The shift in Indonesia’s Eid Al-Fitr Spirit: More Meaning, More Mindful Choices

Feb 24, 2026

Indonesia’s Eid Al-Fitr consumer landscape Ramadan and Eid al-Fitr are the main drivers of

Indonesia’s coffee shifts: The rise of Indonesia’s modern mobile cafés

Indonesia is one of the world’s leading coffee producers, ranking fourth globally after Brazil, Vietnam and Colombia (USDA, 2024), and it also has substantial domestic demand. According to the data from Indonesian Ministry of Agriculture, domestic coffee consumption in Indonesia is projected to reach 365 thousand tonnes in 2025.

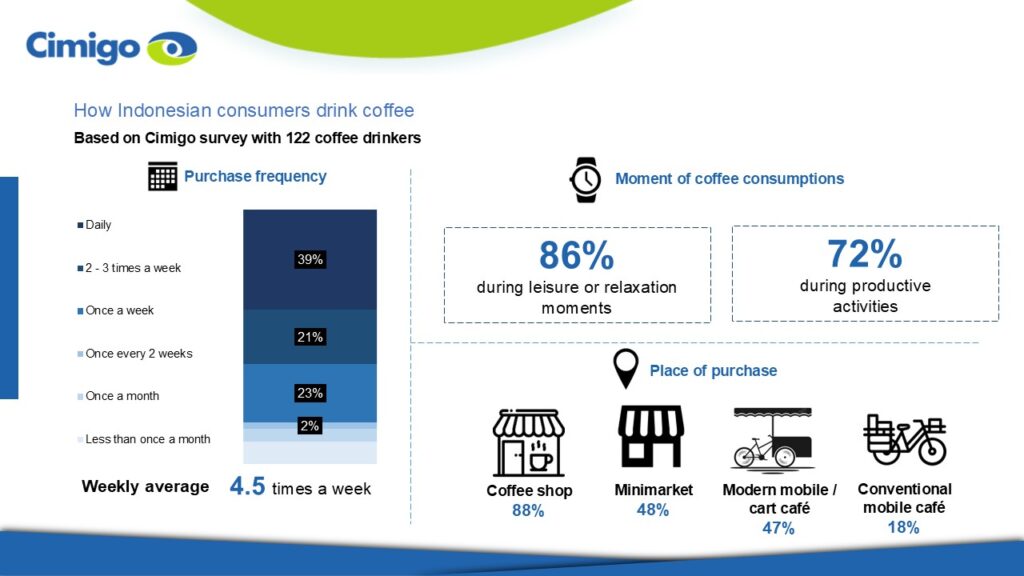

In Indonesia, coffee is enjoyed in a wide range of formats, from ready-to-drink packaged beverages to freshly prepared ones made by baristas or coffee shops. Based on a Cimigo survey conducted in October 2025 with 247 respondents, 72% reported consuming coffee in the past three months, and 49% purchased barista-made coffee.

On average, these consumers drink barista-prepared coffee 4.5 times per week, with 39% drinking it daily. Most of them enjoy this format during leisure moments such as socialising or relaxing alone (86%), yet a significant portion also drinks coffee during productive activities like working or studying (72%). These patterns suggest that coffee plays multiple roles in consumers’ daily lives: as a social and emotional companion, and as a functional beverage that supports productivity.

When looking at where consumers typically purchase barista-style coffee, coffee shops and cafés remain the dominant channel, accounting for 88% of purchases among respondents. However, a noteworthy trend is the growing presence of mobile cafés, which now attract 47% of these consumers. This share is nearly on par with mini-markets (48%), indicating that mobile cafés have become a viable and increasingly competitive alternative for on-the-go coffee purchases.

Their convenience, accessibility, and unique street-level appeal suggest a shifting dynamic in Indonesia’s coffee consumption ecosystem, where informal and mobile vendors are beginning to rival more established retail formats.

The idea of mobile coffee carts isn’t new in Indonesia. Street sellers offering instant coffee have existed for years. What has changed is the format: today’s mobile cafés serve coffee in a more modern, coffee-shop style, in line with the rapidly growing café culture across the country.

