Vietnam consumer trends 2026

Feb 05, 2026

Vietnam is still a growth market, but consumer trends 2026 show that it has matured faster than

Vietnam pre-school and early education insights

Vietnam pre-school and early education: Vietnamese mothers today are raising children in a world where education and digital exposure are deeply intertwined. From preschool enrolment decisions to enrichment programs and screen time rules, mothers are both gatekeepers and enablers of their children’s futures. Their choices reflect a delicate balance: the ambition to prepare children for success, the cultural values of structured parenting, and the new realities of digital-first childhood.

The Vietnam mother care and baby care report provides a rare look at how mothers think about their children’s learning journeys, from early schooling to digital play. For brands in Vietnam pre-school and early education, the insights are clear: success requires aligning with mothers’ aspirations for holistic education, safe digital tools, and culturally rooted parenting values.

Cimigo’s report includes insights from 1,500 mums aged 25–44 in HCMC, Hanoi, Danang, and Can Tho. It reveals how parenting in Vietnam is evolving across emotional, cultural, and digital touchpoints. Cimigo maps the full consumer and emotional journey of Vietnamese mums, from prenatal care to postnatal care, infant nutrition and baby care decisions from products to pre-school education and lifestyle values.

Mothers in Vietnam remain ambitious but divided. While 18% want their children to excel academically at the highest levels, most (82%) prefer a more balanced approach, blending natural development with guided learning.

This spectrum of expectations means brands cannot take a one-size-fits-all approach. Depending on the parenting mindset, messages must flex from rigorous achievement cues to holistic growth stories.

Nearly half of Vietnamese children under six are not yet enrolled in preschool, mainly because mothers feel the child is too young or already well cared for at home. Enrolment typically starts between two and three years old, with mothers citing peer interaction and life skills as key motivators.

City patterns differ:

Private and bilingual schools are becoming the aspirational choice for affluent and aspirational segments in Vietnam’s pre-school and early education. These schools are perceived to offer:

For education providers, the lesson is clear: attracting young learners means offering parents a vision of the future. The most compelling strategies combine:

Vietnamese mothers invest heavily in supplementary learning and enrichment. Across all parenting styles, three themes dominate:

These choices highlight a broad ambition: raising well-rounded, future-ready children. Enrichment is no longer “optional” but a core part of childhood in urban Vietnam.

Visit AskCimigo and interrogate the report with our AI assistant.

Get instant access to syndicated consumer insights, market trends, and competitive intelligence across Vietnam.

Vietnamese children start with TV in their early years, but by ages 3–6, they move into learning apps, games, and interactive content. Mothers walk a fine line:

Digital exposure is less about entertainment, more about learning. Mothers want tools that deliver both education and safe engagement.

Regional differences in digital parenting

This suggests that digital brands must localise their safety, trust, and benefit messages by city.

By preschool age, children in Vietnam are active online. YouTube dominates, but TikTok, Facebook, and Zalo are increasingly common among 3–6 year olds.

For brands, this means opportunities to design age-appropriate content ecosystems that reassure parents while engaging children.

Vietnamese mothers are preparing their children for a future that is both academic and digital. They are ambitious yet protective, digitally open yet cautious, and regionally diverse in their choices. For brands, winning in this space requires empathy, segmentation, and innovation, not just selling products but partnering with mothers on their journey to raise capable, confident, and connected children.

This is not just about education or screen time. It’s about trust, growth, and the future of Vietnam’s next generation.

Get instant access to syndicated consumer insights, market trends, and competitive intelligence across Vietnam.

For more insights on Vietnam pre-school and early education and other mother-care and baby-care categories, such as infant formula and diapers, visit AskCimigo and interrogate the report with our AI assistant.

If you have any questions or specific needs, please get in touch with us at ask@cimigo.com.

