Vietnam consumer trends 2026

Feb 05, 2026

Vietnam is still a growth market, but consumer trends 2026 show that it has matured faster than

Indonesia consumer trends 2025

Indonesia consumer trends 2025 highlights eight key reasons why Indonesia is poised for a rebound.

Indonesia is currently managing financial caution while drawing strength from digital savviness and youthful energy. Following a period of steady post-pandemic growth, the country is now experiencing a slowdown. However, it also retains the potential for a confident resurgence.

10-minute read

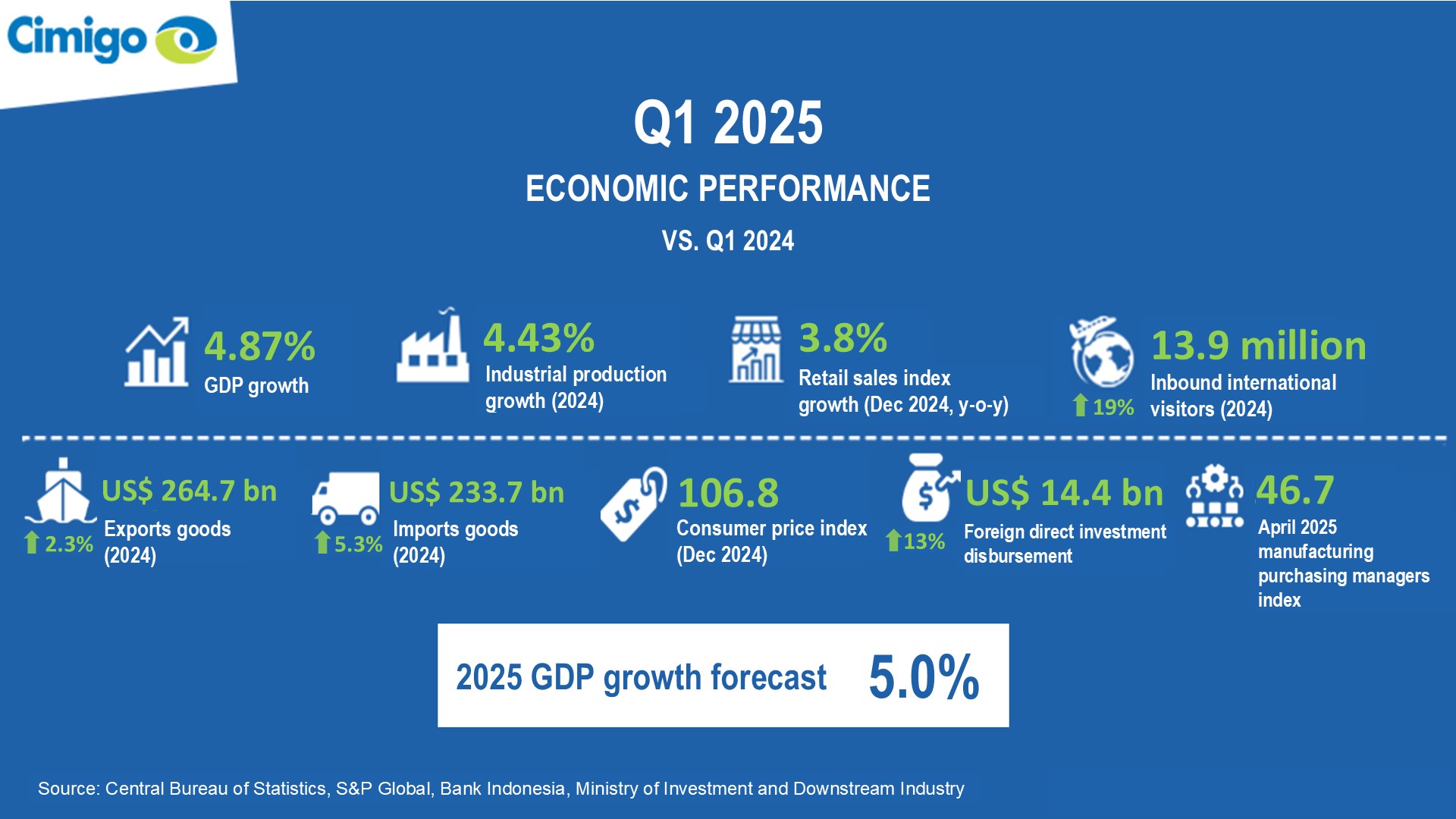

