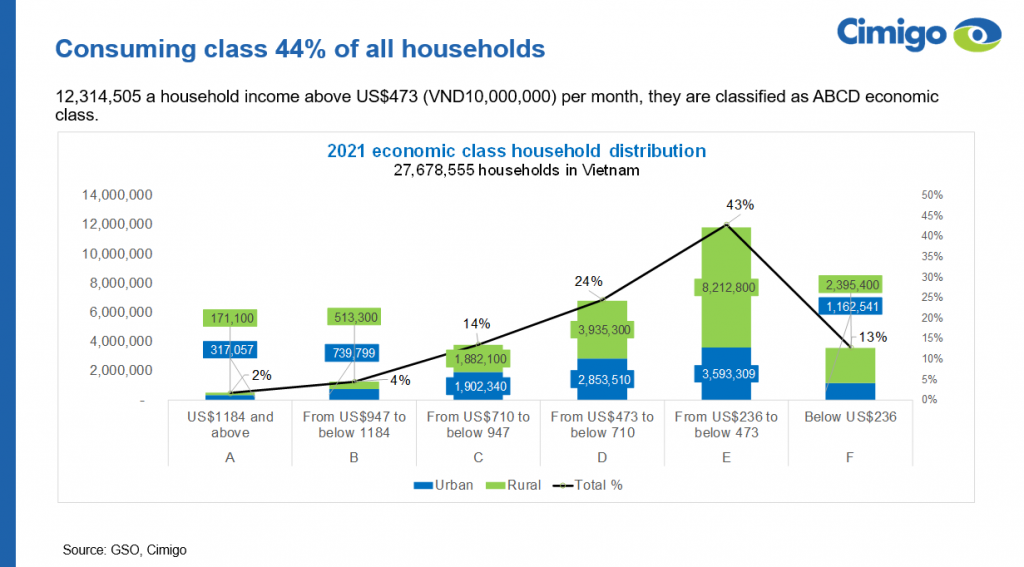

The consuming class for Cimigo refers to households earning more than VND10 million (US$473) per month which accounts for 44% of all households. There are in total 27,678,555 households in Vietnam, 44% of them have the discretionary expenditure possible to walk into a mini-mart and buy some branded products beyond the essentials. These households have the greatest impact on Vietnam consumer trends in 2022.

The main enabler of wealthier households has been migration to higher-paid employment in urban areas. There is a seemingly inevitable lower birth rate with urban living, which means that households are slowly getting smaller leaving them slightly wealthier with more disposable income.

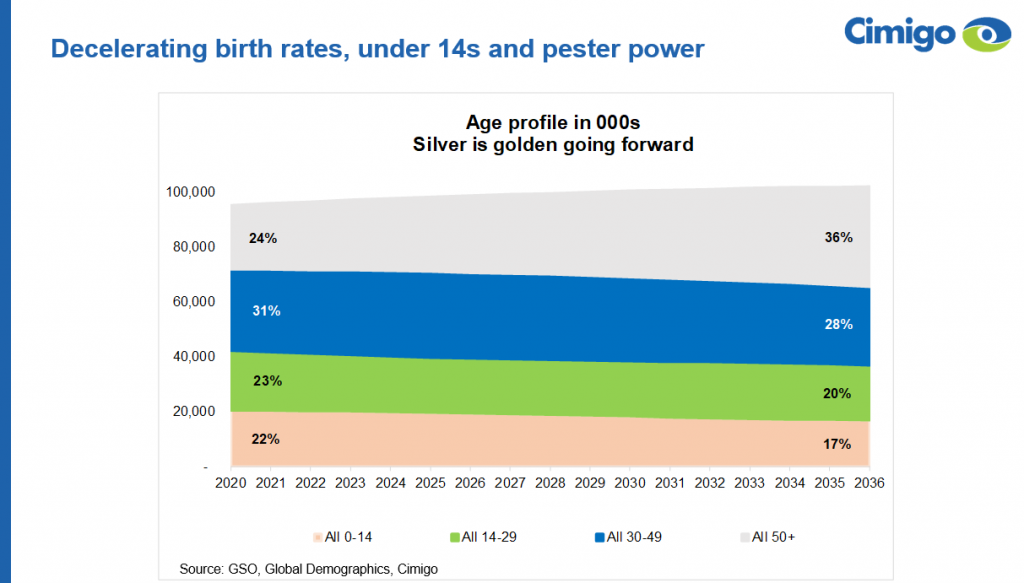

Other demographic shifts impacting consumer trends in Vietnam see two population groups in decline.

