AI di mata orang Indonesia: Sekilas dari kehidupan sehari-hari

Jun 24, 2025

Kecerdasan Buatan (AI) tidak lagi menjadi konsep futuristik; kini AI telah menjadi bagian yang

Vietnam consumer trends 2024

Vietnam Consumer Trends 2024 explores the eight reasons Vietnam will prosper in the next decade.

Vietnam’s economy is set for substantial growth over the next decade, supported by a combination of domestic and global factors. This report explores the drivers of Vietnam’s economic expansion, key consumer trends, and challenges businesses must navigate. As Vietnam’s GDP grows and its digital economy expands, consumers are also changing their behaviours, driving new trends in tourism, retail, and financial inclusion.

12-minute read

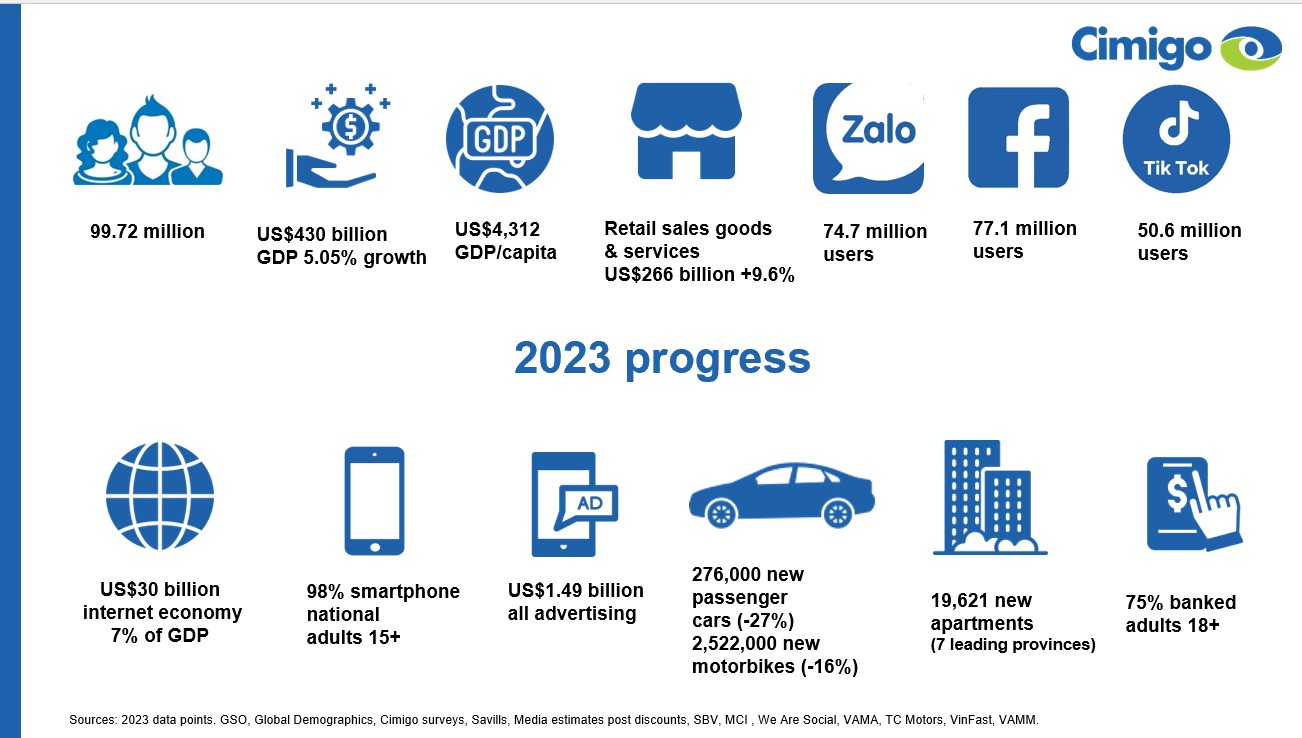

Vietnam made significant strides in both. Several key indicators reflect the nation’s ability to recover from the global pandemic and leverage its economic strengths for growth.

