Vietnam uninterrupted: a twenty-year journey

Mar 18, 2024

Vietnam uninterrupted: a twenty-year journey Review Vietnam’s long-term trends and how consumer

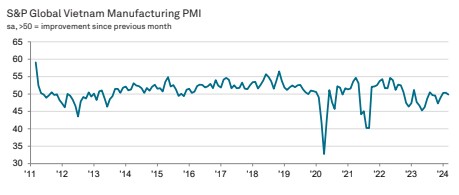

Vietnam PMI March 2024 – manufacturing purchasing managers index

Cimigo Vietnam market research has collected the Vietnam PMI – manufacturing purchasing managers index since 2013. S&P Global compiles the Vietnam PMI S&P Global from responses to monthly questionnaires sent to purchasing managers in a panel of around 400 manufacturers.

After recording marginal improvements in the opening two months of the year, business conditions in the Vietnamese manufacturing sector were broadly unchanged in March. Output and new orders both ticked lower, while a subdued demand environment led to a slower rise in input costs and a reduction in selling prices.

More positively, confidence in the outlook for the year ahead hit an 18-month high and manufacturers took on extra staff at a faster rate. The S&P Global Vietnam Manufacturing Purchasing Managers’ Index™ (PMI®) dipped below the 50.0 no change mark in March, posting 49.9 after a reading of 50.4 in February. The index, therefore, signalled an end to the two-month period of improving business conditions at the start of 2024 but pointed to broadly unchanged operating conditions overall.

There were signs of demand weakness in March, leading to a drop in new orders despite discounts offered to help secure sales. New export orders were also down, and to the greatest extent since July 2023 amid competitive pressures and geopolitical issues.

With new orders down, firms also scaled back production at the end of the first quarter of the year, following growth in January and February. The drop in production was only marginal, however, and limited to intermediate goods firms as expansions were recorded at consumer and investment goods producers.

Despite the weakness seen in March, manufacturers were increasingly confident that production will increase over the year ahead. Optimism was the strongest in a year-and-a-half. Firms expect the launch of new products to boost output, while also hoping that an improvement in market demand will help to support new order growth.

Manufacturers also stepped up their recruitment efforts in March, raising employment for the second month running and at the fastest pace since October 2022.

Rising staffing levels, and a drop in new orders, helped firms to work through outstanding business for the second

consecutive month. Moreover, the rate of depletion was the fastest in five months.

Lower output requirements led firms to reduce their purchasing activity in March, the fifth month running in which this has been the case. In turn, stocks of inputs decreased solidly.

Stocks of finished goods also decreased, and to the greatest degree in 33 months. Lower production and the shipping of products to customers were behind the drop in postproduction inventories. In a number of cases, goods destined for export had been dispatched.

Reduced demand for inputs contributed to a slowdown in the pace of input cost inflation, with the latest rise the softest since August last year and weaker than the series average. Where input prices did rise, panellists linked this to higher raw material and oil prices.

Manufacturers reduced their selling prices for the second time in the past three months. The marginal decline in March followed a slight increase in February and reflected a combination of competitive pressures, subdued demand and softer cost inflation.

Finally, suppliers’ delivery times were broadly unchanged at the end of the opening quarter of the year. International shipping delays and conflicts led to delays receiving goods in some cases, but this was broadly cancelled out by vendors having sufficient inventory holdings to meet orders.

Approach

The S&P Global Vietnam Manufacturing PMI® is compiled by S&P Global from responses to monthly questionnaires sent to purchasing managers in a panel of around 400 manufacturers. The panel is stratified by detailed sector and company workforce size, based on contributions to GDP.

Survey responses are collected by Cimigo Vietnam in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses.

The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

Vietnam uninterrupted: a twenty-year journey

Mar 18, 2024

Vietnam uninterrupted: a twenty-year journey Review Vietnam’s long-term trends and how consumer

Vietnam PMI March 2024 – manufacturing purchasing managers index

Apr 02, 2024

Production dips for the first time in three months Subdued demand leads to falls in output and new

Listen to me! Consumer immersion meets innovation

Dec 14, 2023

In the fast-paced world of innovation, the race to create the next groundbreaking product is

Hy Vu - Head of Research Department

Joe Nelson - New Zealand Consulate General

Steve Kretschmer - Executive Director

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Chad Ovel - Partner

Private English Language Schools - Chief Executive Officer

Rick Reid - Creative Director

Janine Katzberg - Projects Director

Anya Nipper - Project Coordination Director

Dr. Jean-Marcel Guillon - Chief Executive Officer

Joyce - Pricing Manager

Matt Thwaites - Commercial Director

Aashish Kapoor - Head of Marketing

Kelly Vo - Founder & Host

Thanyachat Auttanukune - Board of Management

Hamish Glendinning - Business Lead

Thuy Le - Consumer Insight Manager

Richard Willis - Director

Ha Dinh - Project Lead

Geert Heestermans - Marketing Director

Louise Knox - Consumer Technical Insights

Aimee Shear - Senior Research Executive

Dennis Kurnia - Head of Consumer Insights

Tania Desela - Senior Product Manager

Thu Phung - CTI Manager

Linda Yeoh - CMI Manager

Cimigo’s market research team in Vietnam and Indonesia love to help you make better choices.

Cimigo provides market research solutions in Vietnam and Indonesia that will help you make better choices.

Cimigo provides a range of consumer marketing trends and market research on market sectors and consumer segments in Vietnam and Indonesia.

Cimigo provides a range of free market research reports on market sectors and consumer segments in Vietnam and Indonesia.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Please enter the information for free download.

The report will be sent to your email.