The first population group in decline is the rural population. Whilst at 64% today, it is declining as more people migrate to urban areas. The rural population started to decline in 2017 and will reach just 55% by 2036. Urbanisation provides challenges but it creates high efficiency for the distribution of products, convenience for consumers and changing living and retail environments.

Download the free presentation on consumer trends

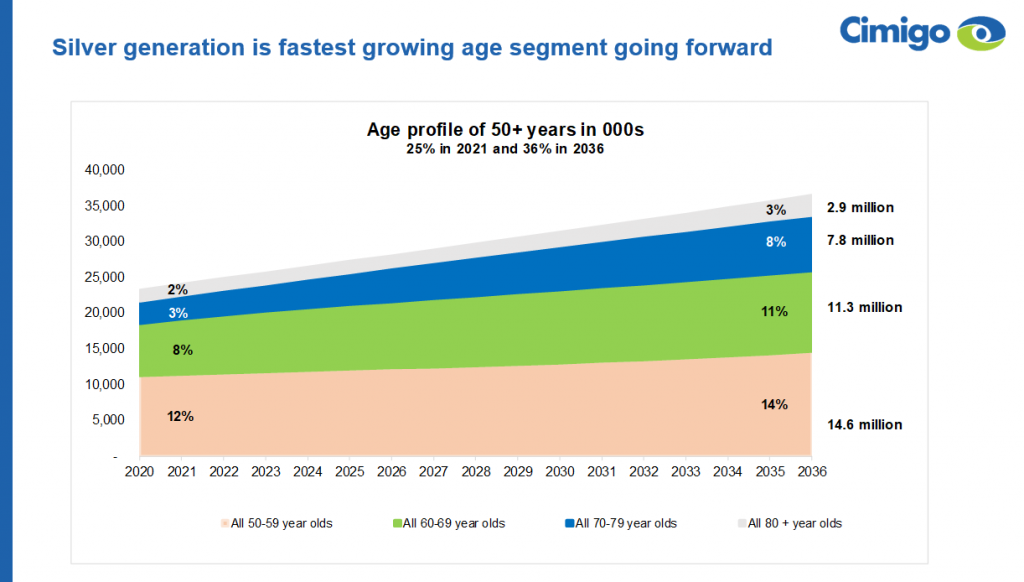

The second population group in decline is the youth (0-14 years old) who are declining with lower birth rates, which are the most pronounced in urban cities. The average age in Vietnam is 34 today. The biggest growth is in the over 50-year-olds, which will move from 24% of the population in 221 to 36% in 2036.

Marketers generally ignore them as marketing staff and their agencies are mostly below 3o years and struggle to relate. Seniors create many opportunities and are truly under-leveraged by both financial services and consumer brands. Seniors have a high disposable income, most of them are empty-nesters, as their kids have their own incomes and their own lives. Seniors have assets, they are often sitting on home ownership.

An aging population will take hold of the next decade and elderly dependents will become a key national and household economic challenge in the 2030s to 2040s. For higher-income households, this will present business opportunities to serve the needs of seniors. However, it will be challenging for the lower end of the economic spectrum, elderly dependents will need to be looked after. 30% of seniors’ household incomes are spent on healthcare, with the plethora of ailments increasing with age. See the Cimigo report on the aging silver generation of Vietnam for greater detail on the challenges and opportunities in the senior market.