Vietnam’s GDP grew by 5.05% in 2023, contributing to a total GDP of US$430 billion. While below the decade-long average of 5.8%, this growth underscores the economy’s resilience amidst global economic challenges. Vietnam’s sustained industrial production and export growth played a pivotal role, with exports continuing to perform well, contributing to a trade surplus. The country’s GDP per capita reached US$4,312 in 2023, reflecting an improvement in living standards and rising household affluence. This marks Vietnam’s gradual transition from a low-income to a middle-income economy.

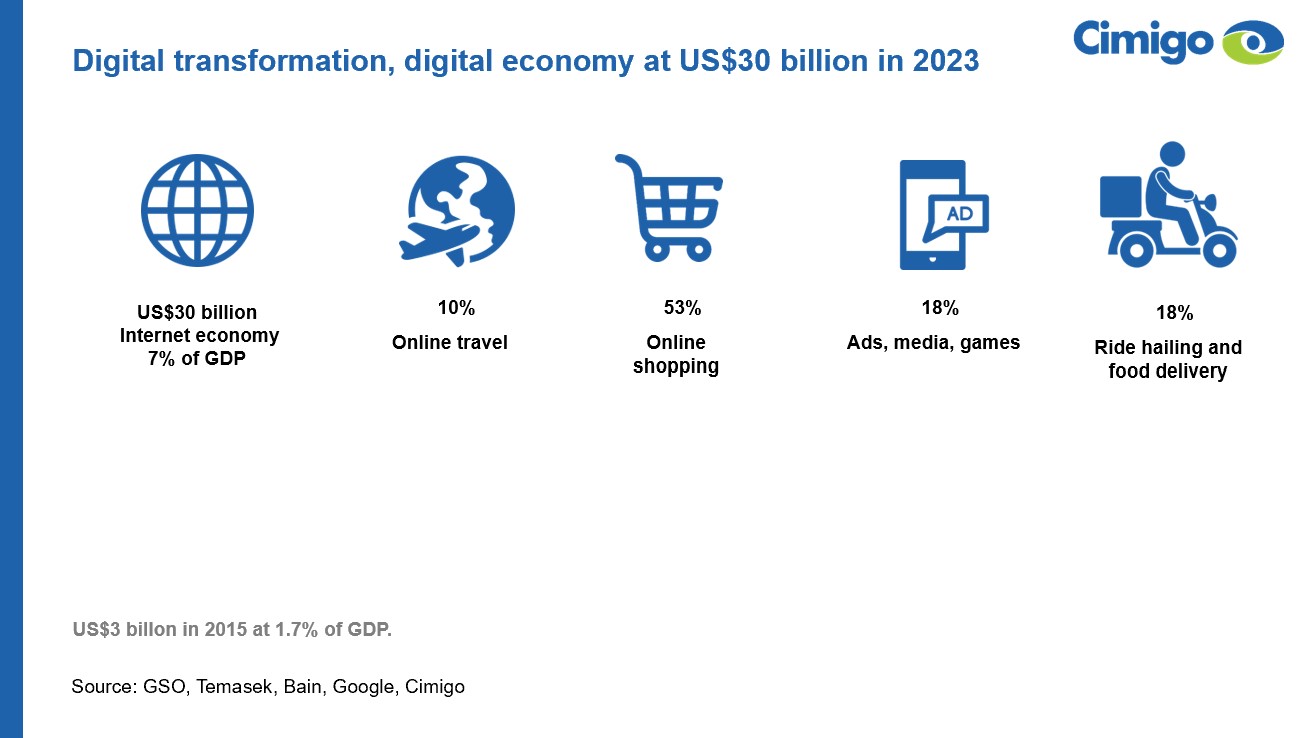

Download the free presentation on consumer trends

One of the most notable economic achievements was the expansion of the digital economy, which grew to US$30 billion in 2023, representing 7% of the national GDP. This robust growth can be attributed to the increased use of e-commerce, online services, and digital payments as Vietnam continues to embrace digital transformation across all sectors of the economy. Vietnam boasted 74.7 million internet users by 2023, with 98% of adults aged 15+ owning smartphones. This near-universal digital access transforms how businesses operate and consumers engage with the economy, particularly in urban areas.

