Let’s talk about Tết, baby

Jan 14, 2026

Tết: what has changed and why it matters? This article is based on a recent episode of the

Behind household appliances: understanding consumers’ preference and purchase

Electronic household appliances have continued to evolve over time in line with technological advancements, ranging from personal devices such as mobile phones to household essentials like refrigerators, rice cookers, and more. These developments have driven manufacturers to compete to remain at the forefront of the industry. This competition is aimed at fulfilling the wants and needs of consumers.

If electronic household appliances are so essential, then which ones truly take priority? What specific reasons or barriers influence their purchasing decisions?

This article aims to briefly explore these questions, providing valuable insights for manufacturers into consumer preferences for household appliances.

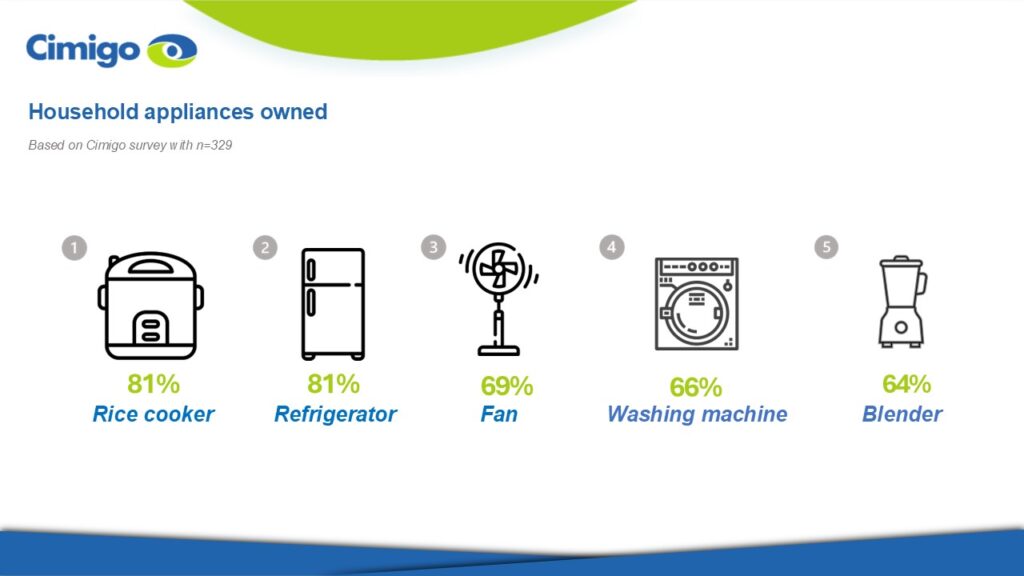

Cimigo has recently conducted a survey with 329 electronic household appliances owners that includes Gen X, Gen Y, and Gen Z. The survey found that daily-use household appliances such as rice cookers (81%) and refrigerators (81%) remain the most commonly owned by consumers. Other frequently owned appliances include electric fans (69%), washing machines (66%), and blenders (64%). Some consumers also own more modern appliances, such as dry irons (63%).