Download the free presentation on Vietnam’s silver generation

The movement of Vietnamese consumers towards shopping online and in modern trade formats has accelerated during Covid lockdowns. This acceleration in changing shopping habits has a massive impact on the 20222 consumer trends in Vietnam. This acceleration is not only in Vietnam’s cities but also across the nation as online shopping platforms have improved logistics serving provincial and rural communities, whilst the largest modern trade retailer has expanded rapidly into provincial towns.

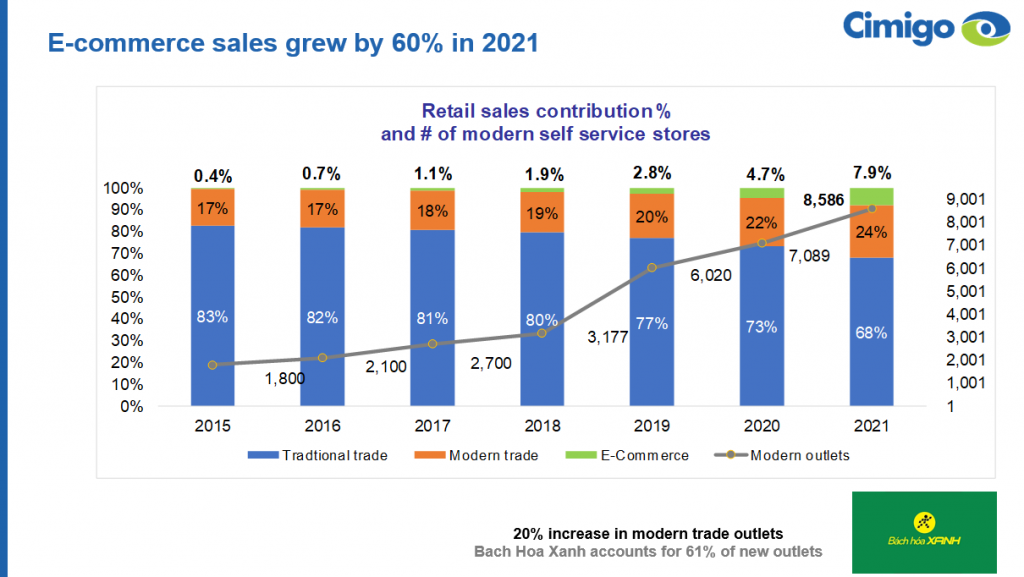

For niche marketers, these shifts present greater access through more organised distribution, bypassing the huge investments required in servicing the traditional trade. For large consumer packaged goods (CPG) companies in Vietnam, the traditional trade remains extremely important, there are more than 1.4 million traditional trade stores across the country. However, the contribution of the traditional trade (wet markets, mom and pop shops) moved from 73% in 2021 to 68% in 2022.

The value of online shopping grew by 60% over in 2021, as a proportion of overall retail sales online shopping now represents 8% of sales. Cimigo forecast that online retail sales will surpass that of the modern trade by 2028.

The modern trade grew 7% in 2021, as a proportion of overall retail sales in the modern trade moved from 22% in 2020 to 24% in 2021. In terms of the number of modern trade stores, they moved from 7,089 to 8,586 outlets a 20% increase over the year.

Bach Hoa Xanh’s modern minimarkets expanded the most in 2021, with 2,147 outlets today. Bach Hoa Xuan accounted for 61% of all new modern trade store growth. Much of the growth has been in smaller towns in the provinces, unlike many competitors where expansion is limited to cities only. This expansion is changing the shopping dynamics far beyond Vietnam’s cities. Bach Hoa Xuan is owned by MobileWorld a very experienced retailer which has a number of different brands with over 4,871 stores.

Download the free presentation on consumer trends

Valued at US$21 billion, Vietnam’s digital economy reached 5.8% of GDP in 2021. It was valued at US$3 billion in 2015. 62% of the value is generated from online shopping, 19% in advertising, media and gaming, and 11% is from ride-hailing and delivery.

Cimigo’s study on the digital generation, amongst 1,500 urban and rural consumers aged 16-29 years old nationally, who have grown up with digital experiences noted that rural consumers are rapidly catching up with their urban compatriots. 54% have shopped online in the last month in urban areas and 34% in rural areas. Shopee, by far the largest platform, is followed by Lazada, Facebook and then Tiki.