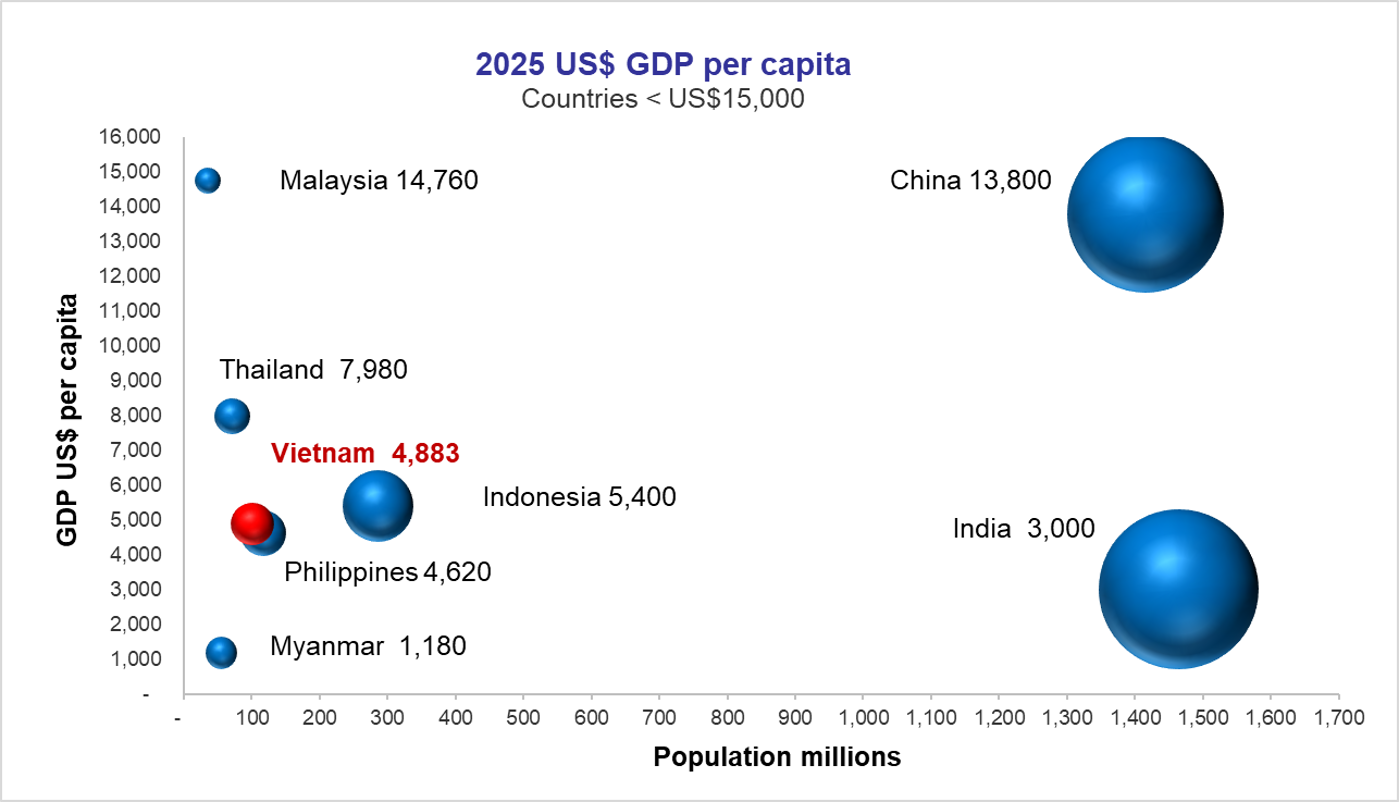

In Q1 2025, Indonesia’s GDP growth slowed to 4.87%, bringing the total GDP to US$344 billion. This year-on-year growth rate is the slowest recorded since 2021. Sluggish manufacturing, weak exports (particularly in the mining sector), and a depreciating rupiah, all of which have heightened economic concerns.

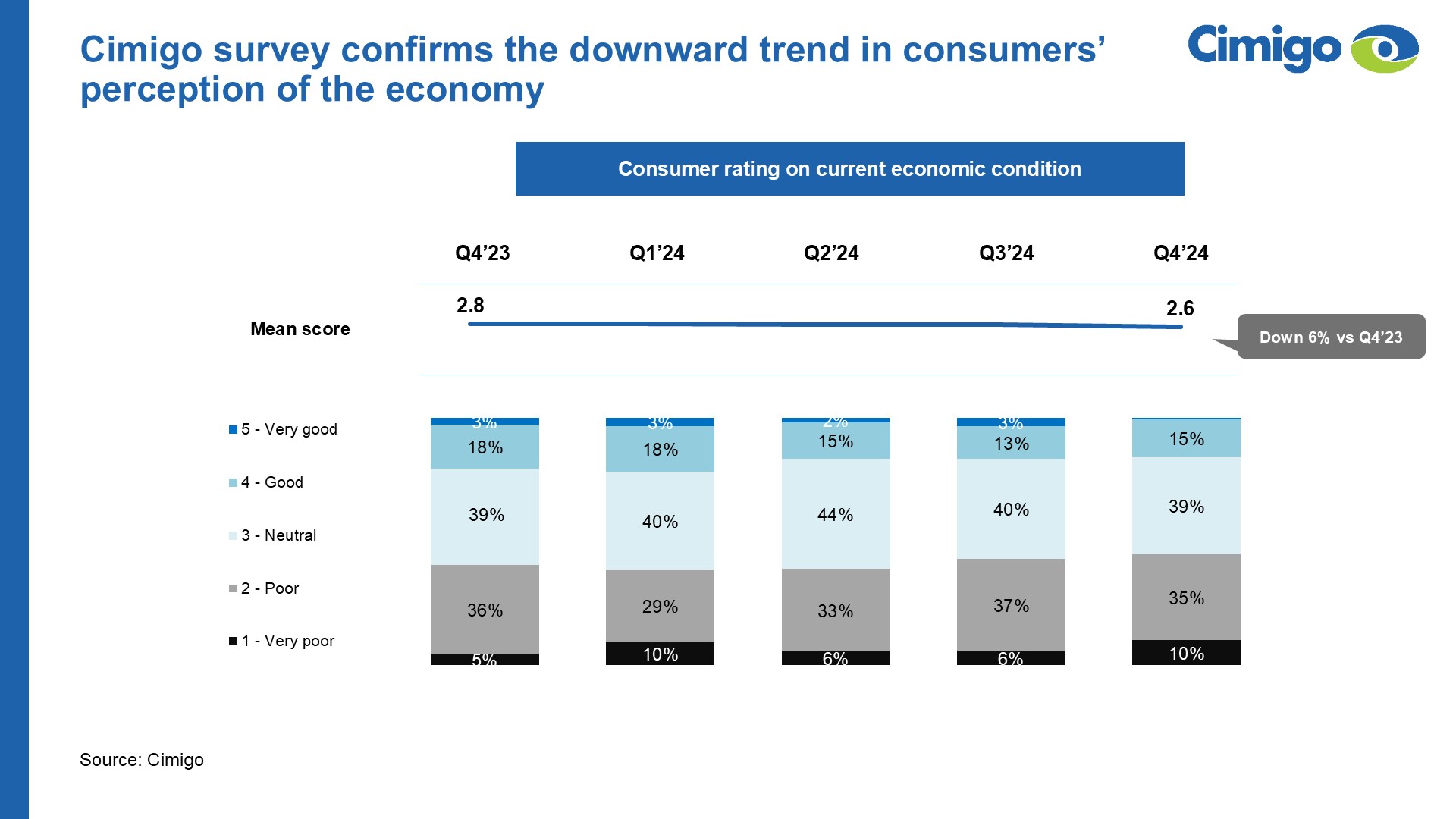

Consumer sentiment towards the current economic climate remains relatively poor, with a downward trend persisting since the end of 2023. Many are increasingly concerned about their financial stability and firmly believe that a recession is on the horizon.

