ESOMAR Connect: Shaping tomorrow’s insights in Vietnam – hosted by Cimigo

Jun 05, 2025

Join us for ESOMAR Connect: Shaping tomorrow’s insights in Vietnam on Thursday, June 26th at

Vietnam e-payments and mobile wallets

Cimigo explored Vietnamese consumer behaviour towards Vietnam e-payments and mobile wallets and the future of payments. The nascent e-payments and mobile wallet market has attracted a plethora of competitors and private equity financing has followed for start-ups, whilst banks have raced to launch mobile applications to fend of increased competition from fintech players. Some banks have opted to invest in mobile wallet companies (e.g. Standard Chartered was an early investor in Momo).

15 minutes read

In quarter one of 2019 Cimigo interviewed 725 consumers aged 18 to 55 in HCMC and Hanoi from economic class ABC (above 9,000,000 VND household monthly income) to understand the rise in e-payments and mobile wallets.

Revenue is generated through commissions collected from merchants and charging users service fees when they conduct online transactions and payments through mobile wallets or payment gateway platforms. Most key players have access to a wide customer base either through:

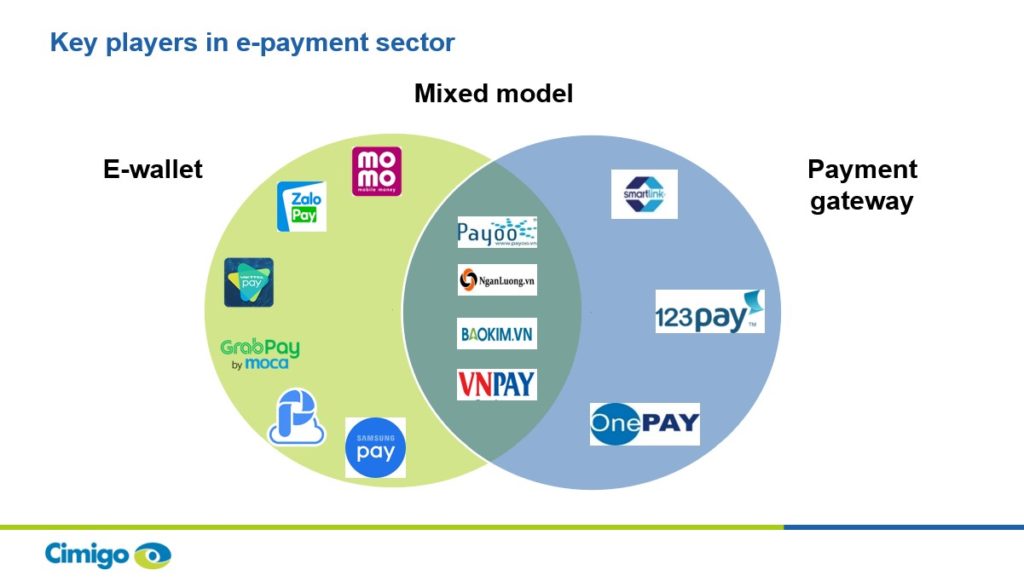

There are 30 licensed non-bank payment intermediary services according to the State Bank of Vietnam, with around 20 of these services offer mobile wallets. See a detailed list here. More than 40 banks also provide mobile payment services. Four main models are apparent;

The future opportunity for e-payments in Vietnam has four driving forces;

With 80% of grocery sales emanating from the traditional trade, arming merchants with e-payment facilities is the biggest challenge to driving growth of e-payments. The merchants are mostly small and micro businesses that are happy to transact in cash and are not willing to pay transaction fees, pay for mobile data up-links nor invest in point of sale software.

Vietnam has a highly organised cash on delivery (COD) system, whether it is online shopping where Cimigo found that 88% paid for cash on delivery (COD) or the ability to pay cash at the doorstep for utilities. Both are highly efficient and convenient for consumers. Lessor yet additional barriers include;

Cash is the only payment method used by 5 in 10 respondents. Remember that the audience for this study is the top 50% of household wealth in urban HCMC and Hanoi. Bank mobile applications (30%) and mobile wallets (29%) are the most common e-payment methods, both are ahead of credit card usage (23%) in the past three months.

