Marketing planning

Marketing planning workshop

Marketing planning workshop Metrics and models used in brand equity audits

Metrics and models used in brand equity audits First Choice – the ultimate brand equity metric

First Choice – the ultimate brand equity metric BrandPower

BrandPower

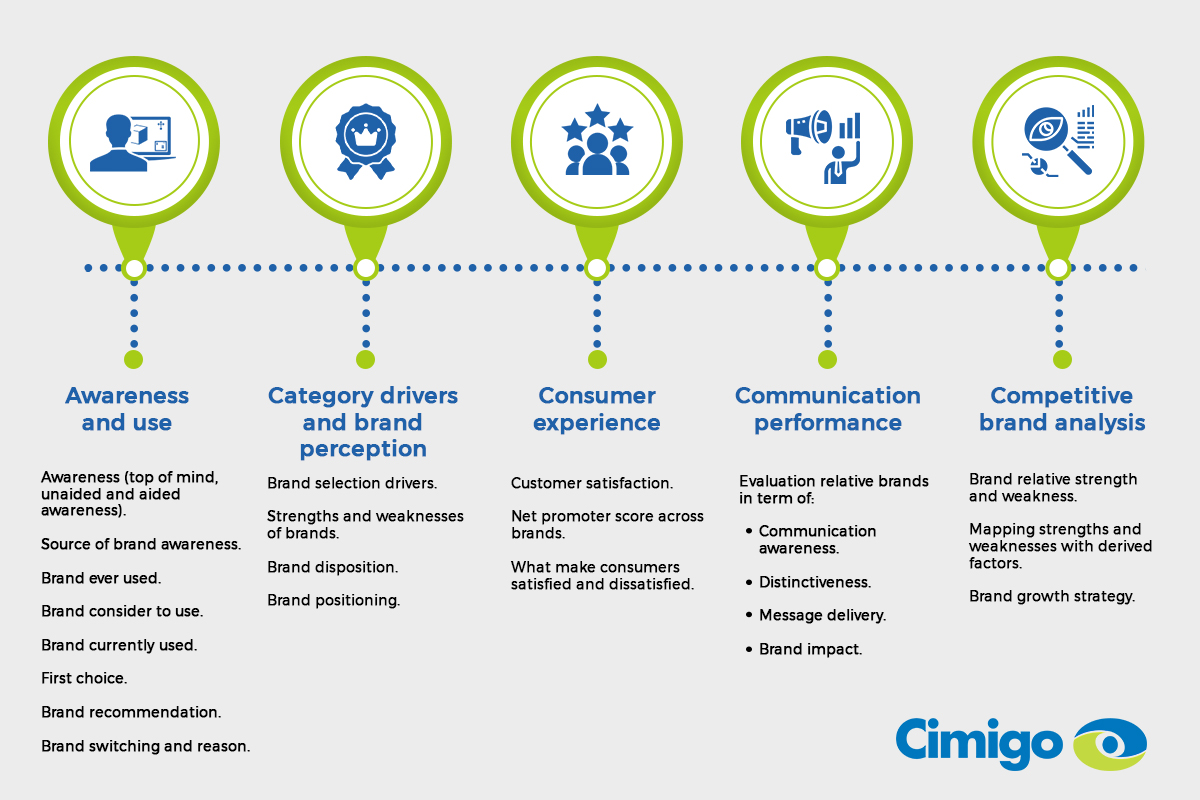

Brand equity audits

There are multiple terms for studies which review competitive brand performance and help you make better choices in your marketing planning; annual brand health check-up, a usage and attitude study in your category, a post launch assessment, continuous tracking of brand performance or a brand audit. All are conducted in preparation for making the best choices when planning your marketing strategy. Cimigo will help you make better choices with a thorough understanding of your performance, competitive analysis and communication touch points’ effectiveness.

Marketing planning workshop

The ultimate outcome is typically a deep dive into the insights from the brand equity audit amongst with stakeholders to formulate action plans and set annual marketing objectives.

Metrics and models used in brand equity audits

Cimigo provide analytical models to help you understand your relative position in the market. Understanding key metrics such as;

First Choice – the ultimate brand equity metric

Brand equity is an intangible asset. Whatever literature is read, brand equity boils down to the sum of what people know and feel about the brand, consciously and unconsciously. The most important outcome for marketers is whether that equity leads to a favourable decision, i.e. whether people choose to purchase the brand.