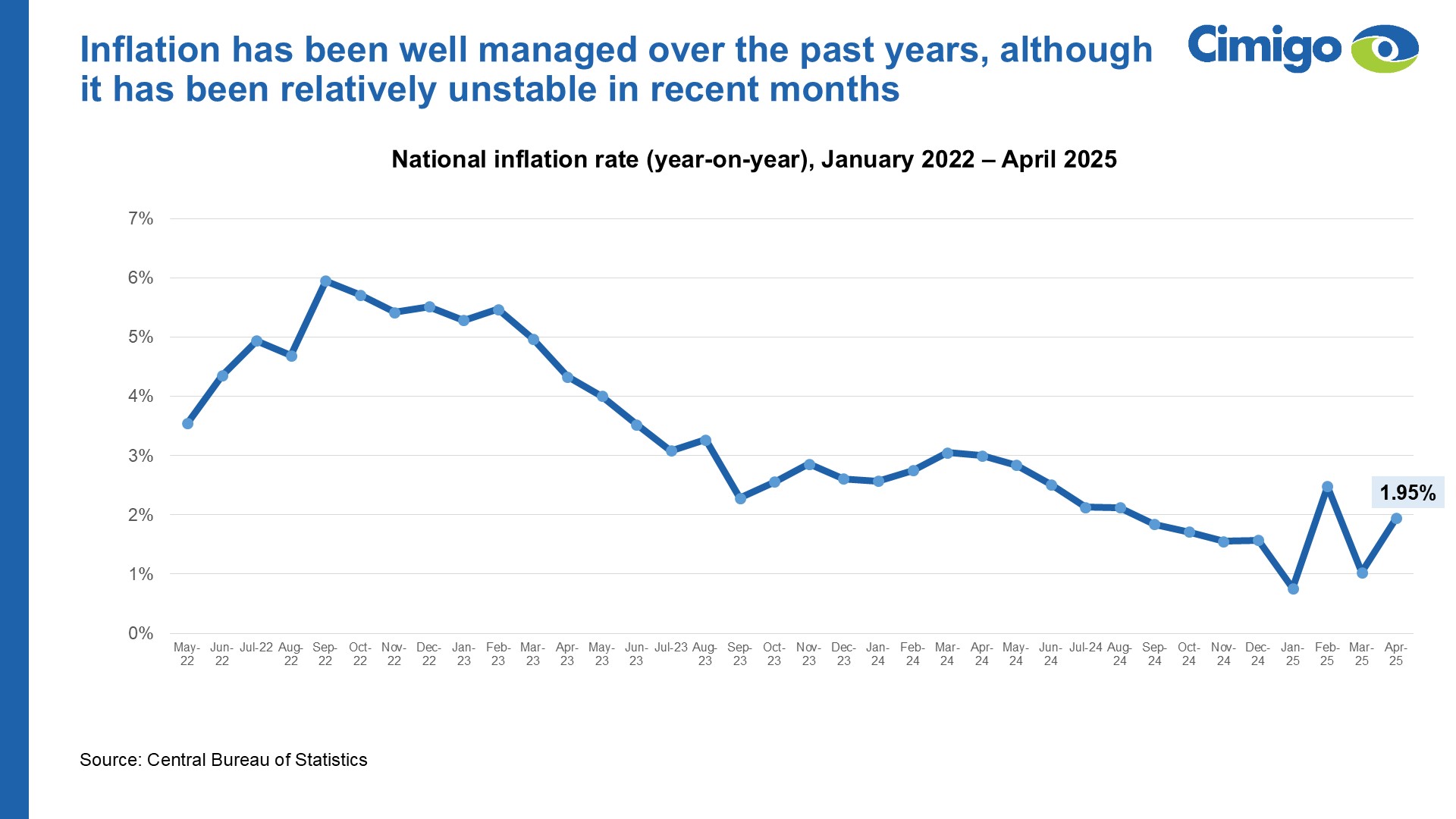

Despite current challenges, GDP growth in 2025 is still expected to reach 5.0%. Indonesia’s economic fundamentals remain robust, with low inflation at 1.95%, retail sales up by 3.8%, and a young workforce. Foreign investment has performed well, increasing by 13% compared to the first quarter of 2024. One of the key sectors, agriculture, recorded double-digit growth, helping to offset the slowdown in the manufacturing sector, which now contributes 19% to GDP. In the past year. Significant progress has also been made in Indonesia’s socio-economic development over recent years, achievements that should not be overlooked.

Cimigo explores eight reasons why Indonesia remains well-positioned to rebound from this challenging situation.