Download the free presentation on Vietnam’s digital generation

Vietnamese consumers spend 2 hours and 46 minutes on screen time. The rise of the digital economy means a rise in the experience economy, which has grown rapidly in the last 4 years. The digital economy has the biggest impact on the consumer landscape. It shifts people’s priorities, it makes experiences much more important than ownership and it shifts how people spend their time and interact with friends and brand communications alike.

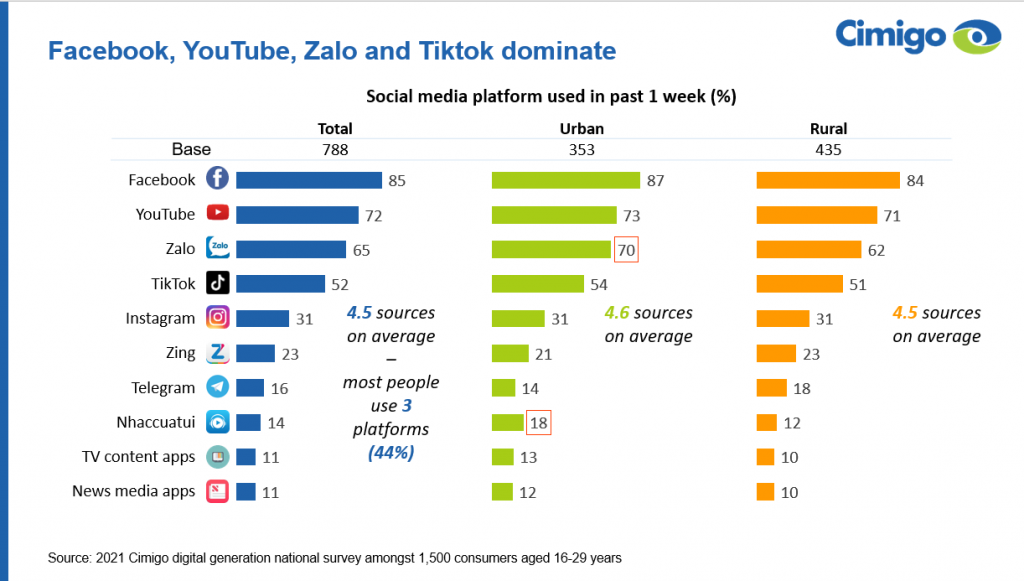

Whether comparing news sources, attitudes, or aspirations amongst the digital generation across urban and rural consumers, the mindset is increasingly converging. Much of their news and most of their interactions are coming from Facebook, Youtube and Zalo (VNG). Tiktok really grew in the last year to become the 4th most used platform. The similarities between urban and rural consumers are now staggering. Their world view, their attitudes and their values are now very similar. Many of the regional differences that Cimigo has seen historically over the last twenty years of research in Vietnam have dissipated.

Financial inclusion is already high with 70% of adults banked. Financial inclusion, the rise of mobile banking, e-wallets and the efforts of eCommerce to move consumers away from cash on delivery (COD) all suggest that digital payment supremacy is near.

Cimigo’s financial services monitor amongst 2,000 consumers nationally assesses financial brand strength and momentum. Vietcombank, MB Bank, BIDV bank lead the top 10 from the consumers’ perspective. There’s a huge opportunity for those banks to enhance relationships and cross-sell different products.

Secured consumer finance loans reached US$67 billion in 2021, experiencing a large jump in non-performing loans up to 11% in 2021. The growth in loans in 2021 was just 1%. This equates to 18% of GDP and 40% of retail goods sales. Buy now pay later (BNPL) in Vietnam remains relatively small, at $500 million in 2021, but note that it was valued at only $270 million just a year earlier.

The fintech hype which suggests there is a need to serve the unbanked or unserved is misinformed. Vietnam has seen a huge surge in fintech and insuretech products serving consumers and businesses in the past year.

