ESOMAR Connect: Shaping tomorrow’s insights in Vietnam – hosted by Cimigo

Jun 05, 2025

Join us for ESOMAR Connect: Shaping tomorrow’s insights in Vietnam on Thursday, June 26th at

Inside the Euros 2024: audience insights and advertising potential in Vietnam

Inside the Euros 2024

The UEFA European Championship, commonly known as the Euros, is a prestigious football tournament held every four years. It features Europe’s top footballing nations competing for European football royalty. This year, the Spanish national team emerged victorious, defeating England 2-1 in a nail-biting final. The tournament attracts a substantial global audience, presenting significant advertising opportunities for companies. Therefore, firms looking to advertise must understand the tournament’s global viewer base to market their products effectively.

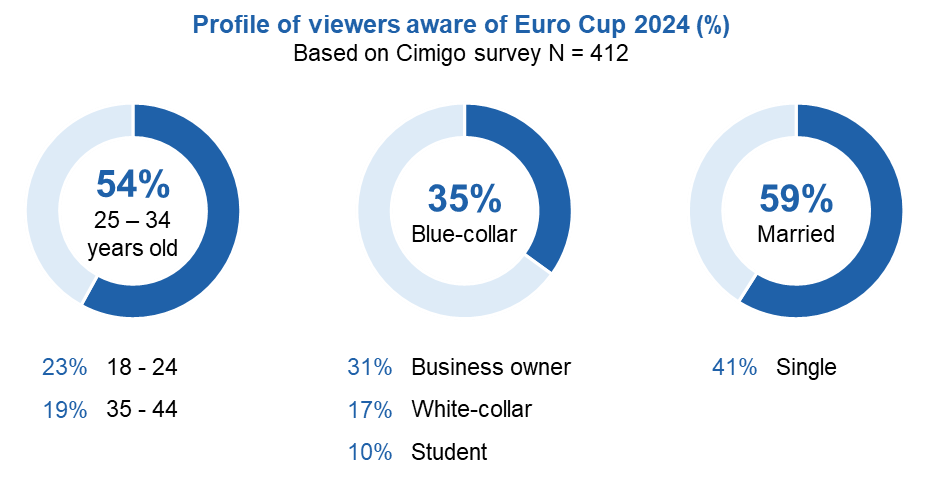

The viewer base for inside the Euros 2024 is primarily composed of individuals aged 25-34, accounting for 54% of the total audience. Additionally, 23% of viewers are between 18 and 24 years old, and 19% are between 35 and 44. Regarding occupations, 35% of viewers work in blue-collar jobs, 31% are business owners, 17% work in office jobs, and 10% are students. Of the surveyed individuals, 59% are married, and 41% are single.

From this data, it can be inferred that the European Championship audience largely consists of individuals with stable, well-rounded lives and manageable work hours who watch the Euros to relax and spend quality time with their families.

