Vietnam consumer trends 2026

Feb 05, 2026

Vietnam is still a growth market, but consumer trends 2026 show that it has matured faster than

Vietnam’s dash to high-income status by 2045

Vietnam’s dash to high-income status by 2045 is credible but not guaranteed. The next decade will determine whether Vietnam can convert momentum-driven growth into productivity-led development.

This article is based on the Vietnam Consumer Trends 2026 report from Cimigo.

Vietnam’s path to high-income status by 2045 depends on two forces: what is working, and what is constraining growth.

Vietnam remains attractive, but execution is harder. High-income status will be earned through productivity, value capture, and confidence, not solely through the speed of growth.

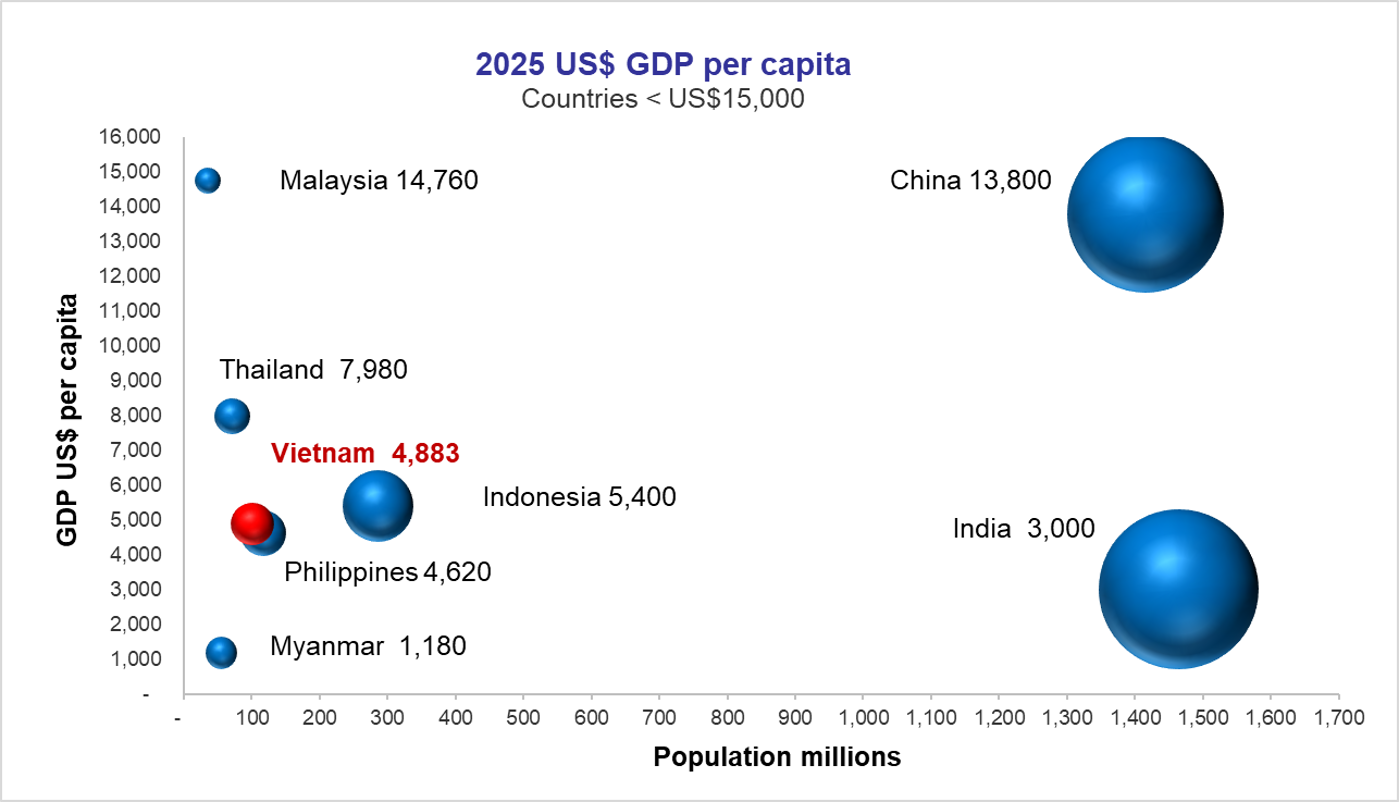

Vietnam’s dash to high-income status by 2045 is no longer a distant vision. It is a concrete, time-bound strategic challenge that will be won or lost within the next decade. Moving GDP per capita from roughly US$4,900 today to around US$14,000 by 2045 implies not just continued growth, but a fundamental shift in how growth is generated, captured, and felt across the economy.

Vietnam has averaged ~6.1% GDP growth over the past decade. Sustaining anything close to this pace as the economy scales will be materially more challenging than achieving it at a lower base.

The question facing policymakers, investors, and business leaders is no longer whether Vietnam can grow. It is whether Vietnam can transition from momentum-driven growth to productivity-led, confidence-backed development before its structural tailwinds fade.

Vietnam enters the 2045 race with genuine momentum. Its starting position is stronger than many peers at a similar income level, but the clock is already ticking.

Vietnam’s demographic profile remains a powerful asset. The working-age population accounts for approximately 62% of the population in 2025, labour participation is high, and the dependency ratio is among the lowest in Asia. Female labour participation, at around 88% among ages 20–64, is exceptional by regional standards and materially boosts household income.

Vietnam’s low dependency ratio is providing a meaningful boost to GDP today, but this advantage peaks before the late 2030s.