Retail sales also showed signs of recovery, with US$266 billion in sales, reflecting a 9.6% growth year-on-year. Vietnam’s automotive and real estate sectors were among the areas that struggled in 2023. The automotive industry saw a decline, with 276,000 new passenger cars sold, down 27% year-on-year. Similarly, 2.5 million new motorbikes were sold, a 16% decrease. In the real estate sector, 19,621 new apartments were sold across seven leading provinces, signalling a modest recovery in the property market but highlighting lingering challenges in affordability and consumer confidence.

Vietnam made continued progress in financial inclusion, with 75% of adults aged 18+ having a bank account by 2023. This growth in banking penetration underscores efforts to broaden access to financial services, supported by the increasing adoption of digital payments. The household saving rate rose from 8.5% in 2019 to 10% in 2024, suggesting consumers remain cautious, prioritising savings over discretionary spending due to inflationary pressures and economic uncertainty.

Vietnam has maintained steady GDP growth over the past decade, averaging 5.8%. Several critical factors contribute to this robust economic trajectory. FDI and export growth have bolstered industrial production, with manufacturing accounting for 25% of GDP. Vietnam’s global interconnectivity reached 159% in 2023, demonstrating its prominence in international trade.

The country has shifted towards producing higher-value goods, with 40% of exports classified as high-tech in 2023, compared to just 4% in 2003. However, challenges still need to be addressed, including a shortage of managerial talent and limitations in infrastructure.