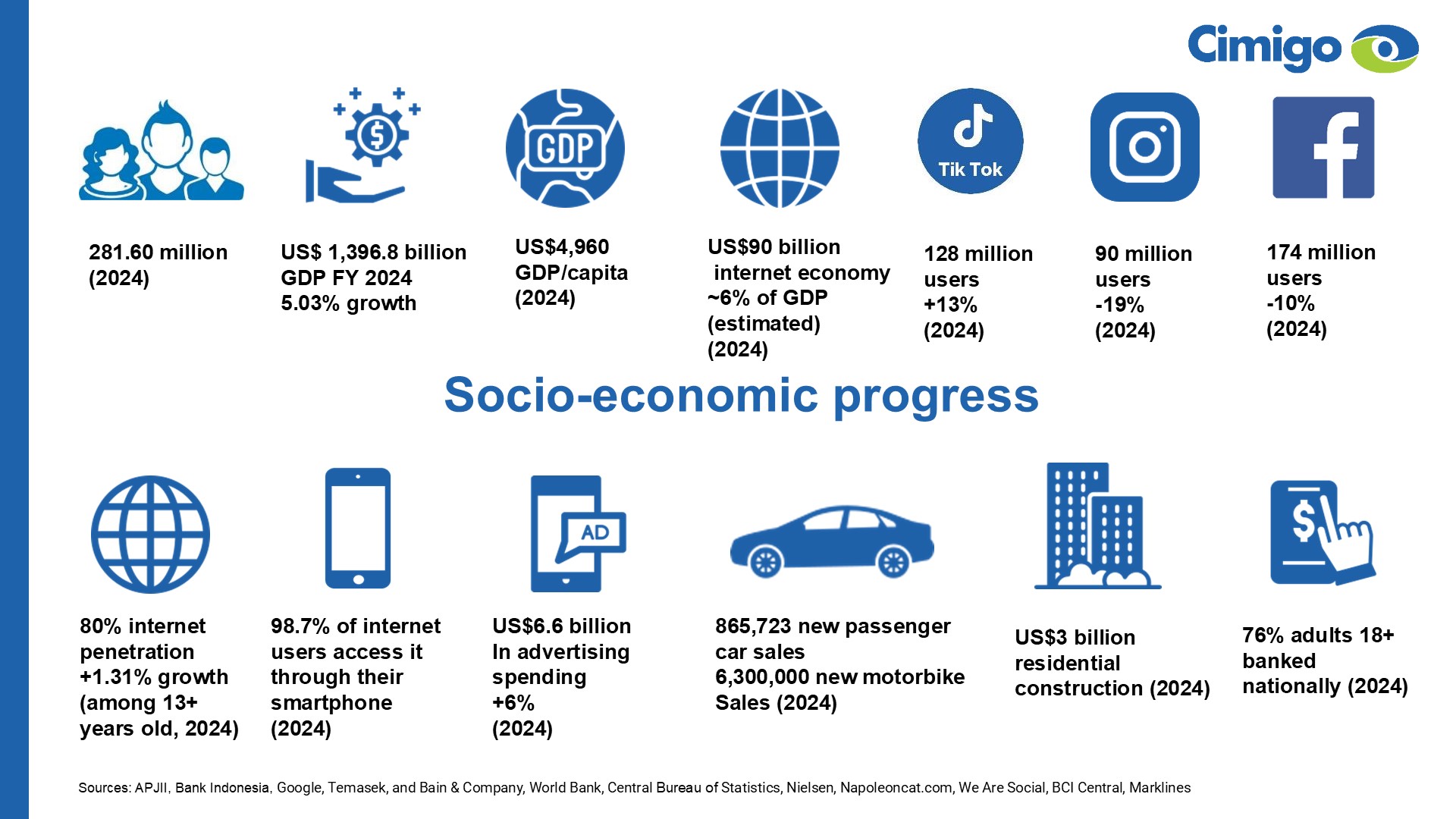

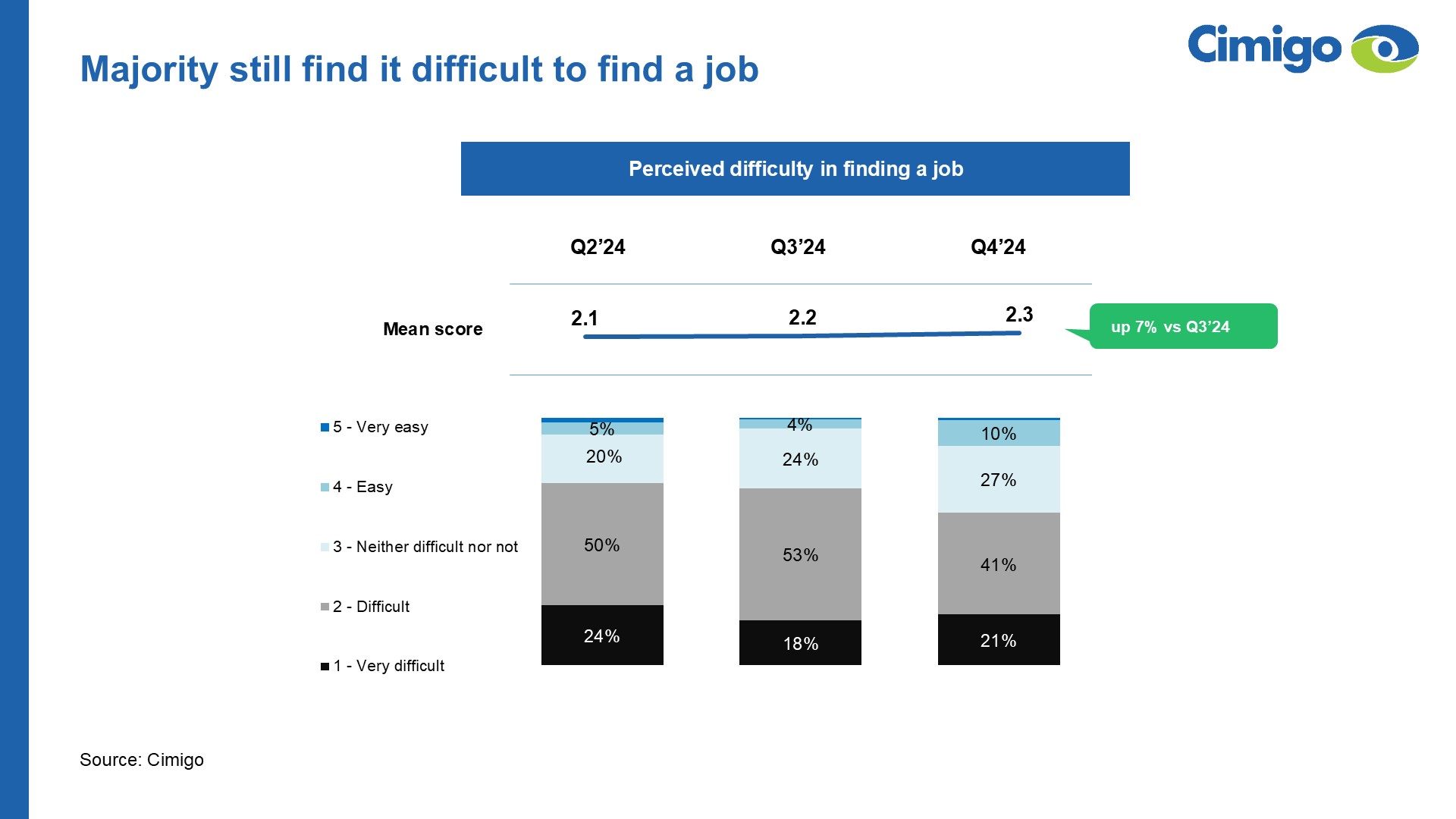

Indonesia’s population has reached 281 million, with 52% falling in the productive age bracket and a low dependency ratio of 0.47. While the unemployment rate may no longer be declining many still struggle to secure full-time employment, overall employment (including part-time work) remains strong at 95.2%, and female participation is on the rise. Urbanisation continues to reshape consumer demand, with over 66% of Indonesians projected to reside in urban areas by 2035.