Preferred media for inside the Euros 2024 viewing

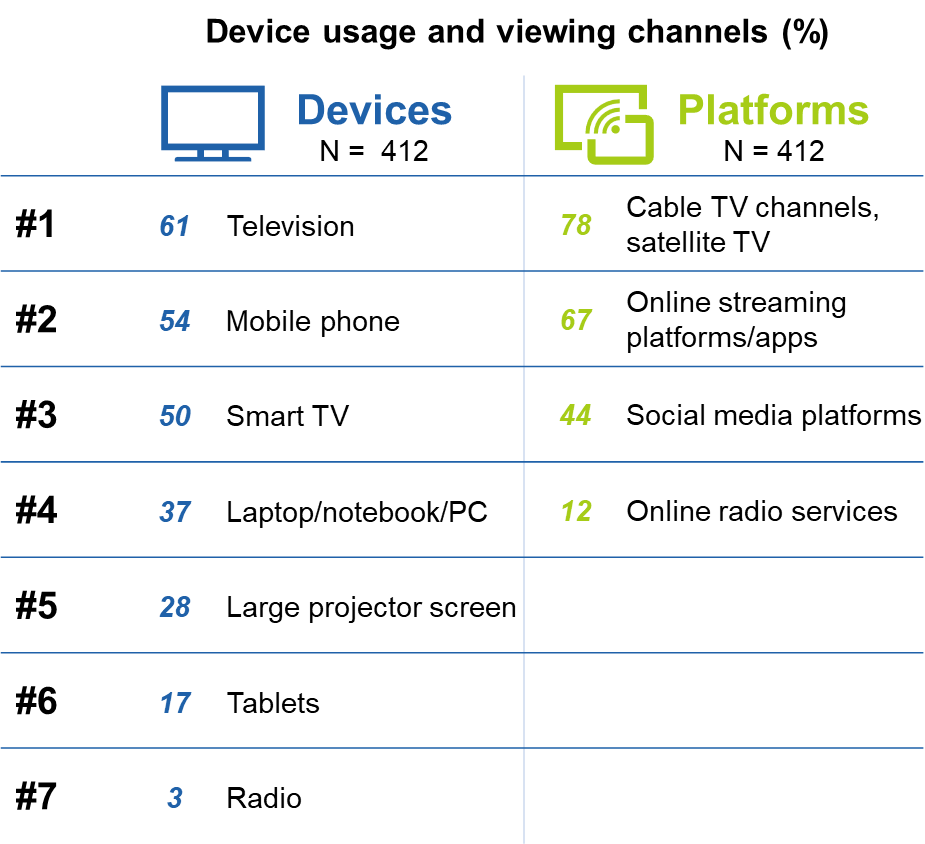

Preferred media for inside the Euros 2024 viewingThe Cimigo Euro awareness survey, conducted during the Euro championship time, shows that television remains the preferred medium for Euro Cup viewers, making TV ads the most effective channel for reaching large audiences. However, online streaming viewership is growing and is now closely behind traditional television.

The rise in usage of online streaming platforms underscores a shift in viewer preferences towards streaming services. Brands should target smart TV and mobile platforms to reach the significant audience of 25 to 34-year-olds who predominantly watch the Euros.

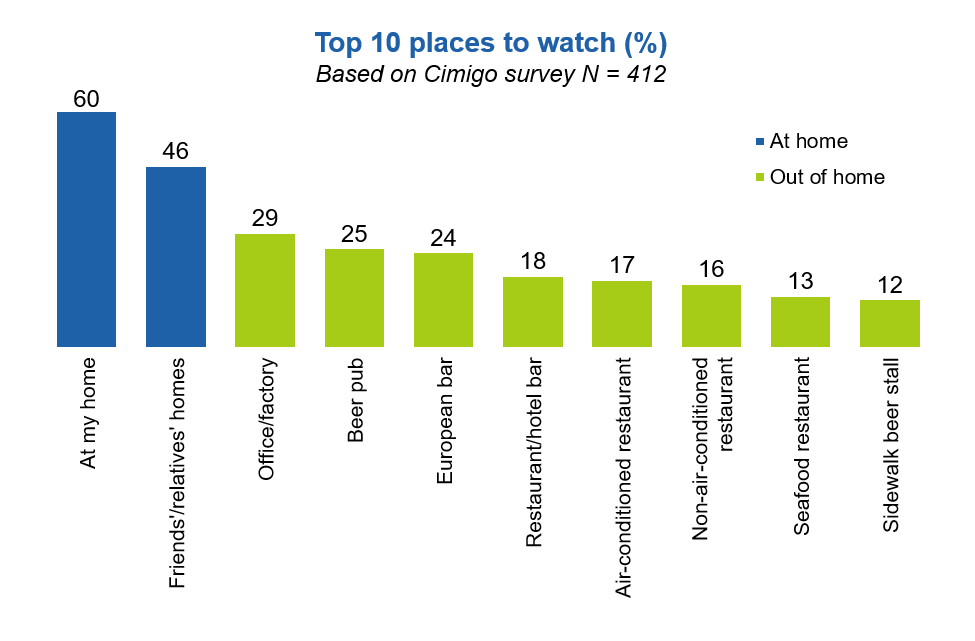

The survey also found that most viewers prefer watching the Euros from the comfort of their homes, often with family or friends. This highlights the importance of campaigns designed to enhance the home viewing experience and engage viewers through communal experiences or events.