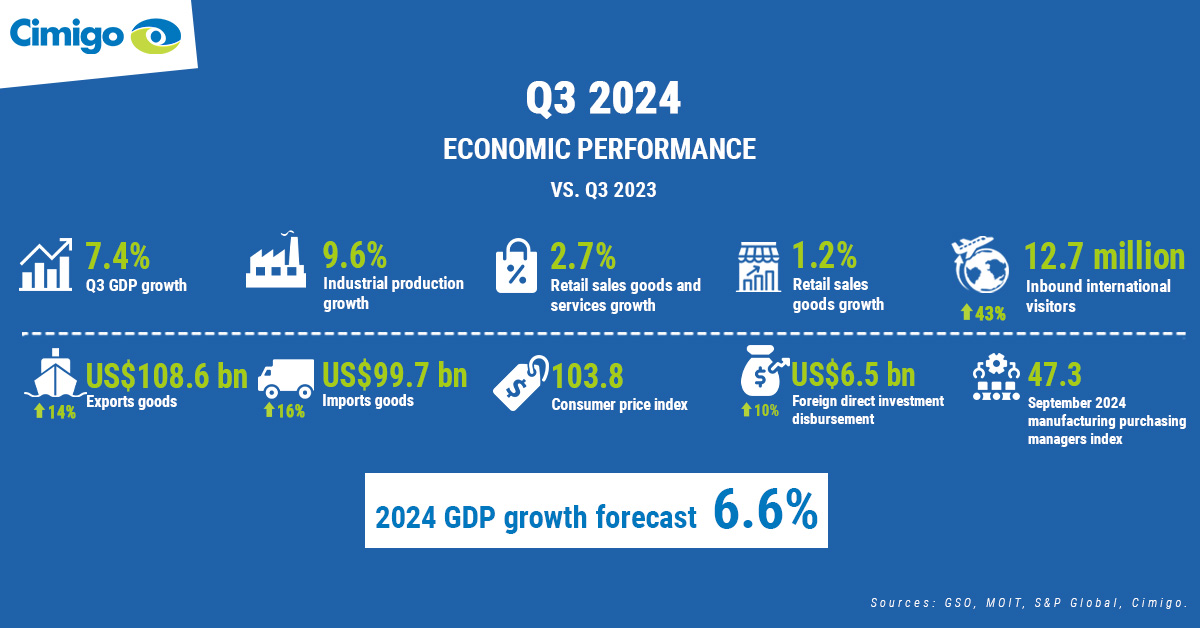

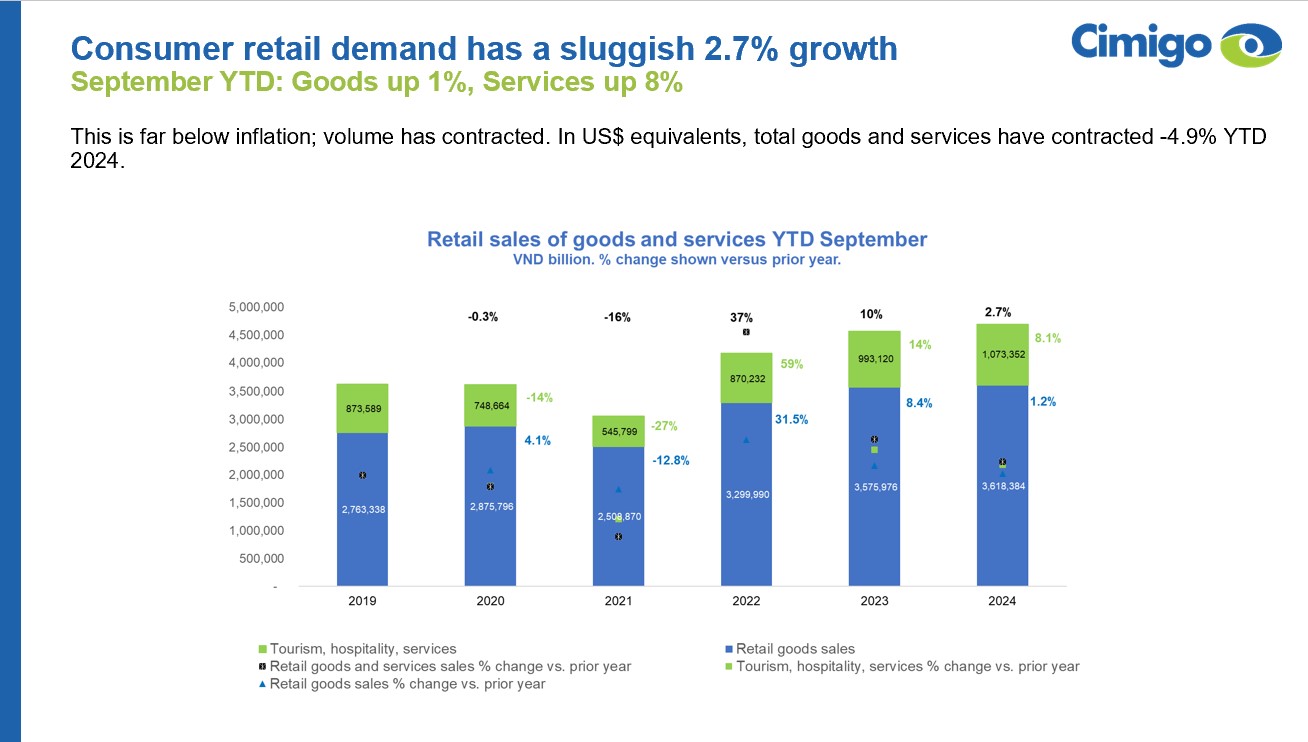

While the macroeconomic outlook is positive, domestic consumer demand in Vietnam has remained sluggish in 2024. True inflation and consumers’ focus on rebuilding savings post-pandemic have contributed to conservative spending habits. Retail growth has been limited, with a modest 2.7% increase by September 2024. Consumers have become more price-conscious, steering away from premium products and seeking value-based purchases, even for basic goods like milk. Businesses that have succeeded in this environment offer strong value propositions. Fortunately, domestic tourism continues to thrive, and international tourism has recovered since the pandemic. By September 2024, inbound tourists had surged by 43%, with emerging trends such as wellness tourism and solo travel impacting the sector.

Download the free presentation on consumer trends

Despite long-term optimism, Vietnam’s short-term consumer outlook remains volatile. Vietnam’s business confidence has been shaken due to anti-corruption campaigns and inflationary pressures. Bureaucratic delays and a lack of government approvals have also hindered business sentiment, with significant improvements expected only after 2026. Cimigo expects Vietnam’s GDP growth to reach 6.6% in 2024, with consumer demand forecasted to improve gradually by 2025. However, this recovery will be modest, hovering just above inflation.