Indonesians spend an average of 7 hours and 22 minutes online each day. The digital economy reached US$90 billion in 2024, marking a 13% year-on-year increase, driven primarily by e-commerce. Mobile phones serve as the main access point, with 97% of internet users going online via smartphones.

The dominance of digital is evident in how people shop, pay, and play. E-commerce platforms are ubiquitous. Digital wallets have become the preferred payment method, and QR code scanning is now part of everyday life. 50% of the Indonesians scan a QR code at least once a month. From groceries to fashion, beauty to electronics, consumer behavior has rapidly shifted online.

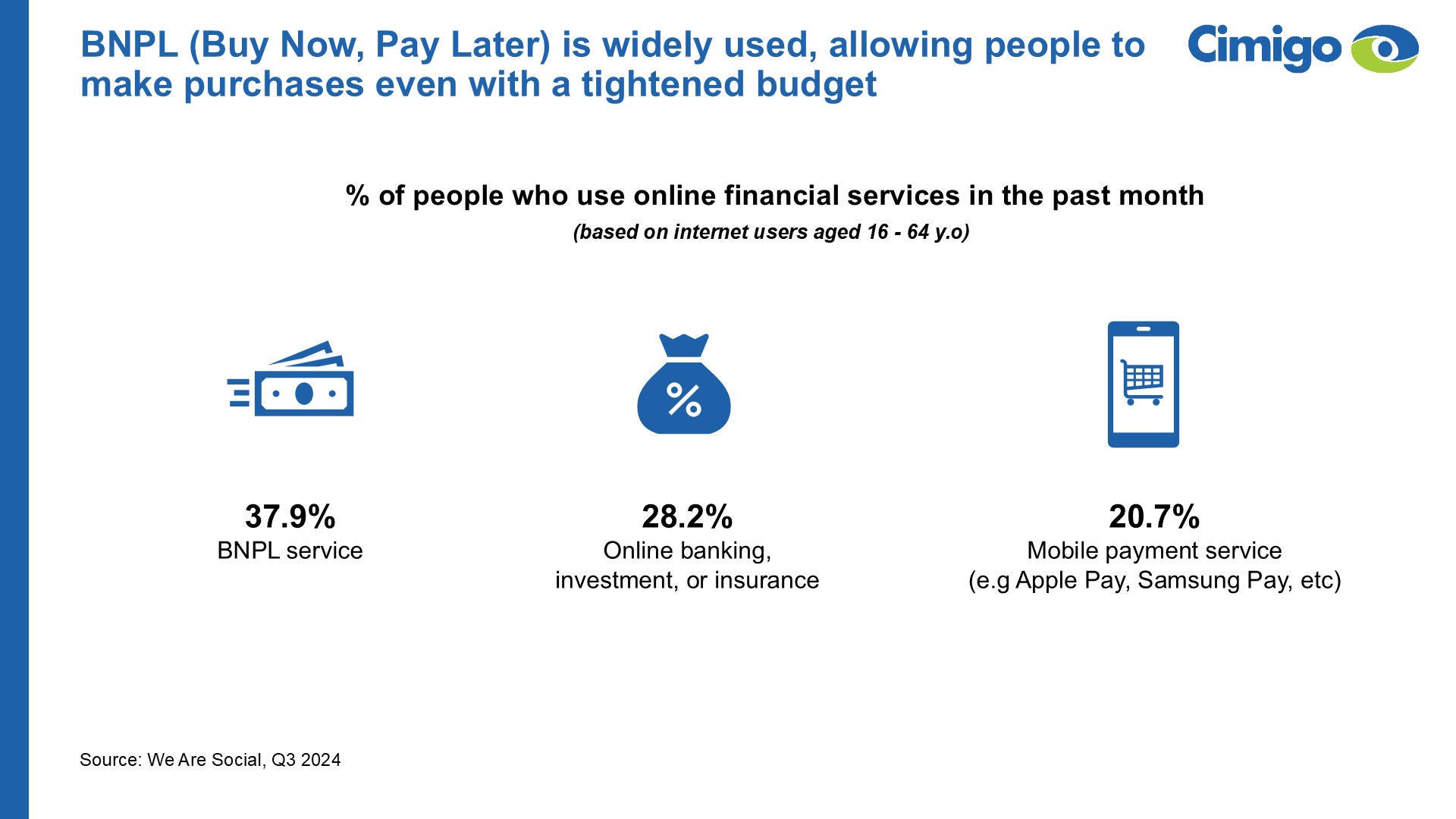

Spending has not vanished. It has merely shifted. Consumers are prioritising emergency funds and using any remaining disposable income to pay off debt. Buy Now, Pay Later (BNPL) services have surged in popularity, with 37.9% of consumers now using them. Digital lending has also seen rapid growth, increasing by 27% compared to 2023. Luxury and tertiary expenses have declined, as many Indonesians delay travel plans, cut back on home improvements, and reduce spending on entertainment.

This is one of the clearest examples: Ramadan, a season traditionally associated with peak consumer spending, was notably more subdued in 2025. Travel was estimated to decline by 24% and money circulation fell by 12% compared to the previous year. This reflects a more measured, cautious mindset. Even as consumers cut back on non-essentials, they remain optimistic about the future.

Inflation remains under control, standing at just 1.95%, with prices staying relatively stable. Retail sales continue to grow at a steady pace, driven by essential categories such as food, beverages, and fuel.

