Vietnam business confidence strengthens across 2025

Vietnamese CEOs’ outlook on business conditions improved markedly throughout the year. Following a slump in confidence in April, when global tariff concerns led to 23% of CEOs expecting worsening business conditions, the tide turned by December, with 66% of CEOs now expecting improved business conditions over the next 12 months.

This growing confidence reflects not only adaptation to external challenges but a belief in Vietnam’s economic fundamentals.

Vietnam’s CEOs 2026 outlook: Optimism anchored in Vietnamese economy

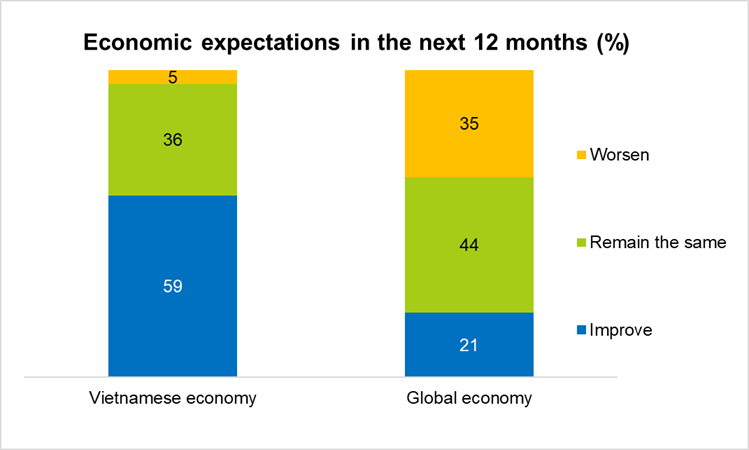

Vietnam’s economy remains a bedrock of optimism for the nation’s business leaders. Six in ten CEOs surveyed in December believe the Vietnamese economy will grow in 2026. Vietnam’s CEOs’ 2026 outlook shows that this sentiment remained consistent through the second half of the year, with 63% holding similar views in September.

In contrast, expectations for the global economy remain subdued. Only 20% of CEOs believe global economic conditions will improve in 2026, a reminder that despite local resilience, Vietnam is not immune to global forces.

Vietnam’s CEOs 2026 outlook: Revenue expectations improve, but risk remains

In April, only 33% of CEOs planned to increase capital expenditure, and hiring plans remained cautious, with 23% anticipating headcount reductions, up from 14% the previous year. However, by September, 62% of CEOs reported they were on track or exceeding their 2025 revenue budgets, reinforcing the strength of current momentum. Despite cautious global outlooks, Vietnam’s CEOs’ 2026 outlook has revenue projections remaining strong. CEOs expect an average 11% revenue growth in 2026. Yet, this optimism comes with a dose of realism.

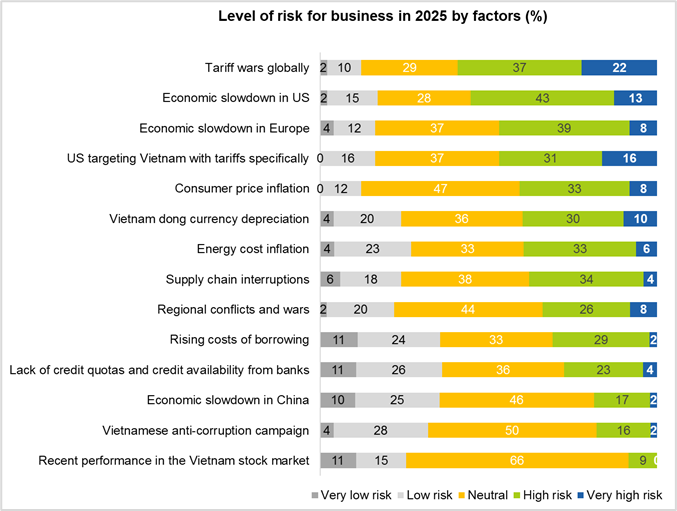

Tariffs and geopolitics loom large for Vietnam’s CEOs

If there is one persistent shadow over CEO sentiment, it is the risk of global trade disruption. Concerns about global tariff wars and US trade policy targeting Vietnam have been consistent throughout 2025.

In April, 67% of CEOs identified global tariff wars as a key risk, followed closely by the potential for the US to impose tariffs on Vietnam (59%). These concerns persisted into September, with 59% citing global tariff wars and 55% worried about a US economic slowdown.

The consistency of these concerns shows that while local conditions are positive, the external environment remains highly unstable.

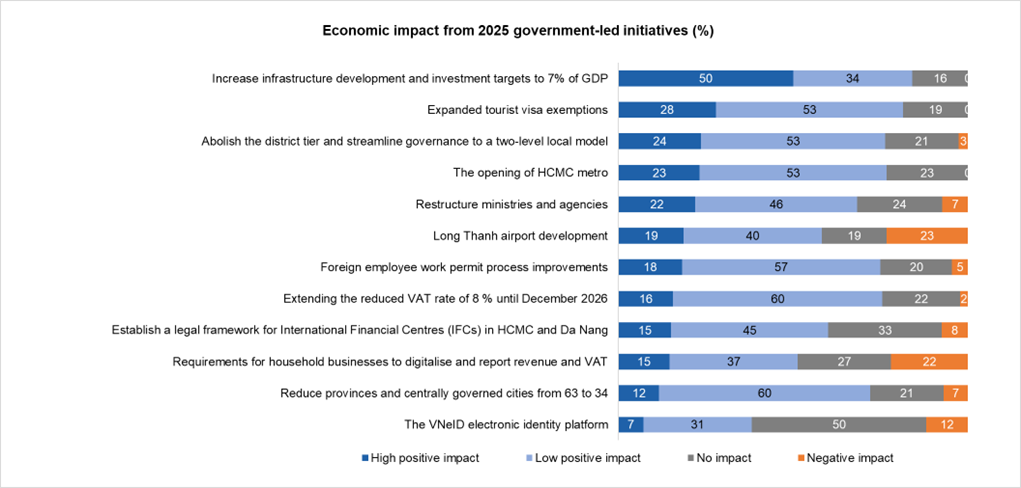

Vietnam’s infrastructure development and administrative reform recognised as future drivers of growth

CEOs have seen a series of government-led initiatives, targeting administrative reforms, infrastructure development and digital transformation in 2025.

Infrastructure expenditure is the most positive economic lever, with the HCMC metro and the Long Thanh airport as major projects expected to stimulate growth. Some concerns exist regarding the travel links to central Ho Chi Minh City from the Long Thanh airport. Visa exemptions, streamlined governance and administrative reform are all expected to have a positive impact on the economy.

New regulations requiring household businesses to digitalise and report revenue and VAT raise concerns about administrative burdens, compliance costs, and inflationary pressure.

Vietnam’s CEOs 2026 outlook: Confidence with caution towards external shocks

As Vietnam’s CEOs turn the page to 2026, their mood is best described as “confident with caution towards external shocks.” While the domestic economy is expected to be a pillar of strength, global risks, from tariffs to inflation, remain high on the radar. For Vietnam’s CEOs, the key will be to strike a balance between ambition and agility, leveraging the local economy while preparing for global turbulence.