A consumer’s “first choice” is therefore an excellent indicator of the sum experience of that brand in their head. Whether pre-store or in-store, there will be a brand that sits at the top of all others in a consumer’s mind. A marketer’s ambition must be to lift the brand up the ladder of choices to reach the top.

First Choice is not the same as actual choice, BUMO, value share, volume share, or basket share. It is a true marketing metric. There are many reasons why someone’s First Choice ends up not being the product they buy; the two key reasons are:

-

Price

A consumer’s First Choice may be Mercedes, but they may buy a Toyota, because they don’t have the money. Mercedes’s smaller value and volume in the market is not a sign of a lack of equity. -

Availability

A consumer may not select the First Choice because it is not in store, so they select their Second Choice.

But pricing and availability issues are often not in the hands of marketing teams. Being a First Choice is what marketing builds. It has been argued that consumers are more likely to consider products in store and are more likely to be swayed by promotions; they are less brand conscious.

The reality is, this happens when there is inconclusive First Choice leadership. The need to consider in store is a sign that brands have not built a First Choice position; the fact they are swayed by promotions indicates their First Choice is not firmly set – an equity fail. First Choice is a pure marketing metric. The pursuit of First Choice leadership is the pursuit of equity that translates to sales.

Research on research continues to show that people are not very good at “Ratings”, however they are very good at making “Choices” – which is why Cimigo continue to see the rise of choice-based research. The way Cimigo ask this crucial brand equity question is the way it reflects choice-based action that people routinely take day-to-day:

“If I offered you these brands now for free, which one would you choose?”

No issue of availability, no issue with price, no confusing factors of discount or promotions – just a very straight-forward choice.

If a brand genuinely has equity that makes a difference, i.e. not just awareness, not just price or distribution advantages, then this is where it is revealed.

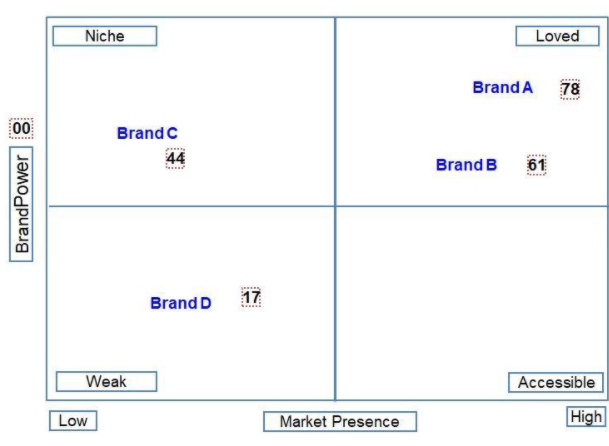

BrandPower

Cimigo’s BrandPower index is a measurement which will help to determine brand power and identify leading brands. The chart below shows an example of BrandPower on the vertical axis and market presence constituting spontaneous awareness, trial and use) on the horizontal access.

A high BrandPower score indicates that the brand is likely to maintain or grow its share. For a competing brand this shows a strong threat and for your own brands it shows great potential.

A low BrandPower score indicates a brand that will require more brand building to grow, without which it will struggle to maintain its current position

As a competitor (with strong market presence) it may be a short to mid-term threat in terms of volume (less so value) driven by price and availability (accessibility).

Niche quadrant: When a brand falls into this quadrant, it means that the brand has a growing equity, but at the same time it has a limited market presence. It could be that the brand is for a ‘niche’ target market, not for everyone. It could also be a small brand which needs to work on market presence.

Weak quadrant: When a brand falls into this quadrant, it means that the brand has a weak equity (i.e. low BrandPower and low market presence).

Loved quadrant: When a brand falls into this quadrant, it means that consumers love the brand and it is likely to maintain or grow share. The brand has a strong equity.

Accessible quadrant: When a brand falls into this quadrant, it means that consumers have access to the brand (good market presence), but consumers are also vulnerable to other brands in the category as well. The brand is likely to have a declining equity and also it indicates that a brand will require more brand building to grow without which it will struggle to maintain its current position.