Vietnam consumer trends 2026

Feb 05, 2026

Vietnam is still a growth market, but consumer trends 2026 show that it has matured faster than

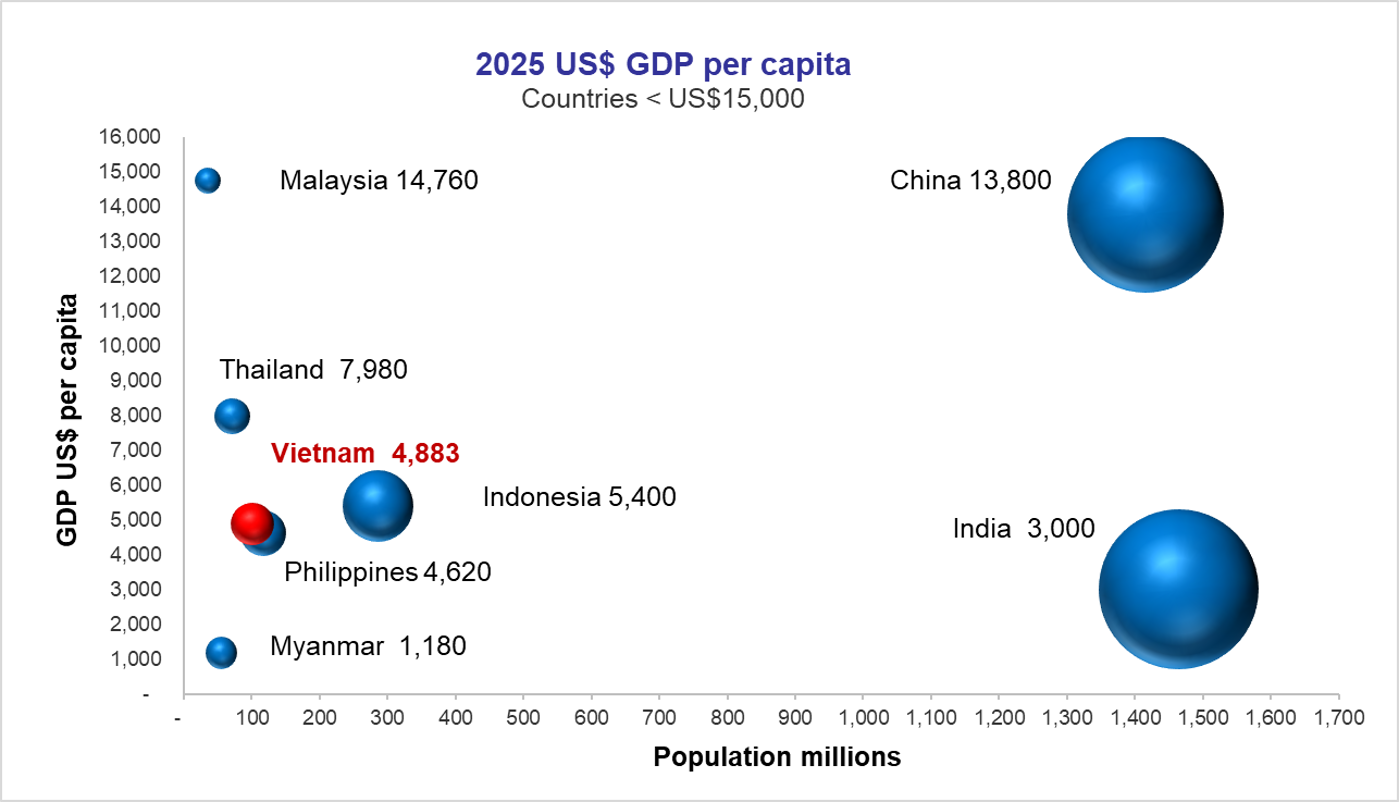

Vietnam’s dash to high-income status by 2045

Feb 06, 2026

Vietnam’s dash to high-income status by 2045 is credible. The next decade will determine whether

Vietnam’s growth story: From catch-up growth to disciplined growth

Feb 05, 2026

Vietnam’s economy behaves like a more mature economy than its income levels suggest. Vietnam’s

Đoàn Ngọc Huy (Johnny Doan), CMO & Market Research Expert -

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.