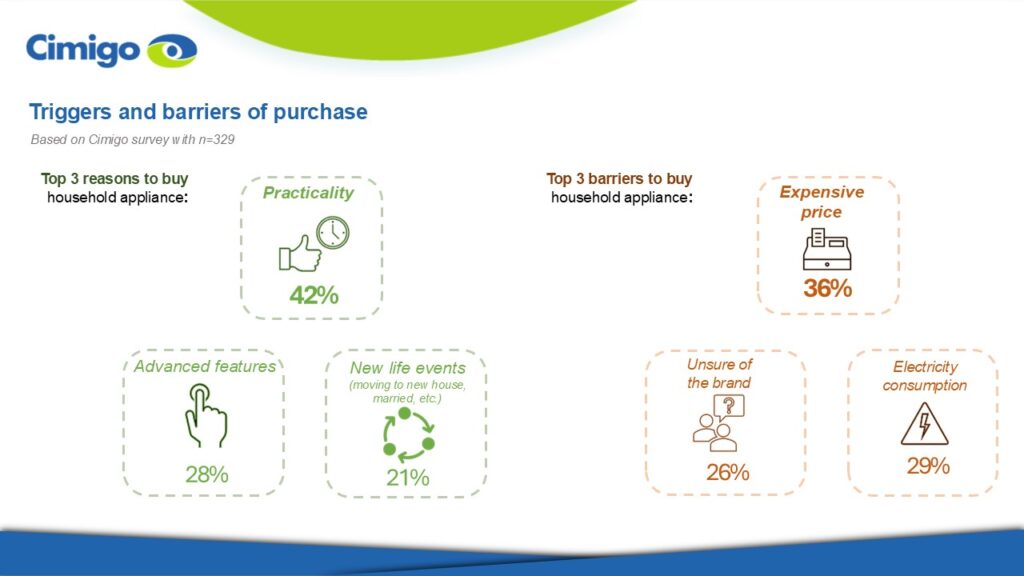

There are several reasons that drive consumers to purchase new household appliances, with practicality (42%) being the most significant. This refers to how useful, time-saving, and efficient an appliance is in supporting everyday household tasks. For instance, some consumers may already own a basic rice cooker that only cooks rice, but choose to upgrade to a newer model with additional functions such as baking or steaming. Other common reasons include the desire for advanced features (28%) and major life events, such as moving to a new home or getting married (21%).

However, high prices (36%) often serve as the main barrier to purchasing new household appliances. This is followed by uncertainty in choosing a brand (36%), likely due to the wide range of options available. High electricity consumption (29%) is another common concern, as consumers are becoming increasingly conscious of long-term energy costs.

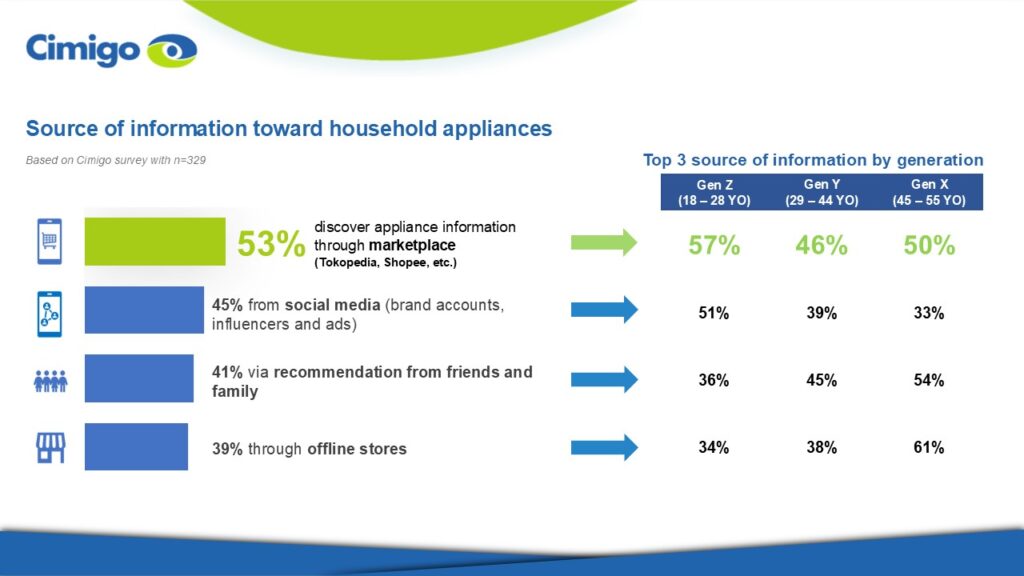

Nowadays, information is easily available, including details about household appliances. Consumers can readily find what they need from various sources such as online marketplaces, social media, or by simply visiting a store in person.

Younger age groups (Gen Z and Gen Y) primarily rely on online sources for product information. Marketplaces such as Tokopedia and Shopee are the most commonly used (53%) due to their convenience and user reviews, followed by social media (45%) which provides quick access to recommendations and promotional content.