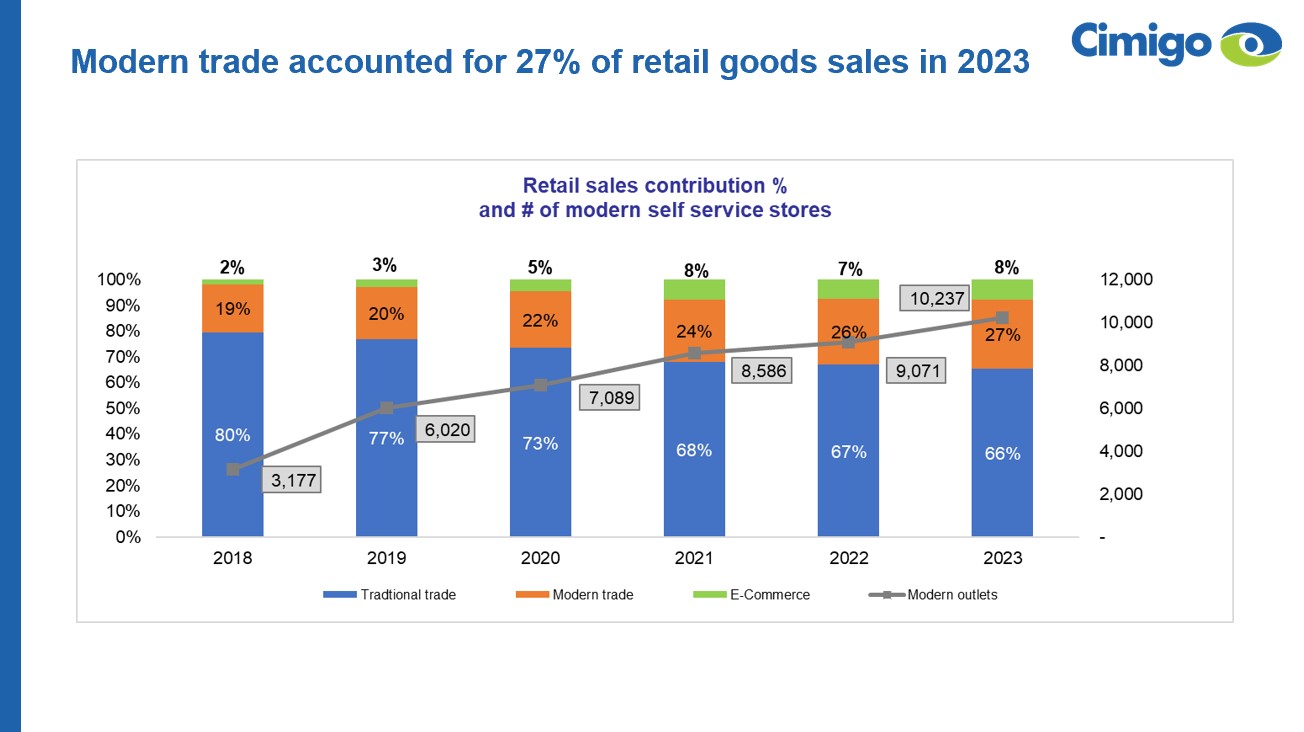

The retail landscape in Vietnam continues to evolve, driven by the rise of modern trade and e-commerce.

Modern trade, which includes organised retail formats like supermarkets, convenience stores, and mini markets, has significantly increased in Vietnam over the past decade. In 2023, modern trade accounted for 27% of total retail sales, up from 15% in 2005. This shift reflects a growing consumer preference for convenience, quality, and a more structured shopping experience.

Versus 2022, modern trade sales grew by 13% in 2023, signalling strong momentum in the sector. This trend is partly driven by Vietnam’s expanding middle class and urbanisation. One of the most notable developments in 2024 has been the significant growth of retail outlets, particularly in provincial towns. The modern trade sector saw an 8% increase in outlets by September 2024 compared to 18 months prior.