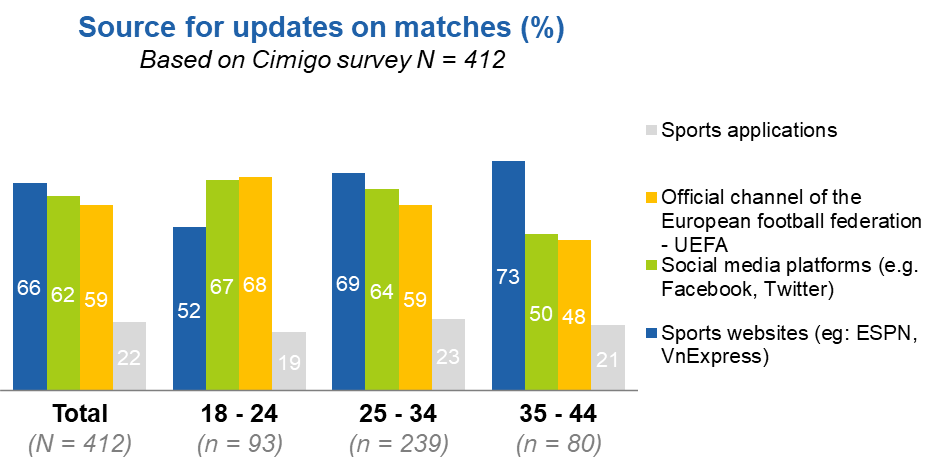

The Cimigo survey reveals various platforms where viewers seek information about match breakdowns and upcoming fixtures. 59% use the official UEFA website, 62% turn to social media, 66% rely on sports websites like VnExpress or ESPN, and only 22% follow the Euro Cup on sports applications.

Brands can target these platforms for advertisements but should consider the age band: younger viewers (18-24) favour social media, while older viewers (35-44) prefer news outlets like VnExpress. Understanding where different audience segments get their information is crucial for effectively targeting advertising efforts.

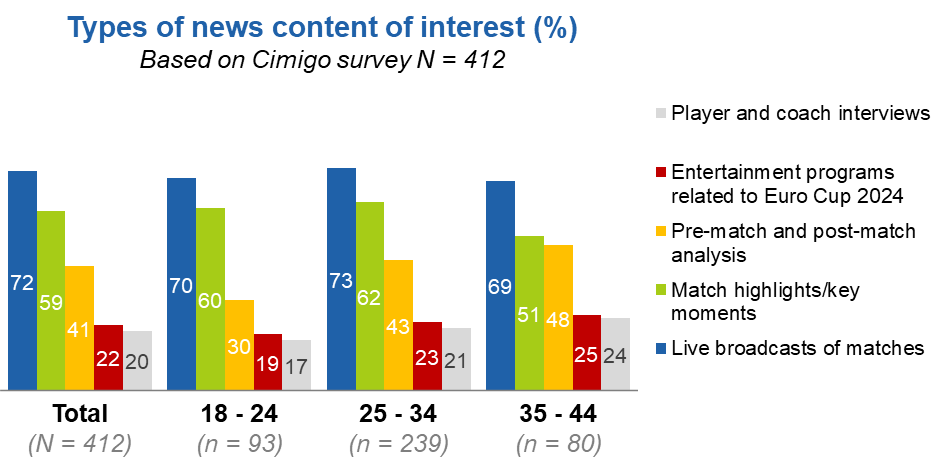

Viewers tune into more than just the matches. Highlight clips of goal passes, player actions, and pre- and post-game analyses are highly popular. According to the Cimigo survey, 72% of viewers are interested in live broadcasts, 59% in match highlights, 41% in pre- and post-game analysis, 22% in related programs, and 20% in player and coach interviews.

Viewers often follow matches for their favourite teams and players, enjoying high-quality football, engaging personalities, and compelling stories. They are drawn to matches because of the action on the field and the narratives surrounding the teams and players. Whether it’s the underdog story, the redemption arc, or the star player’s journey, these stories add an emotional layer to the viewing experience.