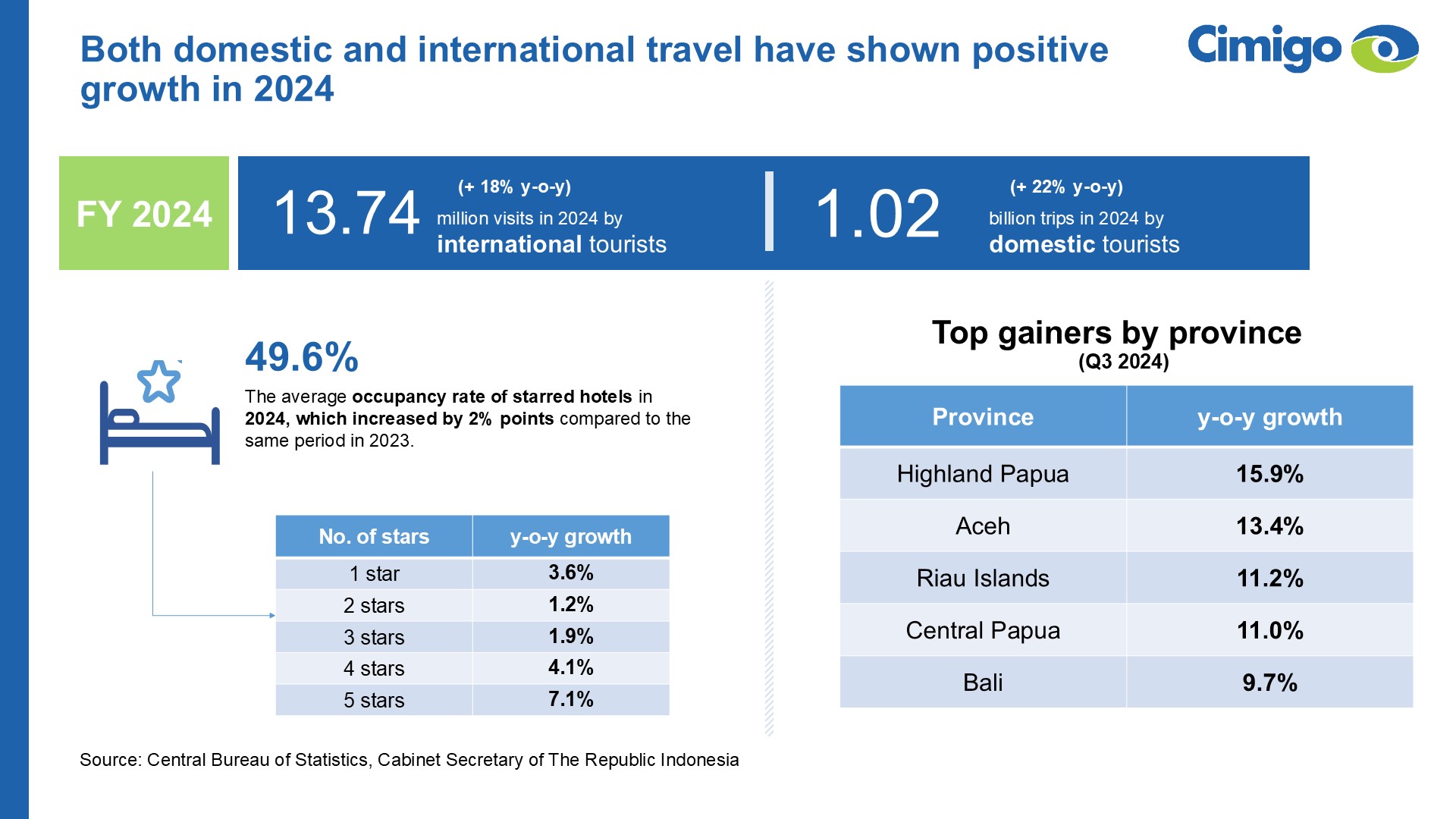

Travel experienced a strong rebound in 2024. Domestic trips surged to over one billion, a 22% year-on-year increase, while international tourist arrivals reached 13.7 million, marking growth of 18%. Hotels across the archipelago recorded a two-point increase in average occupancy rates. Provinces such as Papua and Bali recorded the highest growth in visitor numbers.

However, government belt-tightening on business travel and meetings has cast a shadow over the hotel sector’s outlook. Many operators fear declining revenues and the risk of debt default. Over half of hotel operators estimate that their revenue will fall by 10% to 30% this year, driven by waning demand. The government has sought to mitigate the impact by encouraging the use of collective leave days between public holidays and weekends, aiming to stimulate domestic tourism. This strategy may have limited effect as leisure travel and holidays are currently not a top priority for most people.