As retail chains expand into less urbanised areas, digital and modern trade channels are making significant inroads, offering greater accessibility to rural consumers. At the same time, the experience economy—focused on providing consumers with memorable, engaging shopping experiences—is flourishing. This is expected to shape consumer behaviour further, encouraging more shoppers to move away from traditional markets towards organised retail.

Download the free presentation on consumer trends

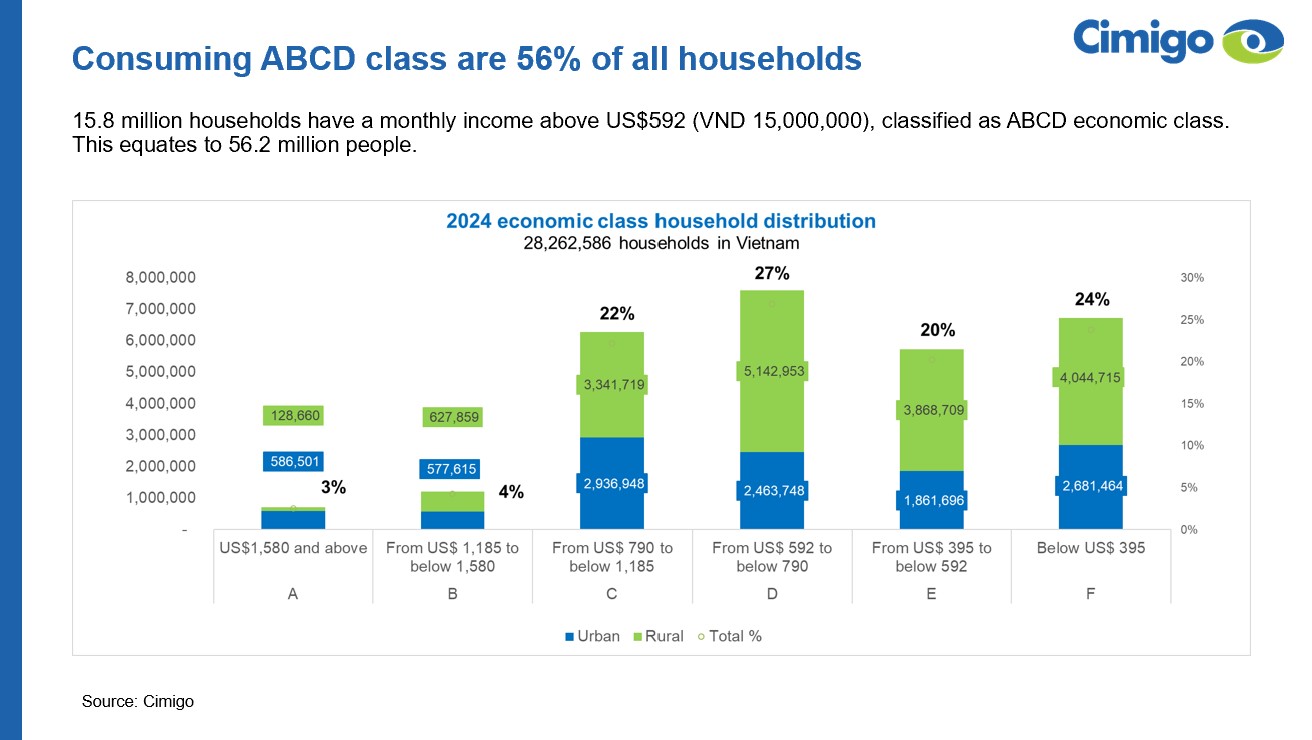

Vietnam’s middle class continues to expand, driving consumption. 56% of Vietnamese households now belong to the ABCD income class, earning above VND 15 million (US$592) per month. However, the increase in household wealth has been incremental, with a 0.5% rise in those earning between US$500 and US$999.

Emerging trends see thriftiness gaining popularity among younger consumers, who gravitate towards secondhand fashion as a sustainable, eco-conscious alternative. Vietnam is seeing a rise in single-person households, leading to increased demand for solo travel, compact living spaces, pets, and single-portion meals.