Bear in mind this is not a proportion of transactions (nor the value of those transactions) but merely a prevalence rate. That is, the proportion whom has transacted at least once in the past three months using the said method. It is too easy to generate click-bait hype around e-payments and mobile wallets by misquoting data. A classic case in point are false headlines generated from a management consulting report claiming that 60% of the Vietnamese population use mobile payments, which is clearly a fantasy, fueling further ignorance and misinformed hype.

Many mobile wallets users also use a bank’s mobile application (or vice versa). E-payment users are typically young, high-income white-collar professionals. They are mostly initially recruited by promotions for cash back or discounts; be that a cash back of 200,000 VND on an electricity bill or 20% off their favourite bubble tea.

The leading bank mobile application transactions are for money transfers, postpaid mobile credit top ups and paying utility bills. Whilst the leading mobile e-wallet transactions are primarily for food and beverage delivery and postpaid mobile credit top ups.

Perceptions towards e-payments are stark in their dichotomy; e-payment and mobile wallets are perceived as fast, simple and cheap. Contrasting with bank cards which are associated with a good reputation, large networks and a stable secure system.

Mobile e-wallets are dependent on promotions to drive transaction volume, the most satisfying aspect experienced from e-wallet users is the simple process and then the promotions. Mobile e-wallets are the payment method with the highest net promoter score for recommendations (likelihood to recommend), compared with all other methods.

7 in 10 mobile e-wallet users top up wallets directly from their bank account with an average of 1,000,000VND. Momo is the most salient mobile e-wallet by far, 9 in 10 consumers will mention Momo first when asked to recall mobile e-wallet brands. Momo achieves the highest use share with three quarters of mobile e-wallet users reporting to use Momo, this is followed by Zalo Pay, VT Pay, Grab Pay (Moca) and AirPay.

Compared to other payment methods, mobile e-wallets have the advantage on ease, speed, rewards, promotions and low fees. They have a strong user experience and high net promoter score. Whilst bank mobile applications provide a good user experience, they lack rewards, promotions and have a poor reputation for customer care.

Mobile e-wallet providers still face State Bank hurdles with the inability to provide interest nor credit and the necessity to be linked to a bank account (and that providers are prohibited from issuing more than one wallet to the same bank account).

Compared with bank mobile applications, mobile e-wallets have far greater consumer centricity and have much to teach banks, ultimately, they could perhaps provide a good distribution (and marketing channel) for an extended range of financial services. However, if banks can step up their customer centricity, mobile e-wallets may struggle for a meaningful role in consumer payments. Momo leads the market today, but faces increased competition for smartphone real (screen) estate, saliency and continued meaning in consumer lives.

Zalo is the leading instant messenger application in Vietnam, but has failed to leverage this reach and thus far it has not effectively integrated Zalo Pay. With Tencent (WeChat) as a shareholder, ambitions to be replicate the WeChat super application eco-system and payments must be ever present boardroom conversation. Grab Pay by Moca continues to expand its role in consumer lives beyond ride hailing; to food and to payments. Like Zalo Pay, Grab Pay is a contender for creating a super application we cannot live without.

A diverse set of international and local competitors from Apple, Facebook, Visa, GoViet, Bao Viet and VIMO will join the battle and seek to win dominance in mobile enabled e-payments. The battle will be long and the investments losses substantial. Much like Vietnam’s online shopping platforms, until a dominant player can comfortably increase fees and cease to subsidise transactions, the only winner will be the consumer.

A diverse set of international and local competitors from Apple, Facebook, Visa, GoViet, Bao Viet and VIMO will join the battle and seek to win dominance in mobile enabled e-payments. The battle will be long and the investments losses substantial. Much like Vietnam’s online shopping platforms, until a dominant player can comfortably increase fees and cease to subsidise transactions, the only winner will be the consumer.

End.

ESOMAR Connect: Shaping tomorrow’s insights in Vietnam – hosted by Cimigo

Jun 05, 2025

Join us for ESOMAR Connect: Shaping tomorrow’s insights in Vietnam on Thursday, June 26th at

How Indonesians perceive and use AI: a Snapshot from everyday life

Jun 10, 2025

Artificial Intelligence (AI) is no longer a futuristic concept; it has become an increasingly

Indonesia consumer trends 2025

May 11, 2025

Indonesia consumer trends 2025 highlights eight key reasons why Indonesia is poised for a rebound.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Janine Katzberg - Projects Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.