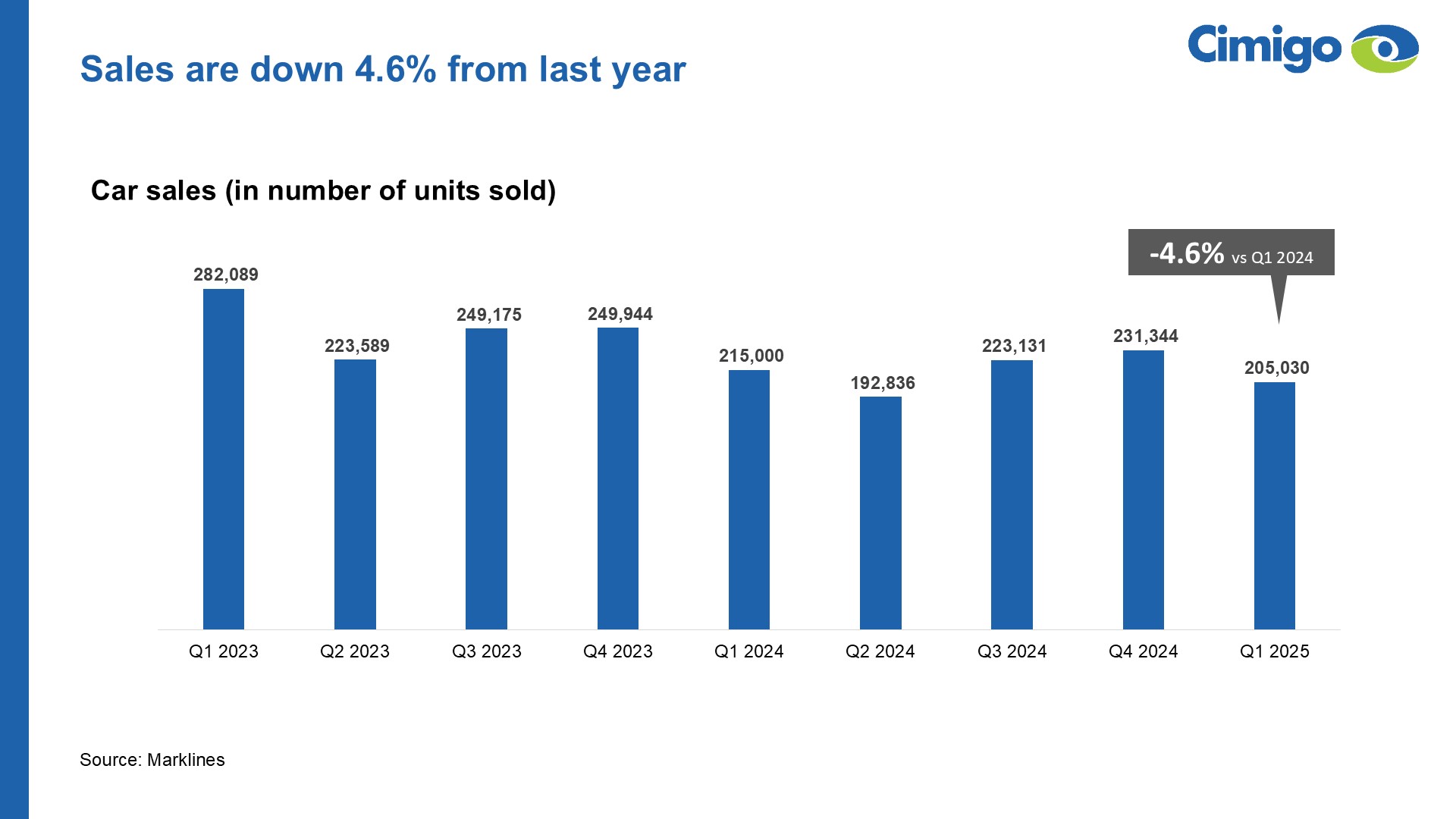

Despite increasing mobility, new car purchases are slowing. Car sales declined by 4.6% in Q1 2025, and purchase intent remains low. Price remains the primary barrier, with 66% of potential buyers citing budget constraints. For many, their current vehicle remains reliable, while evolving lifestyles, particularly in congested urban areas, are prompting a shift away from car ownership.

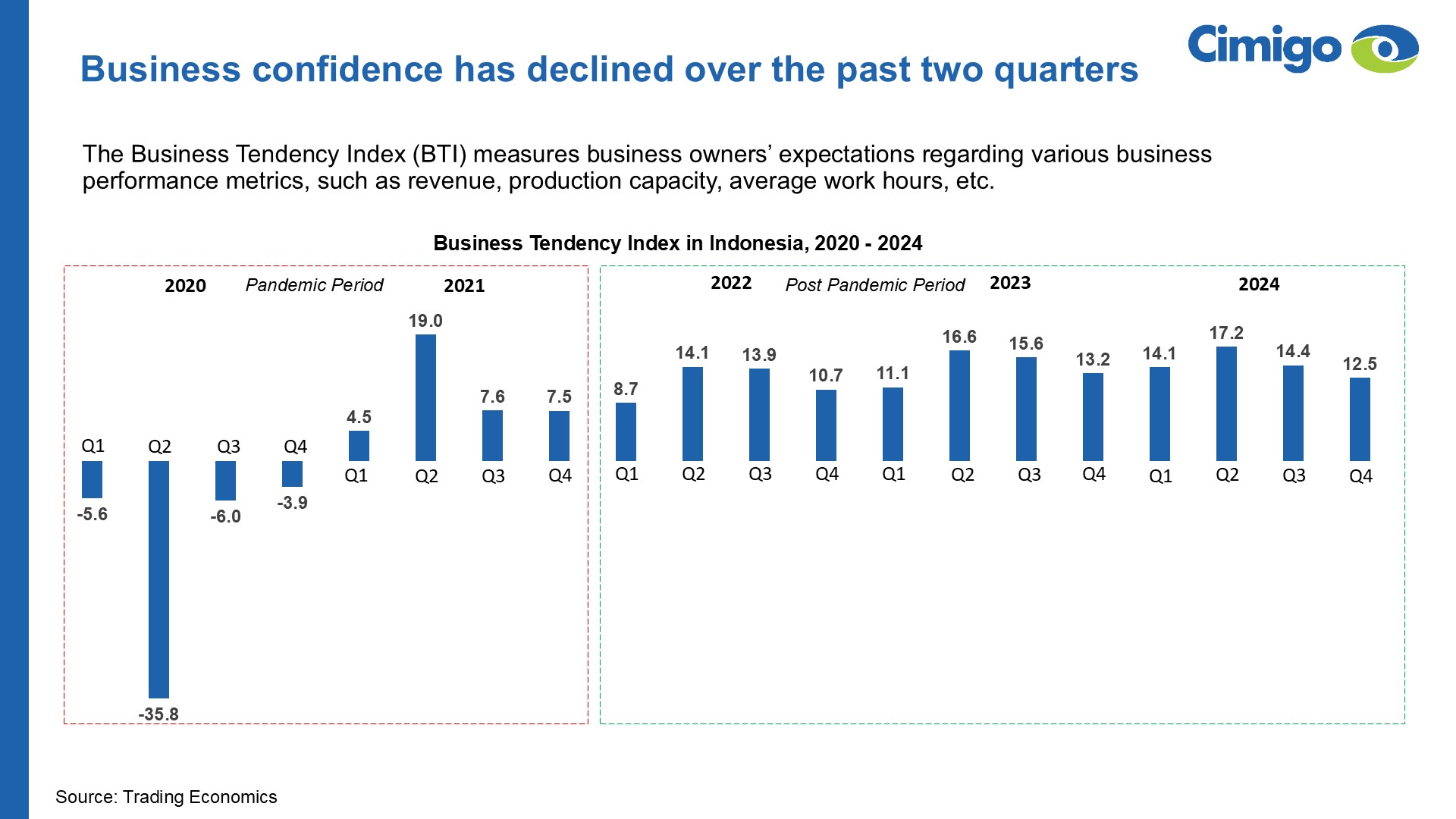

Key sectors attracting investment include basic metals, telecommunications, and mining, with Singapore, China, and Hong Kong among the top investor nations. Despite this, business sentiment is beginning to cool. The Business Tendency Index has declined for two consecutive quarters, signaling growing concerns around revenue, capacity, and profit margins. While investors may continue to trust in Indonesia’s economic fundamentals, businesses on the ground are adopting a more cautious outlook.