Older consumers, particularly those from Gen X, tend to prefer more traditional sources of information when selecting household appliances. They often visit physical stores (39%) to see and assess the product firsthand, which offers a sense of assurance that online platforms may not provide. Additionally, personal recommendations from relatives (41%) play a significant role, as this group values advice from trusted individuals, especially people they know personally, rather than anonymous online reviews.

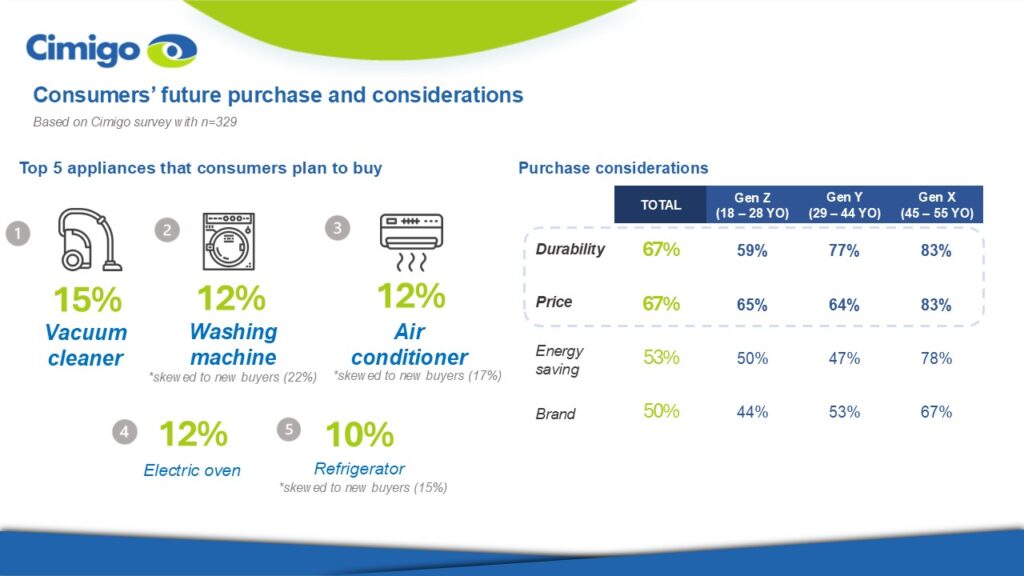

Before deciding to purchase new household appliances, consumers are most influenced by durability and competitive pricing (both at 67%), as they seek products that are reliable and offer value for money. Energy efficiency comes next (53%), reflecting increased awareness of long-term savings and the environmental advantages of lower energy consumption. Brand reputation (50%) is also an important factor, as well-known and trusted brands tend to inspire greater confidence among buyers.

Looking ahead, most consumers planning to buy new appliances intend to prioritise cleaning and comfort products, particularly vacuum cleaners (15%), washing machines (12%), and air conditioners (12%).

Based on Cimigo’s survey findings, the purchase journey for household appliances shows only slight differences across generations, mainly in the way they seek information before making a purchase.

Consumers seek improved features that simplify household tasks, yet high prices remain a significant barrier. The most effective way to meet their needs is by combining innovative technology with affordable pricing. Looking ahead, vacuum cleaners are expected to be among the top appliances that consumers plan to purchase.

For marketing purposes, ensuring products are easy to find on online marketplaces will have a significant impact, as Gen Z and Gen Y primarily use these platforms to gather information. Nevertheless, offline stores remain important, particularly for Gen X, who prefer to see and try the product in person before making a purchase.

Let’s talk about Tết, baby

Jan 14, 2026

Tết: what has changed and why it matters? This article is based on a recent episode of the

Why waiting weeks for research costs marketers millions

Jan 13, 2026

In fast-moving markets like Vietnam, speed is no longer a luxury. It’s a competitive advantage.

Vietnam’s CEOs 2026 outlook

Dec 17, 2025

Vietnam’s CEOs close 2025 with measured optimism amid global uncertainty As 2025 draws to a

Đoàn Ngọc Huy (Johnny Doan), CMO & Market Research Expert -

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.