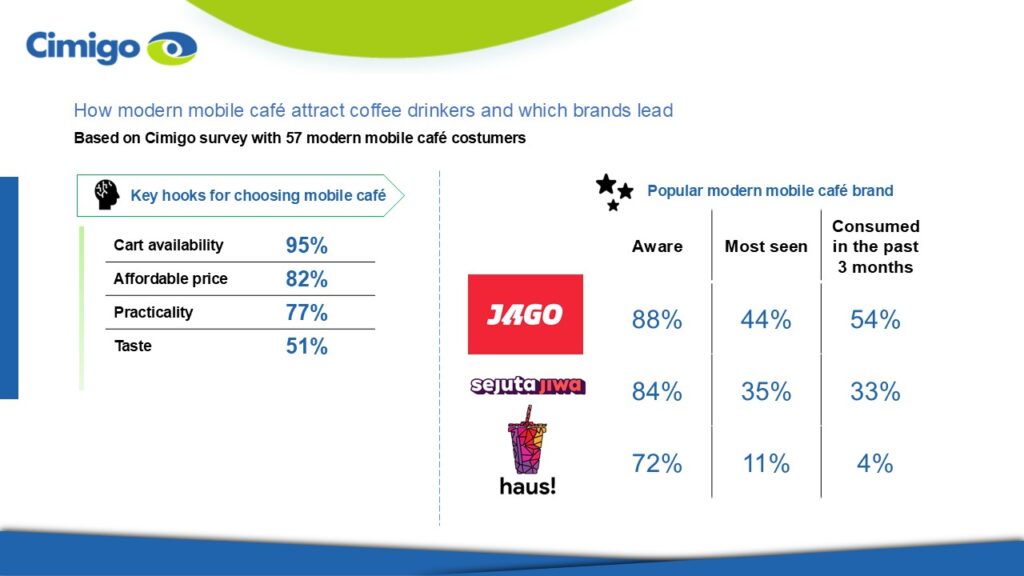

Cimigo’s survey results show that the strongest driver factor is high availability (95%). Consumers appreciate how easily these carts can be found around strategic, high-traffic locations (e.g., near homes, offices, and campuses), making them a convenient on-the-go option compared to visiting larger cafés.

Affordability is another major driver (82%). Consumers are highly value-conscious, considering both portion size and price, and often see mobile cafés as a cheaper alternative to large café chains. Practicality also plays a significant role (77%), as mobile cafés offer quick service with minimal waiting time. Meanwhile, taste (51%) including consistency across carts and offerings that suit consumer preferences remains an essential part of the experience.

Among the many brands adopting this concept, Kopi Jago stands out as the top-of-mind mobile café brand, with the highest awareness (88%). It is followed by Sejuta Jiwa (84%) and Haus (72%). However, consumption shows a clearer gap: Kopi Jago reaches 54%, Sejuta Jiwa 33%, while Haus lags behind at 4%.

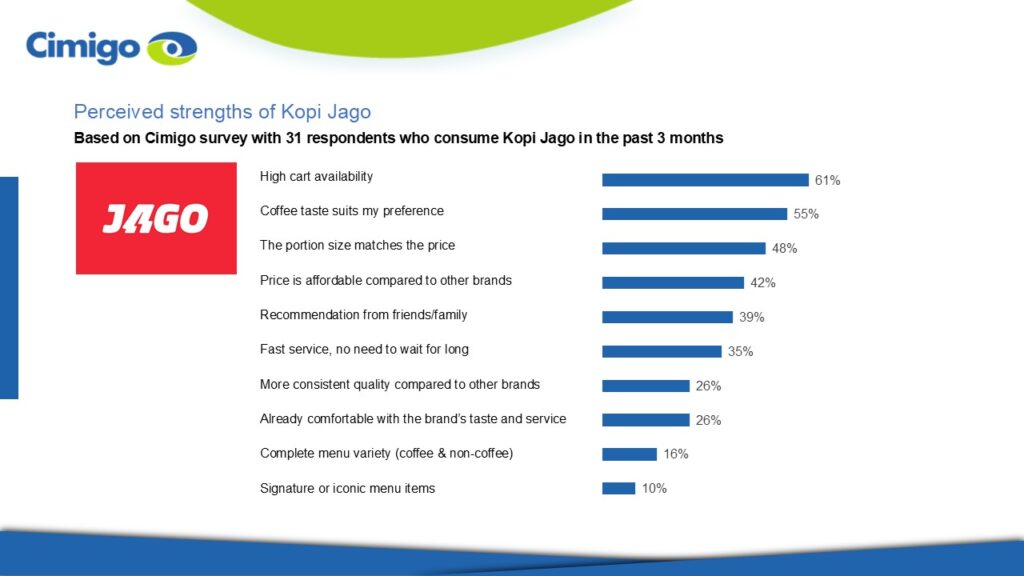

Kopi Jago succeeds by delivering on the core needs of mobile café consumers. Its strong carts availability (61%) ensures easy access, while its taste quality (55%) meets consumer expectations. Consumers also view its pricing as good value for money (48%) and more affordable than competitors (42%). Additional strengths such as positive word-of-mouth, reliable service, and consistent product quality play a role in sustaining Kopi Jago’s high awareness level and consumer preference.

Indonesia’s coffee market remains large and stable, supported by consistent production and strong domestic demand. Coffee consumption is highly habitual, with many Indonesians drinking it daily and enjoying it across various occasions, from social moments to productivity needs. Purchase channels have also diversified, and mobile cafés are increasingly becoming part of consumers’ everyday coffee routines.

Overall, the data shows that the Indonesian market is active, price-conscious, and well aligned with the modern mobile café model, which offers quick access, affordable options, and flexible locations that fit seamlessly into consumers’ daily lives.

The shift in Indonesia’s Eid Al-Fitr Spirit: More Meaning, More Mindful Choices

Feb 24, 2026

Indonesia’s Eid Al-Fitr consumer landscape Ramadan and Eid al-Fitr are the main drivers of

Consumer Insights Vietnam: Why Opinions Aren’t Enough

Feb 23, 2026

Every marketer knows the moment: a tight deadline, a high-stakes decision, and no fresh data on

Vietnam consumer trends 2026

Feb 05, 2026

Vietnam is still a growth market, but consumer trends 2026 show that it has matured faster than

Đoàn Ngọc Huy (Johnny Doan), CMO & Market Research Expert -

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.