Population ageing accelerates after 2036. As the over-50 cohort expands rapidly, demographics will shift from a growth accelerator to a growth constraint. Vietnam has less time than headline population figures suggest.

Vietnam has earned its growth credibility. GDP growth has averaged just over 6% over the past 10 years, placing Vietnam among Asia’s more consistent outperformers. GDP per capita reached approximately US$4,900 in 2025, reflecting both income growth and rapid urbanisation.

Sustaining high growth at low income is impressive. Sustaining it as the economy scales is a fundamentally different test.

As economies grow larger and more complex, maintaining momentum requires increasingly precise execution. Scale amplifies inefficiency as much as it amplifies opportunity.

Manufacturing and exports have carried Vietnam far, but they will not carry it all the way to high-income status on their current terms.

Manufacturing accounts for roughly 24% of GDP, underpinned by substantial foreign direct investment, expanding exports, and deep global integration. Vietnam has signed 16 free trade agreements, and its trade interconnectivity, imports plus exports as a share of GDP, stands at approximately 207%. Export growth reached around 17% in 2025.

Vietnam has become indispensable to global supply chains.

Yet beneath the scale sits a structural constraint.

Around 77% of Vietnam’s exports are generated by foreign-invested firms.

High-tech products now account for roughly 40% of exports, but local value added in these categories is only around 16%. Vietnam participates deeply in global value chains, but captures a limited share of the economic value they generate.

Export volume alone does not deliver high-income outcomes. Value capture does.

Without a step change in skills, technology adoption, and domestic supplier integration, export-led growth will increasingly hit diminishing returns.

If Vietnam is to reach a high-income status, domestic demand must eventually become a reliable growth pillar. For now, it remains constrained.

Household affluence has expanded meaningfully. Approximately 59% of households are now classified as ABCD consumers. Retail sales of goods and services reached around US$270 billion, equivalent to roughly 60% of GDP. Asset ownership, financial inclusion, and urban living standards have all improved.

Despite rising incomes, consumption growth remains cautious.

Household savings rates have risen from an estimated ~8.5% pre-2019 to ~10% in 2025, even as incomes increased.

Consumer sentiment has not returned to pre-2019 levels. COVID-19 scarring, income volatility, healthcare and education costs, and rapid formalisation have altered household psychology. Spending is deliberate, upgrades are delayed, and financial buffers are prioritised.

Domestic demand cannot become a growth engine if households do not trust the durability of their incomes.

Two sectors are frequently cited as engines of Vietnam’s next phase of growth. Both have reached scale. Neither is guaranteed to deliver high-income outcomes without qualitative upgrading.

Vietnam’s digital economy reached approximately US$39 billion in 2025, equivalent to ~8.7% of GDP. Internet penetration exceeds 78 million users, and smartphone usage among adults is close to universal.

The next phase depends on Vietnamese-owned value creation, depth of monetisation, access to capital, and the emergence of domestic platforms capable of retaining economic value.

Tourism is thriving. Inbound international arrivals rose by around 20% in 2025, while domestic tourism increased by approximately 25%.

The average spend per trip for domestic tourists is roughly VND 9.7 million (≈US$380).

Volume growth alone will not lift tourism into a high-income contributor. Destination quality, infrastructure discipline, and spend per visitor now matter more than raw numbers.

This is the decisive challenge on the path to 2045.

The over-50 population has grown from ~18% in 2010 to ~28% in 2026, and is the fastest-growing age segment.

As ageing accelerates, labour-led growth slows structurally. To sustain progress toward high-income status, Vietnam requires sustained productivity growth of approximately 4% per year, not episodic efficiency gains.

Productivity is harder than growth. That is precisely why it is decisive.

This demands significant changes: skills upgrading, technology diffusion, enterprise-level efficiency, and tighter integration between foreign investment and domestic supply ecosystems.

Vietnam’s policy agenda is directionally aligned with the productivity challenge. Government restructuring, private enterprise repositioning, SOE reform, tax formalisation, digital identity, capital market upgrading, and infrastructure investment targeting around 7% of GDP all point in the right direction.

Vietnam aims to upgrade from frontier to emerging market status as early as 2026, subject to review.

The risk lies not in intent, but in sequencing and execution. As formalisation deepens, confidence becomes more sensitive to policy signals. Missteps will be felt faster and more broadly than in the past.

Vietnam remains one of Asia’s most compelling long-term opportunities, but it is no longer easy to access.

Confidence, productivity, and value capture now matter more than the speed of growth.

For business leaders, shallow localisation strategies will underperform. For investors, volatility must be accepted alongside conviction. For policymakers, protecting confidence while enforcing reform is now the central balancing act.

Vietnam’s dash to high-income status is credible. Its momentum is real. But the margin for error is shrinking. The dash to high-income status depends less on how fast Vietnam grows and more on how effectively it converts growth into productivity, confidence, and domestic value.

Visit AskCimigo and interrogate our reports with our AI assistant.

Get instant access to syndicated consumer insights, market trends, and competitive intelligence across Vietnam.

If you have any questions or specific needs, please get in touch with us at ask@cimigo.com.

Vietnam consumer trends 2026

Feb 05, 2026

Vietnam is still a growth market, but consumer trends 2026 show that it has matured faster than

Vietnam’s dash to high-income status by 2045

Feb 06, 2026

Vietnam’s dash to high-income status by 2045 is credible but not guaranteed. The next decade

Vietnam’s growth story: From catch-up growth to disciplined growth

Feb 05, 2026

Vietnam’s economy behaves like a more mature economy than its income levels suggest. Vietnam’s

Đoàn Ngọc Huy (Johnny Doan), CMO & Market Research Expert -

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.