Digital payments have become ubiquitous, with nearly 40% of consumers using banking apps for their latest purchases. This shift has helped expand financial inclusion, especially in urban areas where modern trade has made significant inroads. Vietnam’s internet economy is now valued at US$30 billion, representing 7% of GDP. Shopee dominates the e-commerce landscape, but TikTok is quickly emerging as a strong challenger in the digital marketplace, particularly in social commerce.

Download the free presentation on consumer trends

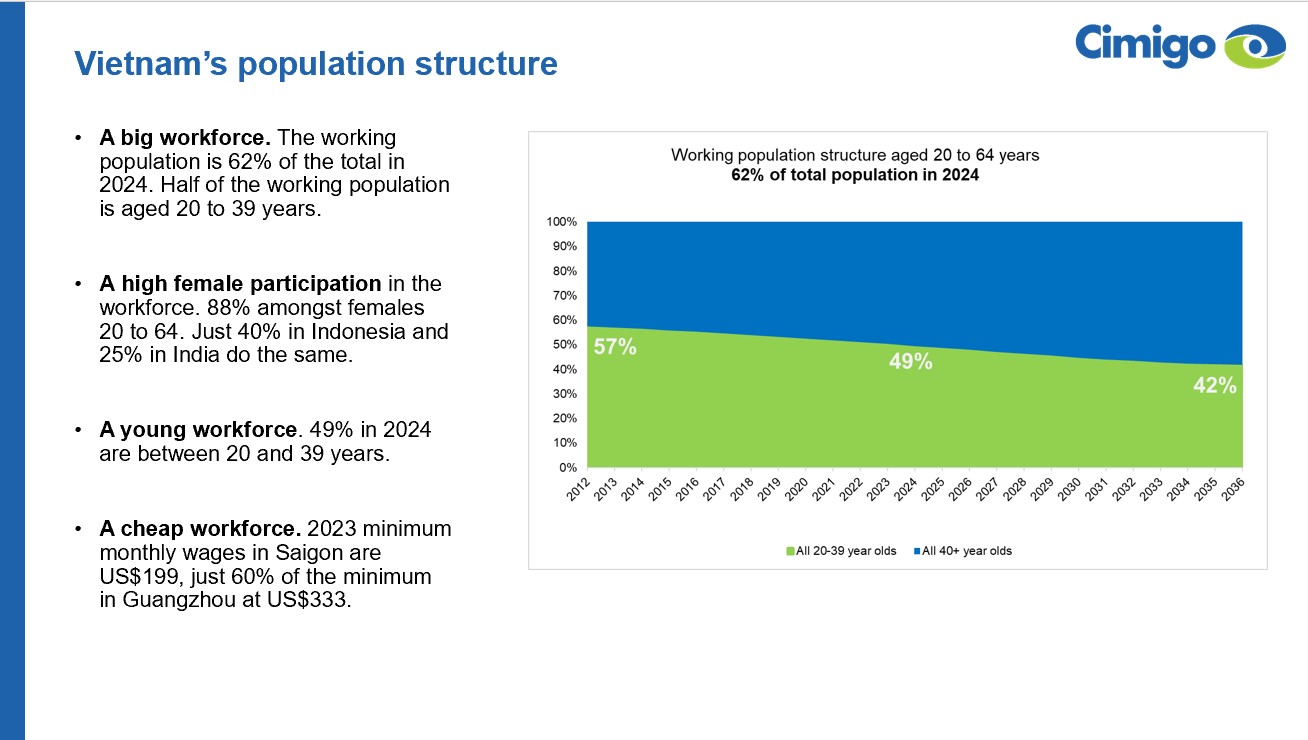

Vietnam’s favourable demographic structure is a significant asset to its economy, though the dynamics are gradually shifting.

In 2024, 62% of the population is of working age, with 49% aged between 20 and 39 years. This young workforce supports high labour participation and a low dependency ratio, which continues to be a key driver of economic growth.

However, by 2036, Vietnam will lose its demographic advantage as the population ages. The silver generation is the fastest-growing segment, and businesses are beginning to tap into their disposable income, focusing on sectors like healthcare, travel, and wellness services.

Download the free presentation on consumer trends

Vietnam is poised for continued economic growth, driven by FDI, a youthful workforce, and an expanding digital economy. However, businesses must navigate a challenging consumer landscape where demand remains muted and price sensitivity is high. As Vietnam transitions into a more affluent, digitalised society, companies that adapt to these trends will be well-positioned for success.