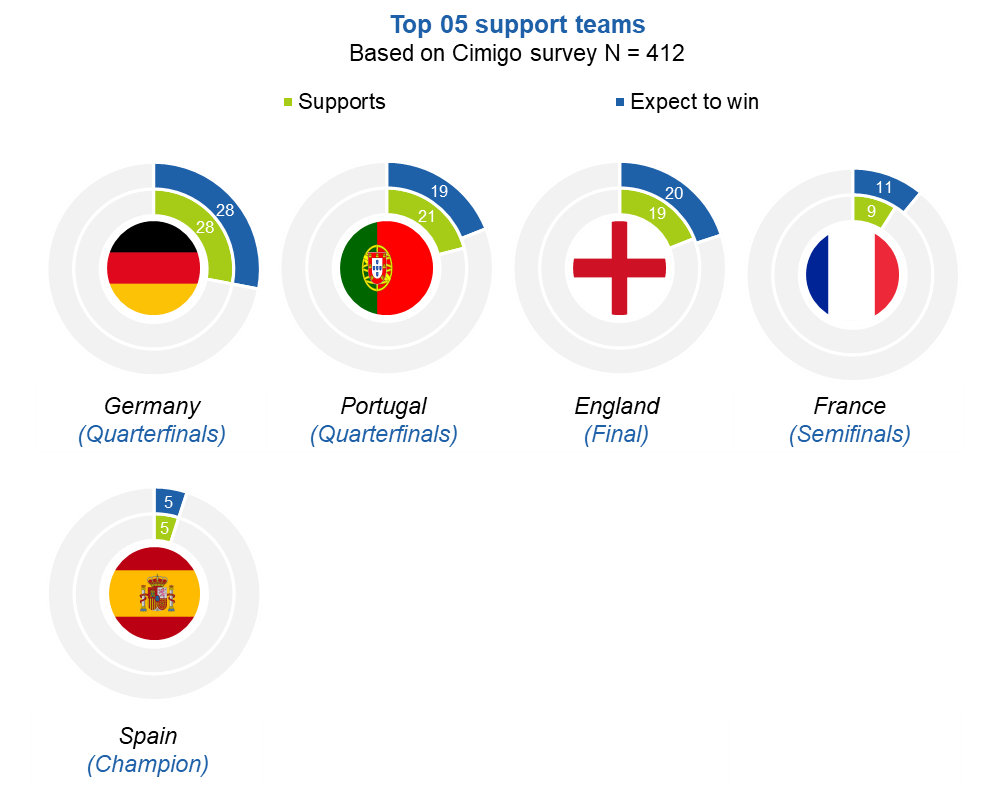

Germany, the tournament host, is favoured to win by 28% of voters, with Thomas Müller as their most popular player. England, with Harry Kane, follows with 20% of the votes, and Portugal, led by Cristiano Ronaldo, is third with 19%.

Unfortunately, not every fan’s favourite team(s) and player(s) advance in the tournament as the playing field is highly competitive. The team was favoured to win it all this year by fans. Germany, with 28% of votes, lost in the quarterfinals to the eventual champions. With 5% of voters, Spain had them take the trophy home. This may result in viewership numbers declining as many fans tune in to watch their favourite footballers and countries compete.

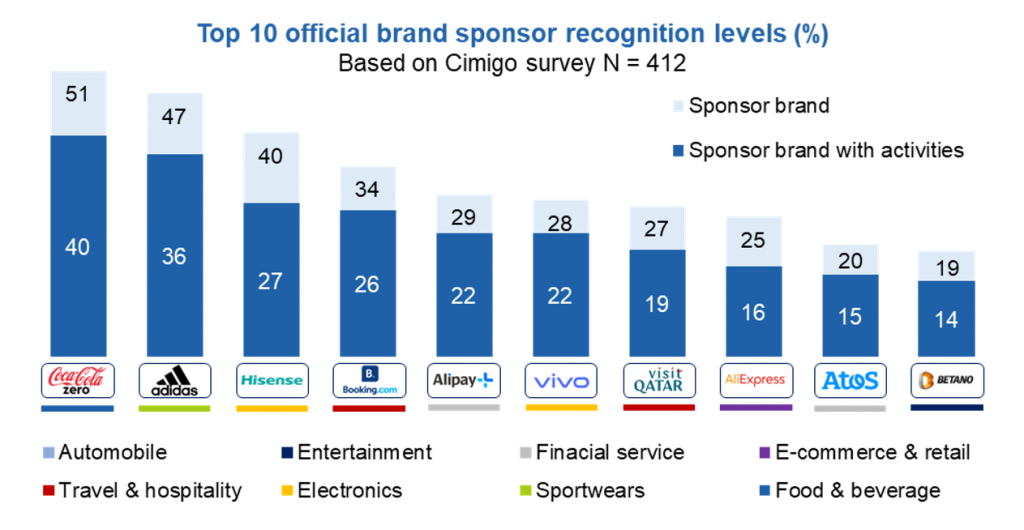

The Cimigo Euro awareness survey showed viewers could recognise many brands sponsoring the tournament, particularly in the food and beverage, sports apparel, entertainment, travel, hospitality, and electronics sectors. The food and beverage industry, led by Coca-Cola, received the highest recognition.