$1.3 billion was raised for fintech in Vietnam in 2021. Vietnam now had four unicorns in 2021, two solely in fintech (Momo, VNpay) one solely in gaming (Sky Marvis) and Vinagme in fintech, instant messaging, media and gaming.

E-wallet penetration reached 66% among 16-29 years olds, almost the same whether they’re in a village or a town. Amongst all banked adults penetration is lower at 39%. In a Cimigo study exploring online shopping habits three years ago, 95% of online shopping payments were cash on delivery. Today amongst 16-29 years olds it is only 64% cash on delivery. This is a great advancement for the eCommerce platforms as money collection, whilst still dominated by cash, is increasingly from bank transfers (23%) then e-wallets at 13%.

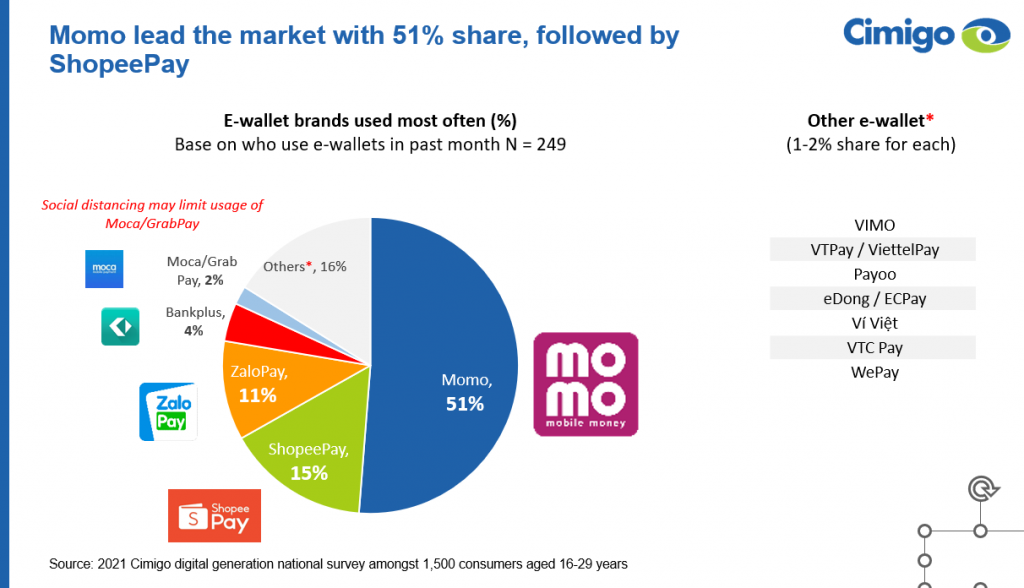

The rise of ewallets in Vietnam is dominated by Momo, followed at a significant distance by Shopee Pay, which is built into the Shopee site, the largest eCommerce platform for Vietnamese consumers. Then follows ZaloPay, which of course has a huge presence due to the dominant Zalo instant messaging app.

Note that there were some social distancing rules in place when this survey was conducted, so Moca, which is built into the Grab app may be underrepresented, as people were not moving around as much at this time.

Unless you lived in China in the 1980s, you will never have experienced the speed of change Vietnam is experiencing in 2022. Cimigo believes that Vietnam’s speed of change will accelerate until 2030. Consumers will leapfrog the stages of development seen in developed nations. Below are the major Vietnam consumer trends accelerating Vietnam’s dynamism.

Download the free presentation on consumer trends

End.

ESOMAR Connect: Shaping tomorrow’s insights in Vietnam – hosted by Cimigo

Jun 05, 2025

Join us for ESOMAR Connect: Shaping tomorrow’s insights in Vietnam on Thursday, June 26th at

How Indonesians perceive and use AI: a Snapshot from everyday life

Jun 10, 2025

Artificial Intelligence (AI) is no longer a futuristic concept; it has become an increasingly

Indonesia consumer trends 2025

May 11, 2025

Indonesia consumer trends 2025 highlights eight key reasons why Indonesia is poised for a rebound.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Janine Katzberg - Projects Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.