The shift in Indonesia’s Eid Al-Fitr Spirit: More Meaning, More Mindful Choices

Feb 24, 2026

Indonesia’s Eid Al-Fitr consumer landscape Ramadan and Eid al-Fitr are the main drivers of

The shift in Indonesia’s Eid Al-Fitr Spirit: More Meaning, More Mindful Choices

Ramadan and Eid al-Fitr are the main drivers of Indonesia’s economy. Historically, Bank Indonesia has often recorded fantastic cash turnover, reaching nearly Rp200 trillion during this season. However, in 2026, there was a shift in behaviour: consumers became very financially disciplined. Based on a Cimigo survey conducted in February 2026 with 344 respondents, Indonesian consumers driving massive spending for the celebration across categories like Pastry (75%) and New Clothes (74%).

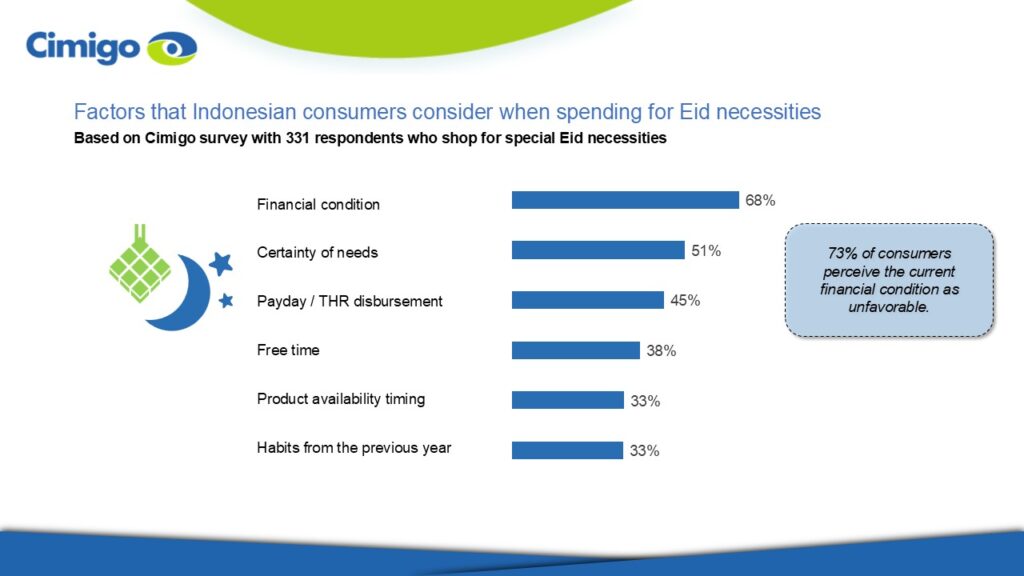

However, the 2026 landscape shows a pivot towards extreme financial discipline. Despite the festive spirit, 73% of consumers perceive the current economic condition as unfavourable.

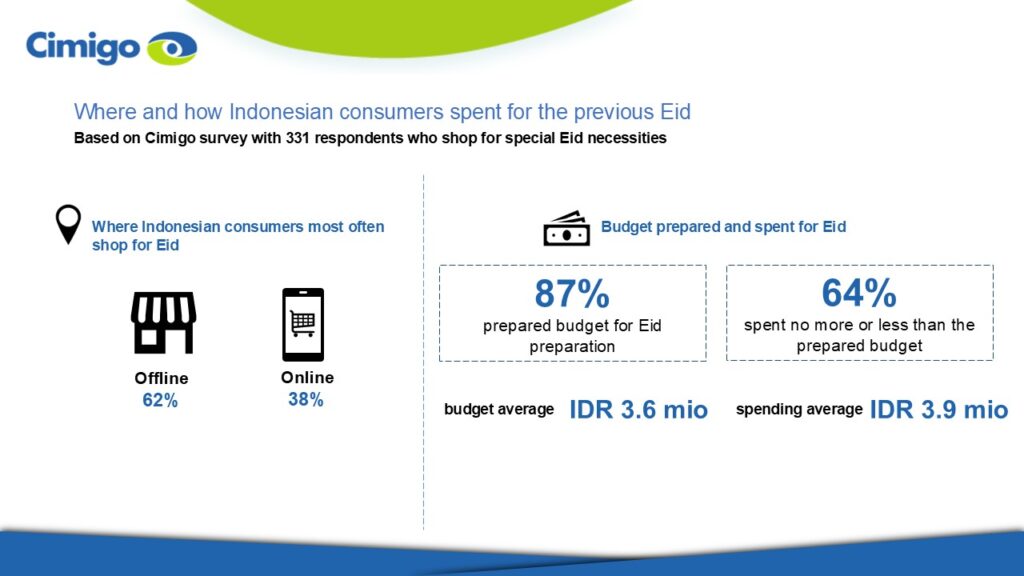

This sentiment has birthed a “Mindful Consumer” who no longer spends impulsively. Data shows that 87% of consumers now prepare a formal budget before the season begins.

This isn’t just a rough estimate; 64% are determined to stick strictly to their plan. With a tight average budget of IDR 3.6 million against a near-identical spending average of IDR 3.9 million, the margin for unplanned purchases has practically vanished.