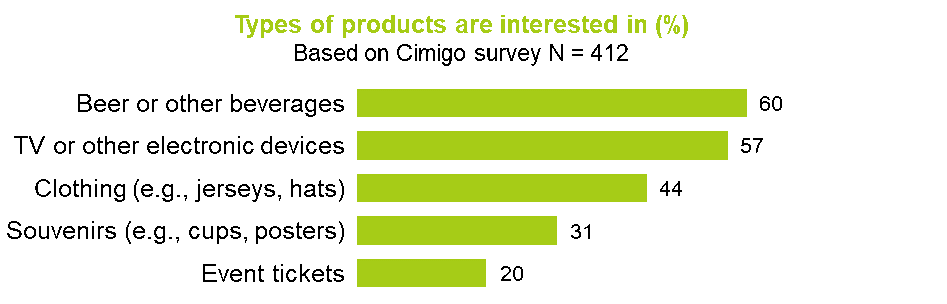

Survey findings indicate that 60% of inside the Euros 2024 viewers are interested in purchasing beverage products such as beer and other drinks, highlighting a significant market opportunity for food and beverage companies to run targeted campaigns around the event.

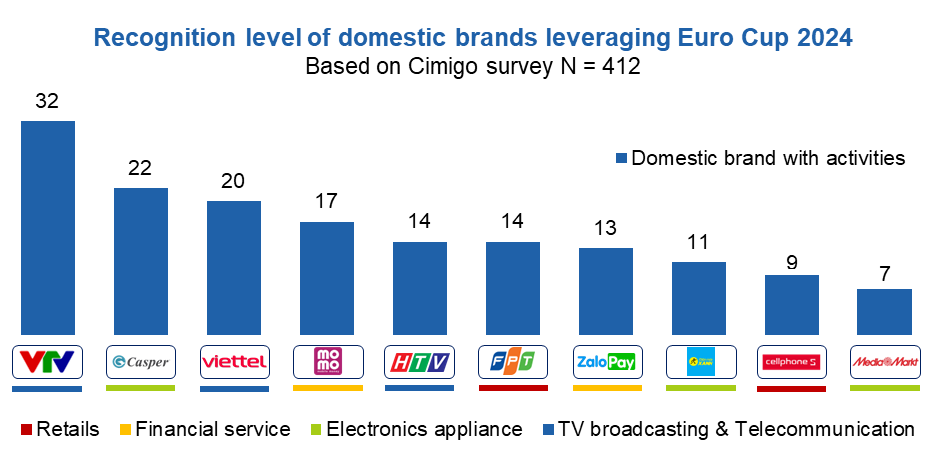

The 2024 Euros have generated considerable buzz in the Vietnamese market, with domestic media and communication companies such as HTV, Viettel, and VTV gaining recognition for securing broadcasting rights.

However, domestic advertising is not limited to the media and communication sector. Other industries, including electronics appliance companies like Casper, Mediamart, and Dienmayxanh and financial services firms like Momo and ZaloPay, are also promoting this year’s Euros. Mobile and electronics retailers FPTShop and CellphoneS have also launched related programs for the tournament.

End.

ESOMAR Connect: Shaping tomorrow’s insights in Vietnam – hosted by Cimigo

Jun 05, 2025

Join us for ESOMAR Connect: Shaping tomorrow’s insights in Vietnam on Thursday, June 26th at

How Indonesians perceive and use AI: a Snapshot from everyday life

Jun 10, 2025

Artificial Intelligence (AI) is no longer a futuristic concept; it has become an increasingly

Indonesia consumer trends 2025

May 11, 2025

Indonesia consumer trends 2025 highlights eight key reasons why Indonesia is poised for a rebound.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Janine Katzberg - Projects Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.