The number one enabler for Vietnam’s economic success has primarily been the structure of its working population and its youth and the high labour participation of women, which provides a low dependency ratio. Vietnam has gone through a decade with average GDP growth of 6%. Vietnam has strong domestic consumer demand, and Cimgio expects these levels of economic growth to be maintained over the next decade.

The change will come in 2036 as the population structure changes. The economic challenge lies in moving from a lower-middle to an upper-middle-income country as these population changes take hold.

Vietnam will stand out as a high-growth economy over the next ten years. These are the eight key reasons why Vietnam will continue to prosper over the next decade, and its growth will be the strongest in Asia and most of the world.

Download the free presentation on consumer trends

End.

AI di mata orang Indonesia: Sekilas dari kehidupan sehari-hari

Jun 24, 2025

Kecerdasan Buatan (AI) tidak lagi menjadi konsep futuristik; kini AI telah menjadi bagian yang

Tren konsumen Indonesia 2025

May 17, 2025

Tren Konsumen Indonesia 2025 menyoroti delapan alasan utama mengapa Indonesia siap untuk bangkit

Dibalut dengan cinta: Makna kue kaleng sebagai simbol kebersamaan di hari Lebaran

Apr 23, 2025

Tradisi manis yang tetap jadi favorit di momen Lebaran Walau Lebaran telah berlalu, kebiasaan

Kevin McQuillan - Chief Marketing Officer

Sam Houston - Chief Executive Officer

Minh Thu - Consumer Market Insights Manager

Travis Mitchell - Executive Director

Malcolm Farmer - Managing Director

Hy Vu - Head of Research Department

Steve Kretschmer - Executive Director

Joe Nelson - New Zealand Consulate General

York Spencer - Global Marketing Director

Laura Baines - Programmes Snr Manager

Mai Trang - Brand Manager of Romano

Hanh Dang - Product Marketing Manager

Luan Nguyen - Market Research Team Leader

Max Lee - Project Manager

Chris Elkin - Founder

Ronald Reagan - Deputy Group Head After Sales & CS Operation

Ha Dinh - Project Lead

Matt Thwaites - Commercial Director

Joyce - Pricing Manager

Dr. Jean-Marcel Guillon - Chief Executive Officer

Anya Nipper - Project Coordination Director

Janine Katzberg - Projects Director

Rick Reid - Creative Director

Private English Language Schools - Chief Executive Officer

Chad Ovel - Partner

Thanyachat Auttanukune - Board of Management

Thuy Le - Consumer Insight Manager

Kelly Vo - Founder & Host

Hamish Glendinning - Business Lead

Aashish Kapoor - Head of Marketing

Richard Willis - Director

Thu Phung - CTI Manager

Tania Desela - Senior Product Manager

Dennis Kurnia - Head of Consumer Insights

Aimee Shear - Senior Research Executive

Louise Knox - Consumer Technical Insights

Geert Heestermans - Marketing Director

Linda Yeoh - CMI Manager

Tim market research Cimigo di Indonesia dengan senang hati membantu Anda membuat keputusan yang lebih tepat.

Cimigo menyediakan solusi riset pasar di Indonesia yang akan membantu Anda membuat pilihan yang lebih baik.

Cimigo menyediakan tren pemasaran konsumen Indonesia dan riset pasar pada sektor pasar dan segmen pelanggan di Indonesia.

Cimigo menyediakan laporan riset pasar pada sektor pasar dan segmen pelanggan di Indonesia.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Please enter the information for free download.

The report will be sent to your email.

When downloading our reports, you agree to be contacted for marketing purposes.

Vui lòng điền thông tin vào biểu mẫu bên dưới để tải về báo cáo miễn phí.

Báo cáo sẽ được gửi vào email bạn điền ở bên dưới.

Khi tải xuống các báo cáo của chúng tôi, bạn đồng ý được liên hệ cho mục đích tiếp thị.

Xin cảm ơn. Một email kèm với đường dẫn tải báo cáo đã được gửi đến bạn.