The drive behind this “locked” budget is a calculated response to two main factors: current financial conditions (68%) and the need for certainty (51%). Consumers are vetting every purchase to ensure it is a necessity rather than a whim.

Timing also dictates action. Nearly half of consumers (45%) wait for their payday or THR (Religious Holiday Allowance) disbursement before making a move. Other factors like product availability timing and previous habits (both at 33%) play a secondary role compared to the immediate reality of their wallets. This selective behaviour is also visible in their channel of choice, where 62% still prefer offline shopping to verify quality before parting with their hard-earned money.

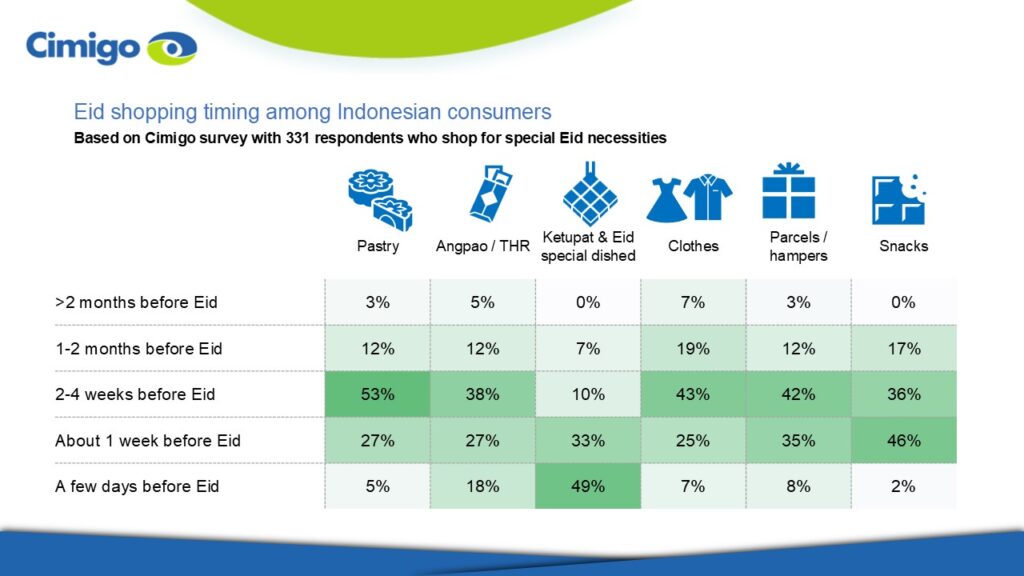

For brands, this mindfulness means the window to influence consumers is narrow. Since budgets are predetermined, businesses must target the right segment at the exact moment their specific category peaks. Missing these “Golden Weeks” means the consumer’s budget has likely already been exhausted elsewhere.

Cimigo’s survey reveals a clear chronological map for Ramadan spending:

The 2026 Eid market isn’t about “if” consumers will spend, but “when” and “how much.” With most shoppers sticking to a pre-set IDR 3.6 million limit, the competition is for a share of a finite wallet.

Overall, success this year depends on operational readiness aligned with these specific peak windows. Brands that offer clear value-for-money and high availability during the right timing in this festive season will win on tradition. In a season of mindful spending, being the “right choice at the right time” is the only way to break through the budget barrier.

The shift in Indonesia’s Eid Al-Fitr Spirit: More Meaning, More Mindful Choices

Feb 24, 2026

Indonesia’s Eid Al-Fitr consumer landscape Ramadan and Eid al-Fitr are the main drivers of

Consumer Insights Vietnam: Why Opinions Aren’t Enough

Feb 23, 2026

Every marketer knows the moment: a tight deadline, a high-stakes decision, and no fresh data on

Vietnam consumer trends 2026

Feb 05, 2026

Vietnam is still a growth market, but consumer trends 2026 show that it has matured faster than

Đoàn Ngọc Huy (Johnny Doan), CMO & Market Research Expert -

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

As a Marketing Director and Market Research Expert Advisor across international markets, I have collaborated with numerous market research agencies, both global and local, that operate with a high level of professionalism and effectiveness. Cimigo is among the most outstanding. The Cimigo team demonstrates exceptional professionalism, strong commitment, and operational excellence. From research design and fieldwork execution to insight analysis, all stages are conducted rigorously, delivered on schedule, and closely aligned with business objectives. This is a highly capable team that I would confidently recommend to my partners and stakeholders.

Lisa Nguyen - Vietnam Marketing Lead

Mark Ratcliff - Managing Director

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

The team at Cimigo are my favourite researchers in South East Asia. They’ve proved adept at tackling the most private and complex personal issues at qualitative research level, not flinching when the client endlessly chopped and changed fieldwork timing, or ramped up the workload without warning. They have recruited the most extraordinarily niche consumers without pause or complaint. Their patience with clients and their flexibility and hard work that went above and beyond what was initially asked of them on two projects relating to sexual behaviour means there is now no other research company we would choose to work with in that part of Asia. The fact they also pulled off a third project for us so well, on men’s relationship with beer and beer advertising, shows they have breadth of expertise— we still quote from the report they produced.

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Vo Thi Thuy Ha - Commercial Effectiveness

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.