While 78% of Indonesians express concern about their financial situation, optimism persists. The Consumer Confidence Index remains above 120, and the majority believe that economic recovery is on the horizon.

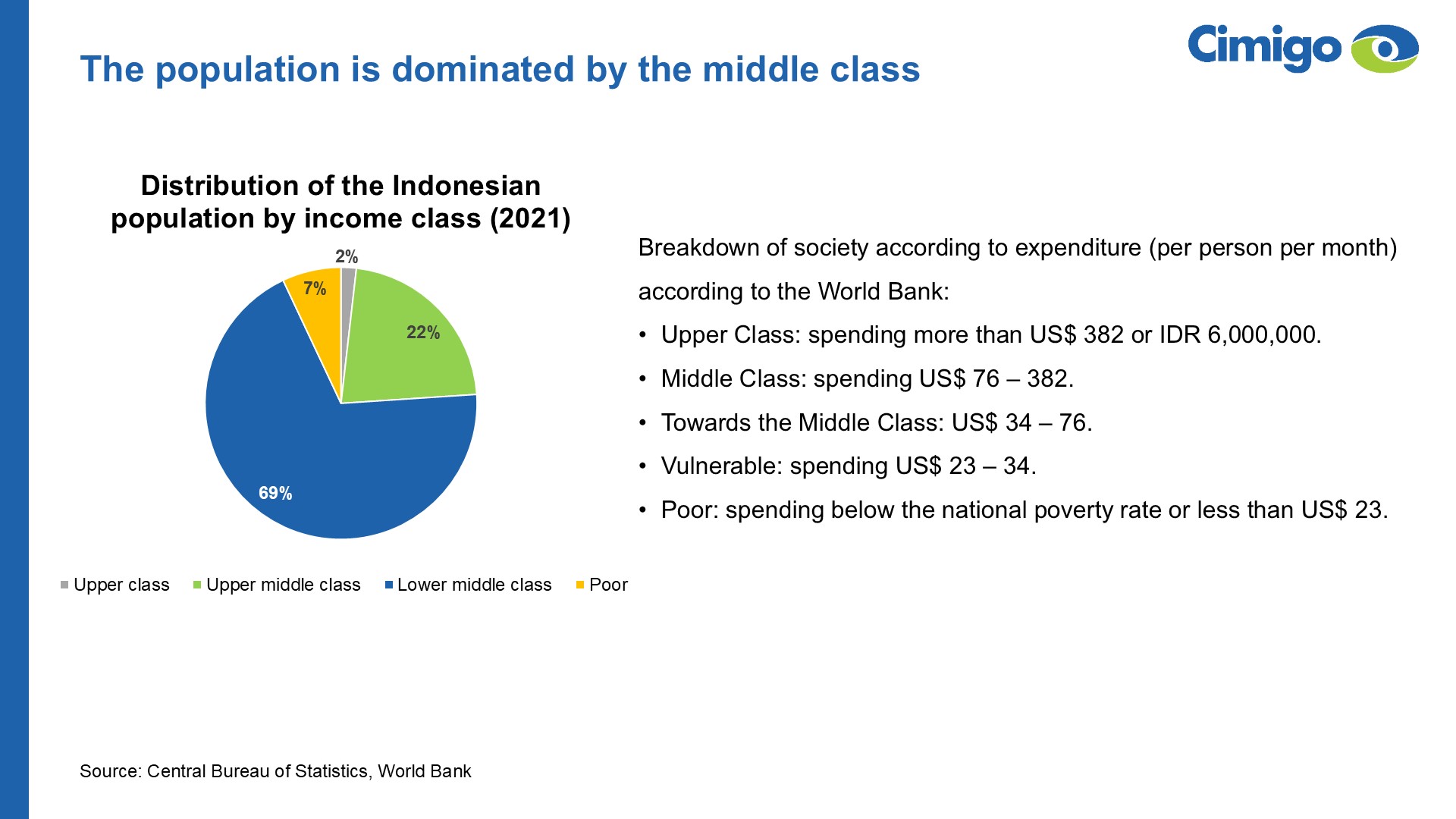

With 12.5 million millionaires, Indonesia’s affluent segment is expanding rapidly. However, this growth is accompanied by vulnerability. Around 69% of the population fall within the lower-middle class, and any sudden shock to prices or income could push many households backwards.

As Indonesia navigates a cooling economy, the underlying resilience of its consumers, workforce, and digital infrastructure offers a hopeful outlook. The nation’s youthful population, increasing digital adoption, and more strategic consumer behavior are reshaping the marketplace. While inflation, cautious spending, and declining business confidence present ongoing challenges, Indonesia continues to attract investment and mobilise its middle class. These are not signs of a market in retreat, but of one undergoing a purposeful reset.

The road ahead calls for brands to be sharper, more agile, and deeply empathetic. Marketers who attune themselves to shifting consumer values, embrace digital ecosystems, and position their offerings with clarity and purpose will be best positioned to succeed. Indonesia’s future may be marked by caution but it remains rich in opportunity for those who understand and alight with the rhythm of its transformation.

Vietnam consumer trends 2026

Feb 05, 2026

Vietnam is still a growth market, but consumer trends 2026 show that it has matured faster than

Vietnam’s dash to high-income status by 2045

Feb 06, 2026

Vietnam’s dash to high-income status by 2045 is credible. The next decade will determine whether

Vietnam’s growth story: From catch-up growth to disciplined growth

Feb 05, 2026

Vietnam’s economy behaves like a more mature economy than its income levels suggest. Vietnam’s

Đoàn Ngọc Huy (Johnny Doan), CMO & Market Research Expert -

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.